While it’s usually not recommended to withdraw money from your RRSP, doing so to buy your first home is a viable option through the Home Buyers’ Plan.

The Home Buyers’ Plan (HBP) is an initiative by the Canadian Government that allows first time home buyers to use up to $35,000 (as of 2020) of their RRSP for a down payment.

Before making any big decisions though, there are some understated disadvantages to this program that I think you should consider:

Here are 4 Disadvantages to the RRSP Home Buyers’ Plan:

- Strict Repayment Rules

- Repayments Cannot be Deducted

- Loss of Potential Growth

- Stress Caused by Repayment Obligations

1. Strict Repayment Rules

Before withdrawing money from your RRSP to purchase your first home, make sure you know the repayment rules associated with these withdrawals.

Repayment Rules for RRSP Home Buyers’ Plan

- Your withdrawal must be repaid within 16 years.

- You must repay at least 1/15 of the borrowed amount each year.

- You have to start repaying the money the second year after you made the withdrawal.

- Before making any normal contributions to your RRSP, you first have to repay your annual minimum amount.

While these repayment rules aren’t completely unreasonable, they can be annoying.

It’s almost like you have a loan out, but against yourself?

Open up an RRSP Today with Wealthsimple Invest (Earn a $25 Sign-up Bonus with your Sign-up)

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

What is the Penalty if I Fail to Repay my HBP Minimum Annual Amount?

What happens if you have a really tough year financially and you can’t make your minimum repayments?

Well tough luck, it’s time to pay the piper.

If you can’t make your minimum repayment for a year, you will have to add the amount you failed to repay to your tax return as RRSP income (line 12900).

Think about it, RRSPs are used for tax deferrals. You don’t get to avoid taxes completely, you just pay them later.

But hey, don’t take my word for it, look at what the CRA website has to say about it.

While I could make a strong argument for why these repayment rules are the biggest disadvantage of the RRSP Home Buyers Plan, there are certainly more.

What makes things even worse?

Related Financial Geek Article: The Pros and Cons of an RRSP [5 of Each]

2. HBP Repayments Cannot be Deducted

Since you already deducted your contributions when you initially contributed to your RRSP, any RRSP contribution that is designated as a repayment cannot be claimed as a deduction.

Tough crowd hey!

When you think about it though, it’s completely fair that you are not allowed to reclaim your repayments, but still, if you’re someone who relies on their tax rebate each year as additional income, you might be in trouble.

Why? Because depending on how much you can afford to contribute, you may not be able to reduce your taxable income from your RRSP contributions.

Remember, before making any normal contributions to your RRSP, you first have to repay your annual minimum amount – and these repayments are not tax deductible.

Furthermore, wouldn’t you miss getting those juicy tax returns each year? It’s like the government saying, “thank you for worrying about your future, here is some more money.”

To recap, I think it’s fair to say that the strict repayment rules and penalties associated with the HBP offers a number of drawbacks.

3. Loss of Potential Growth

If you’ve managed to contribute $35,000 (HBP withdrawal limit) or anywhere close to that in your RRSP, you should be commended for that as it is certainly not an easy thing to do.

If you’re deciding whether or not you should withdraw some of this money to fund a downpayment on your first home, it’s important to factor in how much it could cost you in the long run.

Think about it, if you plan to retire at 65, reducing your RRSP amount now to repay it later means your money won’t have as much time to grow and compound.

In other words, compound interest will have less time to work its magic. And yes, compound interest is magical.

You’d be surprised how much money a few years could cost you.

Let’s look at an example here.

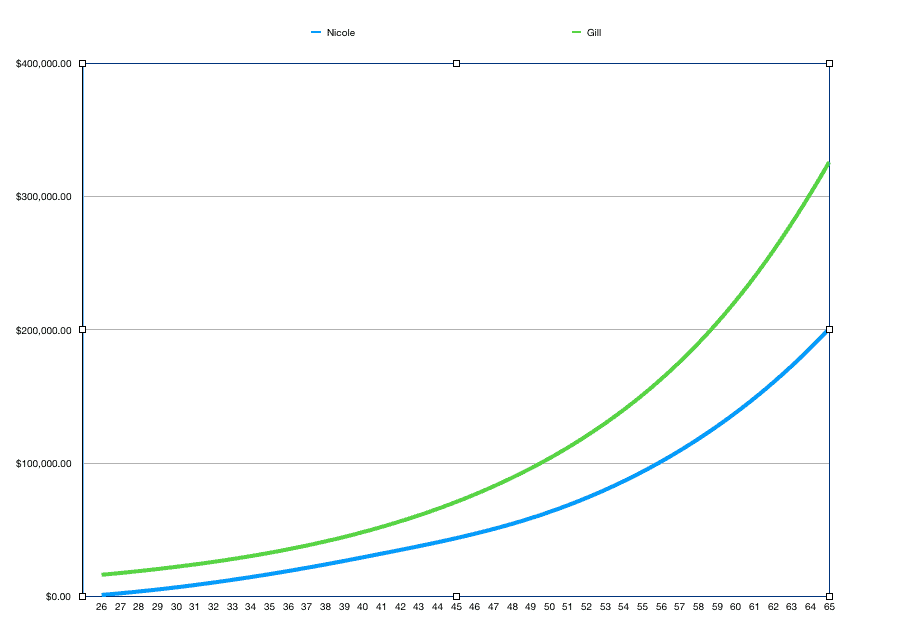

Nicole and Gill both have $15,000 in their RRSP at age 25, very impressive.

They both plan on buying their first home at a cost of $300,000.

Nicole, at age 25, is a little more eager than Gill and she decides to withdraw $15,000 from her RRSP to fund the required 5% down payment ($300,000 x 5% = $15,000).

Gill on the other hand decides to save another $15,000 over the next 2 years, outside a RRSP, and buys her house at age 27 – keeping the original $15,000 in her RRSP.

For the sake of this example, let’s say:

- Nicole stops investing in her RRSP after her $15,000 is repaid at age 40 – she paid back $1,000 a year from ages 26-40. – Her total RRSP contribution is $15,000

- Gill doesn’t invest anymore in her RRSP after age 25 – leaving her with $15,000 in total contributions.

If both Nicole and Gill received an average return in their RRSP of 8% a year from ages 26-65:

- Nicole would retire with $200,827

- Gill would retire with $325,868

Despite them both contributing $15,000 to their RRSP and earning the same 8% return, Gill retires with roughly $125,000 more than Nicole at age 65.

So while Nicole’s withdrawals may have been “tax free”, they ended up being anything but free – $125,000 how ya doing!

How does this happen if they both contributed the same amount and averaged the same return?

As you can see from the chart above, Gill allowed her $15,000 to grow for a full 40 years while Nicole had to start from scratch again.

This gave Nicole a huge disadvantage as it reduced the number of years her money could grow and compound, costing her big time.

Is having six figures less than your friend at retirement a disadvantage? I think so.

And for what? So you could buy your house two years earlier?

If you have to, save up for an extra year or two and buy your first house with money from a savings account outside of an RRSP.

With that said, if you have a small amount of money put away in your RRSP and taking that money out will help you buy a house, there’s nothing wrong with that.

A few hundred dollars won’t make a huge difference in how much money you retire with at 65, but once we start talking about withdrawing thousands of dollars, it’s important to understand how much it could really cost you in the long run.

In other words, don’t be a Nicole!

4. Stress Caused by Repayment Obligations

As mentioned above, one of the major disadvantages of the RRSP Home Buyers’ Plan is it’s almost like you are taking a loan out against yourself. In other words, you’re indebted to your RRSP.

While it’s not all bad as your repayments are funding your retirement, but still, the strict repayment rules can take a toll on one’s mental state after a while.

In another Financial Geek article, 6 Harsh Consequences of Not Saving Money, we talk about the emotional effects of using borrowed money.

Think about yourself, how do you feel when you owe money to someone or something? How would you like that feeling for potentially 15 years – depending on how long it takes to make your repayments.

Not only that, but if the effects really start to take a toll on you, you may start to resent the house you purchased because of the emotional impact it has caused you. (Remember, you still have to make your mortgage payments too!)

It’s important to remember that while you have 15 years to repay your RRSP, you have to repay a minimum of 1/15th of your total withdrawal each year.

While it’s perfectly fine to repay more than this each year, failing to repay the minimum will cost you come tax season and this constant obligation to make your minimum payments could start to weigh on you.

With that said, if you don’t like the thought of borrowing money or going into debt, you may want to think twice about using your RRSP to purchase your first home.

Again, I want to reiterate, I know this is not exactly the same as going into debt – but you are still borrowing money to fund a purchase and failure to repay the borrowed money will cost you.

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

Conclusion

To conclude, there are many downsides and disadvantages to the RRSP Home Buyers’ Plan as demonstrated above.

While the strict repayment rules aren’t ideal, you can’t ignore the opportunity cost of borrowing from your RRSP – Nicole learned the hard way!

While it might only be a few thousand dollars today, when it’s time to retire, that withdrawal can easily cost you six figures.

Additionally, because you already deducted your contributions in previous years, you can’t claim any of your repayments. So if you’re someone who relies on their tax rebate each year, you can kiss that goodbye – unless you plan on contributing additional funds on top of your minimum repayments.

Lastly, the emotional effects of borrowed money can take a toll on some people and this might not be something you want to deal with.

Before I go, I want to make one final point.

Just because the RRSP Home Buyers’ Program has some disadvantages, that doesn’t mean you should ignore it completely. It could be a viable option for you!

If you only have a few hundred dollars in your RRSP, the potential growth will be a lot smaller and you’ll easily be able to repay this amount back in a year or two, so no big deal.

Maybe you need a little extra money to reach 20% on a down payment and this incentive will allow you to avoid Mortgage loan insurance.

Or maybe you know you’ll be able to make your repayments each year no problem and the thought of this doesn’t bother you at all.

I don’t know what your situation is so I can’t make this call for you. All I’m here to do is inform you of some of the disadvantages of this plan.

If you really want my yes or no answer on if you should do this or not, I say no. But I’m also a Maple Leafs fan so not all my decisions are well thought out..

Geek, out.

![Can you Put Closing Costs on a Credit Card? [Legally]](https://thefinancialgeek.com/wp-content/uploads/2022/11/Featured-Image-48-768x404.jpg)

2 Comments

Comments are closed.