Robinhood is an online investment and financial operation that came onto the scene back in March of 2015. Initially, Robinhood became the upstart in the online investment and financial markets. And then in February 2018, Robinhood began offering cryptocurrency trading in a limited number of states.

Understanding all the downsides of using Robinhood as an investment platform is critical to any investor. Knowing the pitfalls is often more important than understanding the advantages. An examination of some of the problems with Robinhood that could affect your investments is imperative.

With that said, the purpose of this article is not to persuade you away from Robinhood, but more so to give you the full picture so you can make decisions for yourself.

| Starting to Invest? | Our Recommendation | Start Trading Today |

|---|---|---|

| Robinhood InvestOnly in USA

| Start Trading Today |

What Are the Many Downsides of Using Robinhood?

A close examination of Robinhood reveals some real problems that can quickly get inexperienced investors in trouble if they aren’t careful.

Whether you are a novice investor or a seasoned trader, there are things to consider about Robinhood before you start investing with them. But before doing anything, let’s make you aware of these fundamental shortcomings with the Robinhood investing platform.

| 10 Downsides of the Robinhood Investing Platform |

|---|

| 1. The Website has Poor Design and Operation |

| 2. Robinhood Makes Money Selling Investor Data |

| 3. Customer Service Lacking |

| 4. Poor Crytopcurrency Trading Management |

| 5. Charges for Standard Services |

| 6. Limited Customer Account Types |

| 7. No Access to Bond Market |

| 8. Stock Quotes that Don’t Deliver the Data |

| 9. Poor Reliability During Critical Times |

| 10. Watchlist Doesn’t Deliver Needed Features |

1. The Website has Poor Design and Operation

From a user standpoint, Robinhood leaves a lot to be desired. The original partners in Robinhood were both experienced IT professionals in the investment industry. However, the product they delivered to the market is often perceived as inadequate from an investor’s standpoint.

Overall, the Robinhood system suffers from some serious and potentially devastating drawbacks for traders and investors. Even novice investors expect the online products they choose to perform with some level of efficiency and reliability. Unfortunately, this seems to be an issue with Robinhood that a lack of fees may not even mitigate.

On The Upside of the Website

It isn’t all doom and gloom with the Robinhood website. The Robinhood mobile app is clear, concise, and intuitive to use. Robinhood has seemed to keep this function of its online presence well managed and well run.

Many users of Robinhood like the user interface of the online trading platform. Comments indicate that the simplicity and lack of options are a blessing to novice investors.

2. Robinhood Makes Money Selling Investor Data

Ever wonder just how Robinhood makes money to stay operational without charging fees?

Well it’s a very valid question. Many people point to the Robinhood Gold program as a profit generator. But, in truth, barely enough people subscribe to pay the bills on that subscription program.

What makes money for Robinhood is the payment for order flow concept. When you use Robinhood to search for the best price for a specified stock, Robinhood sells your trading data to what is termed high-frequency trading firms.

These HFT firms use the data about your trading patterns in their marketing programs. In other words, Robinhood makes its profit selling your data.

The Truth of Making Money Selling Data

Every website and online service provider does the same thing. Robinhood isn’t participating in anything that almost every other website and social media site isn’t doing as well. Online trading has become a seriously competitive market and finding ways to monetize a trading platform outside of commission fees is the new name of the game.

You don’t think free trading is actually…. free, do you?

| Starting to Invest? | Our Recommendation | Start Trading Today |

|---|---|---|

| Robinhood InvestOnly in USA

| Start Trading Today |

Related Financial Geek Article: Does Robinhood Affect People’s Credit Score? (Full Details)

3. Customer Service Lacking

If you want impeccable customer service, I’m not sure Robinhood is the gold standard here.

From what I’ve been told, Robinhood severely lacks customer service support. What is considered standard features on most other online trading platforms is essentially non-existent on Robinhood. For example:

- Robinhood offers no phone or live chat support on its online trading platform. This is almost a given on other online trading systems.

- Many users report that customer support calls are either delayed or go unanswered even during normal business hours.

- Emails for customer service or help often go unanswered for days. Yet, there seems to be no lack of urgency in providing help for its customers.

Given that Robinhood seems to target inexperienced investors, the lack of reliable and quick customer support seems like a serious downside.

Why Customer Service is not a Priority for Robinhood

In its defense, it must be said that Robinhood provides the services that it set out to provide when it was launched. The goals of the founders of Robinhood were to offer streamlined trading services in the most popular market products with the cheapest and easiest entry system.

And in fairness to Robinhood, at no time did they declare themselves to be a behind-the-scenes broker offering advice, instruction, or education.

4. Poor Crytopcurrency Trading Management

If you are interested in trading cryptocurrencies, choosing Robinhood may be costing you money. At best, Robinhood’s approach to cryptocurrency trading leaves a lot to be desired.

And let’s face it, we all want to have the most efficient trading platform.

Trading stocks, bonds, and cryptocurrencies on the same trading platform are attractive for many new traders. However, Robinhood doesn’t manage this combination well. The downsides of trading cryptocurrency on Robinhood are fairly well known.

- You can’t withdraw coins from Robinhood

- You can’t transfer your coins out of Robinhood to your wallet

- There is no access to your wallet or wallet address within Robinhood

- You don’t hold the keys to your cryptocurrency. This, in effect, is like not owning the coins at all since you can’t access them directly

- If you are dealing with cryptocurrencies, you may find that the spreads on buy and sell orders are larger than on other platforms.

- A limited number of coins available to trade on the Robinhood exchange

With no access to your coins and no way to transfer them from Robinhood to your wallet, you effectively don’t control your coins.

Don’t Count Out Robinhood in The Crypto World Just Yet

Robinhood was late getting into cryptocurrency trading, and we haven’t yet seen all they have to offer. You can indeed get more coins, more services, and more options if you elect to use a dedicated cryptocurrency trading platform.

However, you won’t get the convenience of combining most of your investing activities all into one website and one account, which as we all know is a much better way to go.

5. Charges for Standard Services

Robinhood does offer a premium subscription investing service called Robinhood Gold. A membership to this service costs $5 per month. The Gold membership does get you a few extra options and perks.

- Margin Investing

- Access to professional research

- Level II market data

- Larger instant deposits (you don’t have to wait for the money to clear)

And if that sounds like a great deal to you, then you probably haven’t done your research yet. Most other brokerages with online services offer these options and features for free. Inexperienced investors may think they are striking “gold” when they actually might be spending money they don’t have too.

The Other Side of the Stock Portfolio

If you want basic free trading with the fundamental services that allow some research for technical trading, Robinhood gives you all your needs.

If access to a broader set of tools and services becomes a priority, for a modest $5 per month, you can have that access as well. You can indeed get much more detailed and in-depth tools and research at other sites.

The question is, how many first time investors understand how to use and interpret all that data and knowledge? My guess is none.

Related Financial Geek Article: Can You Lose Money with Robinhood? (Full Details)

6. Limited Customer Account Types

When you open your Robinhood customer account, there are no choices. You will get a standard customer account meant for individual investing. As you become more aware of the possibilities on other trading platforms, you realize that something is lacking, such as:

- You won’t be able to open a joint account with your partner or your spouse.

- There are no options for custodial accounts

- If you have an IRA or any other kind of tax benefitted savings account, there are no options to manage or maintain these accounts through Robinhood

If you manage accounts for a child, these limitations can hamper your abilities using Robinhood. Couples cannot engage in long-term financial planning and management together. Investing for long-term goals is difficult without access to these kinds of account options.

Robinhood is What it Was Meant to Be

Robinhood never set out to be the end-all and be-all of investing platforms. From its inception, the concept was to provide an easy to enter and quick to learn investing platform that served the needs of investors from the beginner to the intermediate level. The Robinhood website and services were never meant for advanced investment management.

7. No Access to Bond Market

Experienced traders and anyone investing for long-term security understand the need to diversify your portfolio. Spreading your investment funds across various investment types is a form of insurance against the fluctuations that are normal in the markets. With Robinhood, you are limited to some basic investment categories, including:

- Stocks listed on US exchanges

- US-listed ETFs

- Some cryptocurrencies

- American Depository Receipts for approximately 250 global companies

The biggest lack in Robinhood’s trading options is bonds. Balancing your investment portfolio in stocks and bonds is a key strategy for many investors. If you use Robinhood, you have no direct access to the bond market.

Bond Traders – A Different Class of Customers

While some solo investors trade stocks and bonds, it is relatively rare for beginning or intermediate investors to be in the bond market. Trading bonds requires an entirely different set of skills, research, and knowledge. Robinhood focused on serving mainstream beginning and intermediate traders whose typical targets are the thousands of stocks and options available through its website.

So for most, this lack of access to the bond market won’t big a huge deal.

For more information on the pros and cons of investing in bonds, check out my article here.

8. Stock Quotes that Don’t Deliver the Data

Robinhood advertises that its customers receive real-time stock quotes for free. Your orders are indeed completed at the real-time price of the stock. However, the research data provided as part of your free service is usually less than real-time.

Robinhood purchases the data that is provided to its customers from a third-party company. This is the same company that supplies data to such organizations as The Motley Fool and Stocktwits. The data supplier is the cheapest and offers barebones reporting at best.

Most other online brokers offer real-time quotes that provide more data, more in-depth coverage, and access to many more stock exchanges. Comparing the real-time quotes you get on Robinhood with the data from other online trading platforms will show you the difference.

Research and Data – Doing Due Diligence

Ask any serious trader where they get their information, data, and research, and you will get hundreds of different answers. Successful stock traders know that using a single source of data is never the basis for sound decisions.

The internet offers a multitude of sources on up-to-date and relevant investing data. Robinhood really doesn’t try to re-invent the wheel, knowing that most investors will use a wide variety of research tools plus what is offered on their trading platform.

9. Poor Reliability During Critical Times

The ability to access your accounts and perform trades is an attractive feature of online trading. Many investors who use online trading accounts often make moves at a moment’s notice. This is especially true of day-traders and investors who like to move on fast-flowing information and in real-time.

Unfortunately, Robinhood’s history of reliability leaves a lot to be desired. When markets turn volatile, quick and efficient access to your accounts is critical. Robinhood has suffered severe outages at least three times in the recent past.

Is Reliability Really an Issue?

Robinhood indeed suffered at least two outages during some critical trading periods. This is very unfortunate, no doubt about it.

But with that said, with the exception of these two or three occasions, Robinhood’s uptime is as good as any other trading platform available. Judging the performance of a website on two or three exceptional cases can skew the results.

Over the long-term, Robinhood has proved to be a very reliable platform for traders.

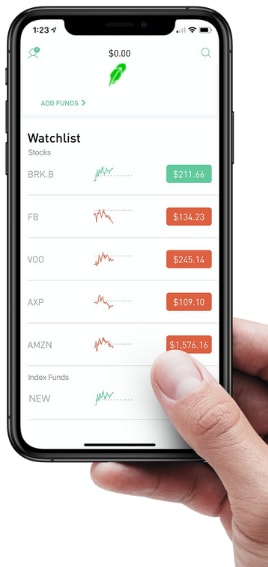

10. Watchlist Doesn’t Deliver Needed Features

A key element of many investment strategies is watching the movements of a variety of stocks over time. A watchlist feature is a critical part of this mind of investment strategy for many investors. Unfortunately, the watchlist feature on Robinhood is less than ideal.

Once a watchlist of stocks is created on most other brokerage platforms, the list can be manipulated to show the data in multiple ways and many investors will then use these features to look at the data on their watchlist by:

- Creating multiple watchlists for different stocks, opportunities, or investment ideas

- Sorting the data on a watch list by price, volume, bid and other indicators

- Adding alerts or push notifications when stock on the watchlist moves or the data changes

Using Robinhood takes away all these features. The watchlist on Robinhood is crippled, to say the least. You cannot sort your watchlist alphabetically, much less do any serious research.

How Long is Your Watchlist Anyway?

A watchlist that requires sorting and manipulating in some ways is not something most beginning and intermediate stock traders use.

A simple, straightforward watchlist that gives the basic information in a simple user interface is often of more use than a complicated list filled with data.

Remember, when you are starting out – KISS. Keep it Super Simple. While watchlists can be beneficial, it’s not something I’d really focus too much of my energy on at the beginning.

Final Thoughts

At the end of the day, Robinhood delivers on what its creators set out and intended to deliver on.

So even though Robinhood does have downsides and weaknesses to its platform, doesn’t everything and everyone?

Just because Lebron James is a weak free-throw shooter, this doesn’t mean he’s a bad player. Far, far from it!

But in the end, your investment success is about your money, your time, and your future. The goal of any investment strategy has two equal parts. You want to protect and grow your assets. So find a platform that does that for you and ride with them.

I personally think, despite its downsides, Robinhood is a great platform to get started with as a beginner investor who is living in the United States.

And will call it there! Thanks for reading folks, hopefully you learned a thing or two along the way.

Geek, out.

| Starting to Invest? | Our Recommendation | Start Trading Today |

|---|---|---|

| Robinhood InvestOnly in USA

| Start Trading Today |