When building an investment portfolio, investors are instructed to have a sensible mix of stocks and bonds. However, while most people understand that a stock is an ownership share in a company that will rise or fall based on the company’s performance, even some experienced investors are unsure of what bonds are and the pros and cons of investing in them.

The main pro and the main con of bonds happen to be the same: investors can expect to see a fixed return when investing in bonds. However, there are numerous pros and cons to investing in them.

The fixed return can be highly beneficial for investors who want to be able to predict what their nest egg will look like at a certain point in the future. On the other hand, it can be detrimental when interest rates fluctuate, and bondholders are stuck with an unfavorable rate.

The following breakdown will look at several pros and cons of placing investment dollars in bonds.

| Pros of Investing in Bonds | Cons of Investing in Bonds |

|---|---|

| 1. Bond’s Give Investor’s Fixed Returns | 1. Bonds Yield Lower Returns Than Stocks |

| 2. Bond’s are Less Risky Compared to Other Investments | 2. Larger Investment Sum Needed for Bonds |

| 3. Bonds are Better Investments than the Bank | 3. Bond Defaults Can Occur |

| 4. Bonds Are Rated Based on Risk Level | 4. Bonds are Less Liquid Than Stocks |

| 5. Interest Rate Risk | |

| 6. Prepayment Risk |

The Pros of Investing in Bonds

Bonds are widely considered one of the safest investment options a person can use for modest, stable capital growth. With that, there are several benefits to using bonds as an investment instrument.

1. Bond’s Give Investor’s Fixed Returns

Everybody would like to be able to put their money into an investment and accurately predict what it will grow to by a given point in the future. However, there is simply no way to guess what type of return investments such as stocks, real estate, or cryptocurrency will return. While the upside can be an exciting reality, the chance of seeing red (losing money) is just as real.

Bonds, on the other hand, will give investors a fixed rate of return that they can bank on each year. The bond’s coupon rate is the amount that investors will be paid at fixed intervals, usually annually or semiannually, for the use of their money.

For example, if an investor buys $10,000 worth of corporate bonds in a company at an annual coupon rate of 4%, they will know that the bond will yield $400 each year.

While this may not be an exciting return, the ability to bank on a guaranteed return is extremely valuable for many investors, especially those approaching retirement who need to use their investment dollars as part of a fixed-income annuity.

2. Bond’s are Less Risky Compared to Other Investments

In addition to a predictable rate of return, investors want to eliminate as much risk as possible when putting their money to work. To this effect, bonds are arguably the safest investment option available—if you do not count FDIC-insured savings accounts with their minuscule interest rates as actual investments.

Bonds are a form of debt, meaning that the bond issuer has a legal obligation to repay bondholders to use their money. Therefore, if a municipality or corporation goes bankrupt, bondholders take priority during the liquidation process, as debtholders are the first to be paid after administrative and legal costs are taken care of.

Stockholders, on the other hand, are usually out of luck when bankruptcy occurs. As they are shareholders in an ownership stake of the company, they only get what money is left over after all debt has been repaid.

3. Bonds are Better Investments than the Bank

As mentioned, placing money in an FDIC insured checking or savings account provides negligible interest. Given that inflation typically hovers around 2% (the Fed is forecasting 2.4% inflation as the economy emerges from the pandemic) those funds sitting in bank accounts are actually losing purchasing power over time.

While some municipal bonds do not have excellent yields (the 10-year government bond yield was 1.61% as of May 2021), the return is much better than keeping your money in cash or a savings account, while providing essentially no risk for your investment, as government bonds are practically fail-proof.

4. Bonds Are Rated Based on Risk Level

While stocks are not rated based on their risk, bonds are universally rated by agencies such as Standard & Poor’s. This gives investors a clear understanding of exactly how much risk they will be taking on when purchasing a bond, with riskier bonds offering more attractive coupon rates.

Rating agencies use a letter-based system to judge the quality and creditworthiness of a bond. The highest-rated, investment-grade bonds will carry a rating of AAA, BBB, Aaa, or Baa3, depending on the agency. These bonds will typically have the lowest coupon rates.

Lower quality bonds and junk bonds will have lower ratings but higher interest rates to compensate for the increased risk.

The Cons of Investing in Bonds

Although bonds offer a steady, reliable return on investment dollars with minimal risk, investors should be aware of a few downsides.

1. Bonds Yield Lower Returns Than Stocks

While the fixed return is attractive for investors who cannot stomach the volatility of other instruments, the total return of bond investments can leave a person feeling a little hollow at the time of its maturity.

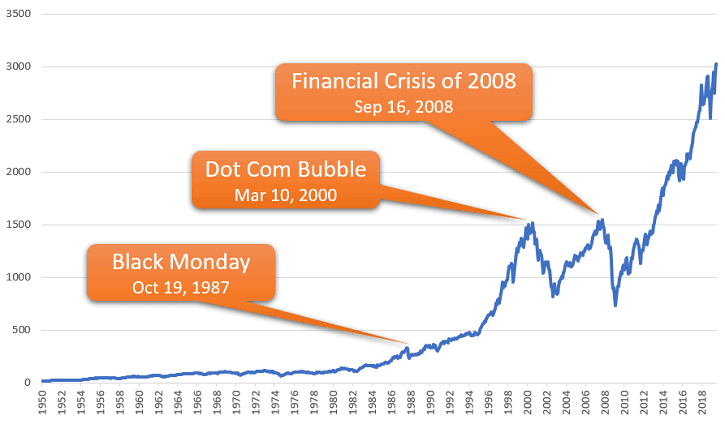

Although there are no guarantees when investing in the stock market, historic records show that since the inception of the stock market in 1926, average returns have been between 10% and 11%.

This means that if you lock in a large sum of money in a 10-year government bond at 1.61%, you could be missing out on tens of thousands of dollars (perhaps more) if the stock market performs anywhere near its historic averages.

2. Larger Investment Sum Needed for Bonds

Many bonds are used to fund large-scale public or corporate projects that cost millions of dollars. As a result, even the smallest bonds issued for such projects may run into five or six figures.

This can put bonds out of reach for some investors, who have the ability to purchase fractional shares of their favorite stock for as little as $1.

3. Bond Defaults Can Occur

As a form of debt, bonds are more secure than stocks in the event of a bankruptcy. However, there are cases when a company is in such a bad financial situation that it cannot pay back its debts, causing them to default on its loans and bonds.

Therefore, it is essential to look at the bond rating and research the company’s financial health before purchasing a bond.

Remember, the riskier bonds will often yield a higher return, but will also have a great fault of defaulting.

4. Bonds are Less Liquid Than Stocks

Stocks are not a perfectly liquid asset. However, with the mass adoption of ECNs, most stocks can be bought and sold in a matter of seconds.

Bonds, on the other hand, are extremely low in liquidity. The bondholder will not be paid back the principal of the investment until the bond reaches maturity, usually 10, 20, or even 30 years down the road.

For those who are in need of liquid cash, they’ll want to stay away from bonds as these long maturity dates can often be problematic in the event of a financial emergency.

5. Interest Rate Risk

Arguably the most direct threat to bonds is interest rate risk. When an investor purchases a bond, they are locked into that rate for the bond’s term. If interest rates increase the day after the bond is purchased, the bondholder will be stuck getting unfavorable returns for the life of the bond.

It is recommended to purchase bonds of varying maturity lengths to help spread out interest rate risk.

To learn more about the correlation between bonds and interest rates, check out this article by Investopedia.

6. Prepayment Risk

On the flip side of interest rate risk is prepayment risk.

If interest rates suddenly drop after a bond is purchased, companies may buy back all of their outstanding bonds and issue new bonds at the lower interest rate. (How the hell is that fair?!)

With that said, it is essential for bondholders to know the terms and conditions of their bond before purchasing to plan for these scenarios.

Conclusion

Bonds are generally accepted as one of the most attractive investment instruments on the market for those wanting a stable, modest return on investment.

But with any type of investment comes potential downsides. If you are someone who needs reliable, steady cash flow, bonds might be for you.

On the other hand, if you are looking for 10%-11% returns year over year, investing solely in bonds won’t get you there. So you’ll want to make sure you have some diversification in the form of equity within your portfolio.

So by considering the breakdown discussed above, you should weigh the factors most important to you when, and if, you decide to invest in bonds.

Geek, out.

![What Happens if No One Sells a Stock? [Complete Breakdown]](https://thefinancialgeek.com/wp-content/uploads/2022/12/Featured-Image-26.jpg)