The average American has roughly 4 credit cards open at one time.

3.6 to be exact, but last time I checked, 60% of a credit card is worthless, so let’s say 4.

With this many credit cards open at one time, some cards often get left unused, which begs the question: is it bad to have a lot of credit cards and not use them?

In short, having a lot of unused credit cards is not bad and can actually help your credit score. Owning, but not using, multiple cards at one time can build your credit score as you will have a lower credit utilization rate as well as a longer average age of credit account. These 2 factors have a huge impact on one’s credit score.

There are certainly some exceptions to this, and we will get to them shortly, but first, allow me to elaborate on my answer.

2 Reasons Why Unused Credit Cards Can Help your Credit Score

Credit Utilization Rate

Credit utilization rate is calculated by dividing your current debt by your total available credit. According to Experian, credit utilization rate accounts for 30% of a person’s FICO score.

So, the lower this number is, the better.

While you should try to keep it as close to 0% as possible, anything below 30% is a good range to be in.

Credit History

In terms of your average age of account, the longer you have a credit account open for, the better your credit score will be. Even if you aren’t using the credit card, keeping the account open is usually a good idea.

While the average age of your credit account is not as impactful on your credit score as your utilization rate, Experian states that your length of credit history accounts for 15% of your FICO score.

3 Situations When You Should Close Unused Credit Cards

Like most questions, the answer usually depends on different factors. And the answer to the question is it bad to have a lot of credit cards and not use them? is no different.

While I generally believe it is not bad to have a lot of unused credit cards, the answer is based on a few assumptions and my answer will probably change if;

-

The credit card has an annual fee associated with it.

-

It is a relatively new credit card.

-

The credit card provider has an inactive cancellation policy.

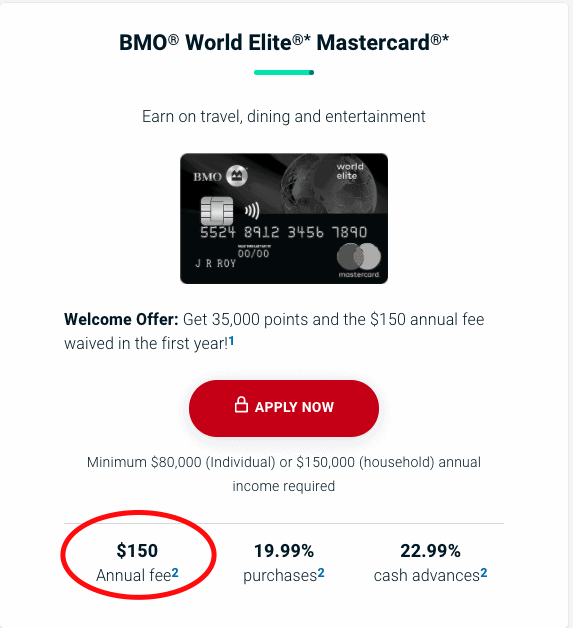

Annual Fee – Whether its travel rewards points, cash back or movie tickets (my favourite), credit cards often come with some pretty great benefits. And with these great perks, annual fees sometimes tag along.

While you can certainly get no fee credit cards, credit cards with premium rewards usually ask for a small annual fee that can be paid on a monthly or annual basis.

Credit cards usually have a pay-to-play system as I like to call it. In order to take advantage of all the great benefits they offer, you have to spend on it.

If you have a credit card that comes with an annual fee that you don’t use, ditch it.

Spending $139 a year or more to maintain a certain credit score just doesn’t make sense.

What’s the point of having something that costs you money every year and offers you no value?

New Card – If you just got a new credit card, and you realize you don’t plan on using it, you might want to ditch it as well.

I know I mentioned above that the average age of your credit card will impact your credit score, but closing a brand new account shouldn’t have much of an impact on your score as it hasn’t been around for too long anyway.

So it won’t hurt your credit score by keeping a new and unused card open, but, as long as you already have a good credit score, what’s the point?

Even if you aren’t paying an annual fee, it just seems unnecessary.

Again, this is for those who’ve already developed a solid credit score. If you haven’t yet, or you have a poor credit score, opening new credit cards and not using them can actually help your score as explained above.

But, if you’ve already got a great score, don’t burden yourself with another credit card.

Inactive Cancellation Policy – While not always, some credit card companies will deactivate your card if you don’t use it over the course of a full year.

Think about it, how do credit card companies such as Visa and Mastercard make their money?

Transaction fees and interest charges.

So, if you’re not spending money on your card, assuming no annual fee, the credit provider is potentially losing money off of you, why would they want that?!

Cancellation policies differ by company, so it might be a good idea to check with your credit providers on what their inactive card policies are before making any decisions.

At the very least, it might be a wise idea to make a transaction or two each year just so your card doesn’t deactivate.

What’s more, having a credit card cancelled on you is terrible for your credit score.

Not only will your credit utilization rate lower by having less available credit, but if your cancellation is reported, your average credit age will be reduced, which as mentioned above, will reduce your credit score.

Conclusion

To conclude, while there are exceptions, having a lot of unused credit cards is not bad.

But what does this mean exactly?

In relation to one’s credit score, having multiple unused credit cards can increase your overall credit score as the more unused credit you have available, the lower your credit utilization rate will be.

Furthermore, 15% of one’s FICO score is determined by their average age of credit accounts. So the longer you have accounts open for, the better your score will be!

That said, there are exceptions.

If your card has an annual fee, cancel it.

If it’s a new card that you don’t plan on using and you already have a solid credit score, cancel it.

If you are at risk of having your credit card cancelled, you guessed it, cancel it.

Before I go, there is one other quick point I want to make.

Not using your credit cards means you’re not spending on credit, and that’s a really good thing. I know that is obvious, but it is worth pointing out.

If you aren’t using all your credit cards, be proud of yourself!

You have available funds at your fingertips that can be spent with a quick tap but you’ve decided against it. That is surprisingly very hard to do. Kudos to you!

Anywho, time to therapy shop on my American Express Platinum card. Joking of course!

Am I….