Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

One of the safest ways to invest in the stock market is to put your money into defensive stocks. Defensive stocks are well-established companies who have demonstrated consistent profitability over the years. As they are less concerned with growing, these companies usually distribute some of their profits in the form of dividends to shareholders.

But do fractional shares pay dividends?

Fractional shares do pay dividends if the fractional share you purchase is a dividend-paying stock. Therefore, you will receive a proportionate dividend if you own fractional shares. For example, if the dividend payout is $5 per share and you own half a share, you will receive $2.50 as your dividend.

| Starting to Invest? | Our Recommendations | Start Trading Today |

|---|---|---|

|

Wealthsimple Trade ($25 Bonus)Only in Canada

|

Start Trading TodayRead our Review |

|

Robinhood InvestOnly in USA

|

Start Trading Today |

While the dividends for most fractional shares will likely be small amounts, they can be a great starting place for building wealth if you consistently reinvest these dividends back into the company to further grow your position

Read on to find out all you need to know about how fractional shares work.

Do Fractional Shares Pay Dividends?

Fractional shares do pay dividends. They will pay a fractional dividend based on the proportion of the share you own. But remember, as I talk about in my article Do All Stocks Pay Dividends, not all companies pay a dividend, so this will only apply to dividend-yielding stocks.

The best way to understand how dividends work with fractional shares is to look at a hypothetical example using some easy math.

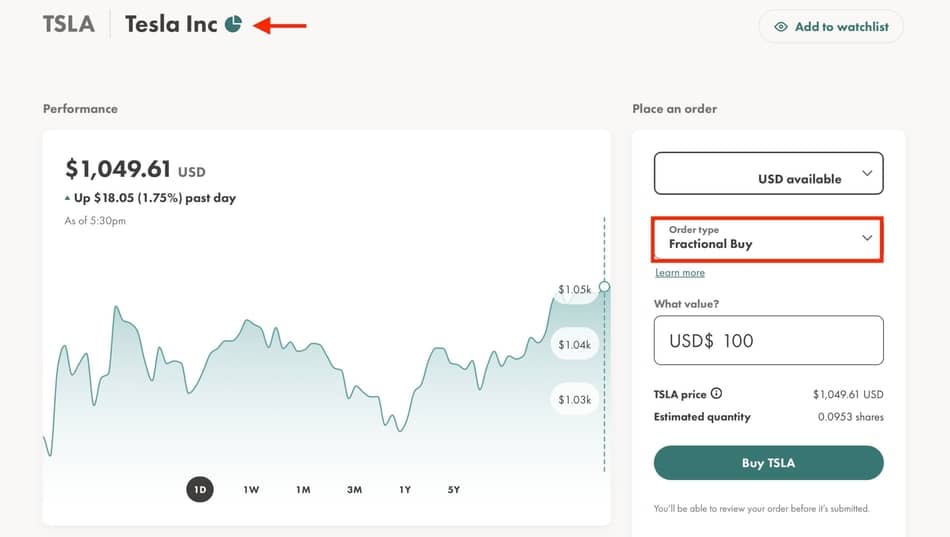

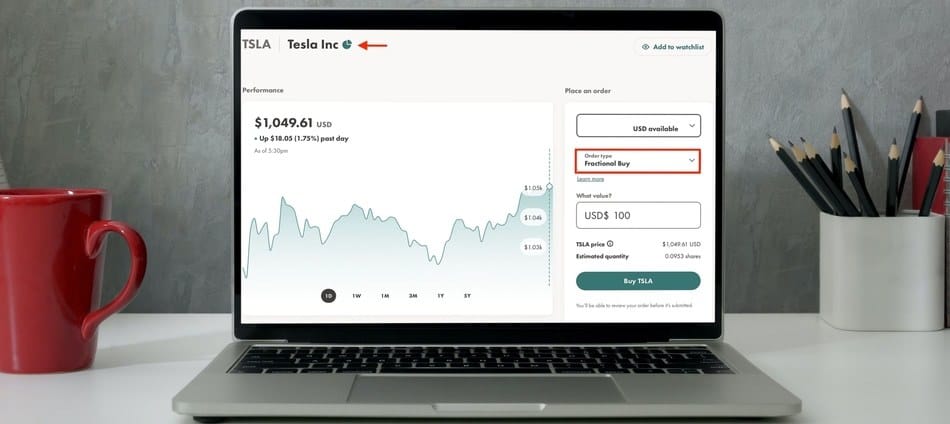

Let’s say that the stock of a company trades at $1,000 per share. You do not have the money to buy a full share, but your brokerage offers fractional trading. You decide to invest $200 in the company.

This $200 investment means that you now own .2 shares of the company’s stock ($200/$1,000=.2), or 20% of a share.

Now, say that this company pays a 10% annual dividend (wow!) to its shareholders. This means that each year, shareholders will receive $100 for each share of the company’s stock they own ($1,000X10%=$100).

However, since you only own .2 shares of the company, you will receive a proportional share of this dividend. In this case, that would be $20 ($100 dividend X .2 ownership stake).

The other thing to remember is that dividends are usually paid out quarterly. Instead of getting $20 at each disbursement, you will more than likely get $5 paid every three months.

So, in summary for this hypothetical case, owning .2 shares of a $1,000 per share, 10% dividend-yielding company will provide you a quarterly cash stream of $5.

Pretty straightforward, right?

Is It Worth Owning Fractional Shares?

Yes, it is worth owning fractional shares. Everybody has to start their investing journey somewhere, and the advantage of fractional shares has made it possible for many investors to purchase shares in companies that would previously have been out of reach.

When investing in fractional shares, it is important to remember that gains and losses are proportional, no matter how big a position you purchase. If a company experiences a 50% increase in stock price, you will get a 50% appreciation in your investment, regardless of whether you own .01 shares or 1,000,000 shares.

Is There a Downside to Fractional Shares?

There aren’t really any downfalls to trading in fractional shares. However, there are a couple of remote possibilities you may want to keep in mind.

The one area in which you really have to be careful regarding fractional shares is comission fees. If you have a brokerage that charges a per-trade commission to place a trade, then buying in low dollar amounts is not necessarily advisable.

If a brokerage charges a fee of $4.95 per trade, then investing $100 for a fractional share is an expensive proposition, as the fees alone represent roughly 5%, which is a healthy figure in the investment world.

However, as fractional trading gained exposure with the rise in free trading platforms, it is not likely that you will be trading in fractional shares on commission-based platforms. So just be sure to read the fine print and understand your brokerage’s commission structure before putting yourself in a hole.

Another drawback in trading fractional shares is that it is supposed to be harder to find buyers when you are ready to sell. There is always a rich tycoon or corporate conglomerate willing to buy large lots of stock, but few entities are said to be interested in .25 shares of that same company. But to be completely honest, this argument does not hold much water given the rise in retail trading and micro investing platforms.

I’ve invested in fractional shares since 2021 and I’ve never had any issues selling my shares.

Finally, the last super nit-picky downside to fractional shares is the bookkeeping convenience – or the lack there of.

It can be a bit challenging to keep track of your dollar-value stake in a company when you only own fractional shares. This is not a major issue since all modern platforms conveniently display your position, but if you see a change in share price and want to do a quick mental check on how it affects you, dealing in fractional shares makes matters a little more difficult.

Can You Make Money Off Of Fractional Shares?

Yes, you can absolutely make money off of fractional shares.

As mentioned, gains are proportional. If a company experiences a 10% gain, that is a 10% gain for everybody -regardless of how many shares you own. Obviously, a 10% gain in a $100 position won’t be as significant in total dollars as a 10% gain in a $1,000,000 position, but the reward-to-investment ratio is the exact same.

In addition, as owners of fractional shares receive dividends, you can reinvest those dividends back into the company to slowly grow your position, resulting in larger dividend disbursements as time goes on.

Platforms That Offer Fractional Shares

Trading platforms are under heavy pressure to offer fractional shares, as it is one of the best ways to attract retail investors. As such, while the list is not quite universal at this point, the following platforms do offer fractional shares:

- Wealthsimple Trade (my recommendation for Canadians)

- Robinhood

- M1 Finance

- Stash

- Public

- SoFi

- Stockpile

If a brokerage in which you are interested does not yet offer fractional shares, be patient – it’s likely only a matter of time before they unveil the feature to meet consumer demands.

As mentioned above, if you are Canadian, I’d highly recommend Wealthsimple Trade for buying fractional shares.

I’ve been buying fractional shares on the Wealthsimple Trade platform since 2021 and have had a great experience with the platform. Plus, the sign-up process only takes a few minutes (and you’ll get a $50 cash reward when you sign up).

Do Fractional Shares Pay Dividends: Everything to Know

So remember, assuming that the company offers a dividend, fractional shareholders are entitled to their share of the dividend. The dividend will be a fractional amount proportional to the percentage of the share you own.

So if you’re looking at starting a little dividend portfolio but can’t afford to buy stocks from a company like Apple, then sign-up for an online brokerage that supports fractional shares and buy slices of stocks from these larger dividend paying companies.

As you now know, you’ll still get your share of the pie when it dividend payouts are made.

And lastly, remember that it’s also beneficial to buy fractional shares in non-dividend paying companies like Tesla if you think they will appreciate in value over time.

Anyways, that’s all folks – thanks for reading!

Geek, out.