If you’re looking for an easy way to better manage your finances, I would strongly recommend you download the free app called Mint.

Mint is a budgeting app that I’ve used for quite some time now, and I love it.

The set up is so easy. You download the app, fill out some information, connect your accounts and you’re all set.

7 Reasons Why I Recommend the Mint Budgeting App

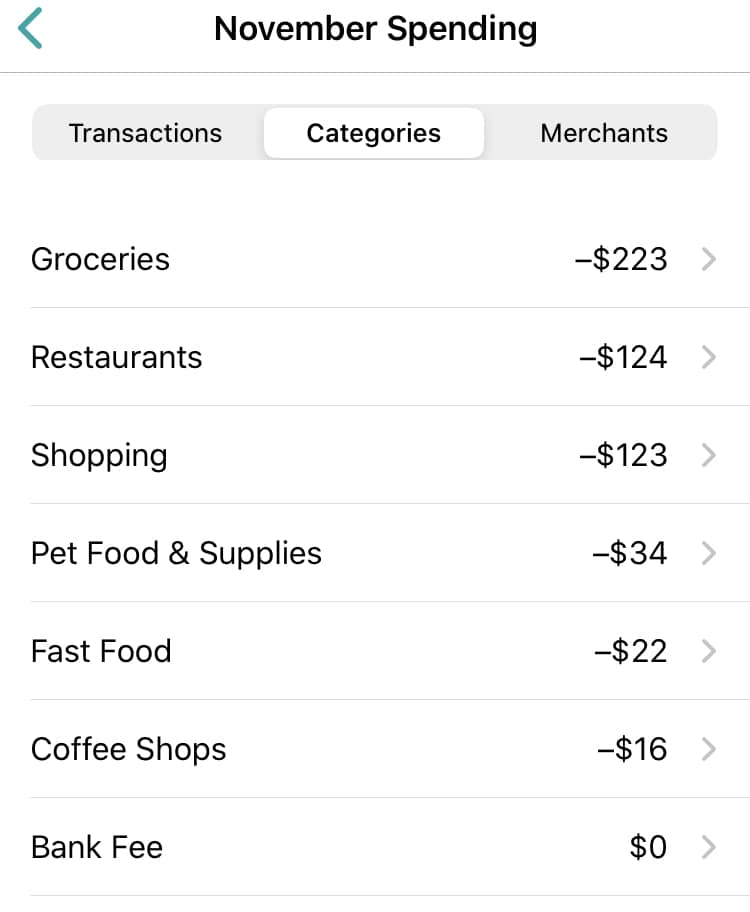

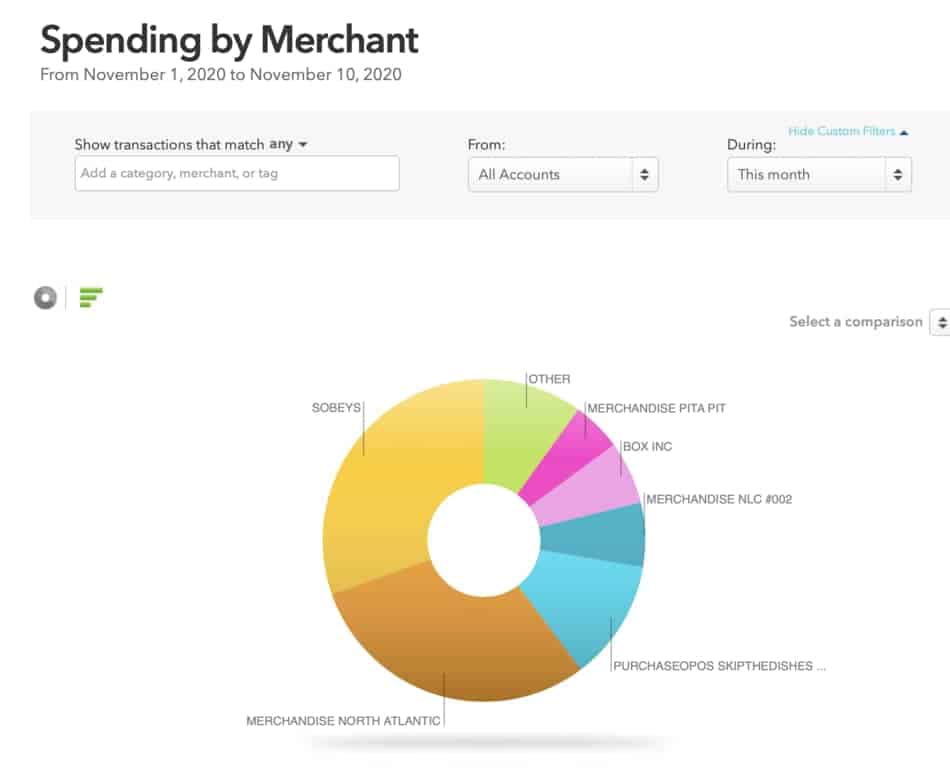

1. Tracks Your Spending

One of my favourite things about the Mint budgeting app is that it just simply tracks and categories your spending habits.

In other words, you’ll be able to look at the Mint app and see exactly where you spend your money.

I’ve included a screenshot below to show you exactly what I’m talking about.

It also includes a Merchants tab (show n above) which shows you what business you gave all your money too!

Hurray! ($47 at Pita Pit in November, cheers)

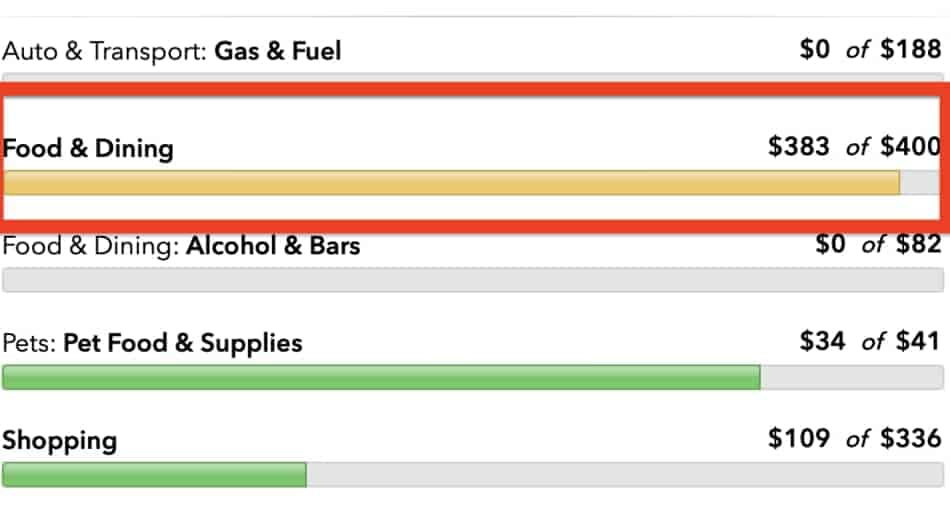

2.Budget Tracking

The other aspect of Mint I love is the Budget feature.

Mint lets you input a budget amount for each of it’s spending categories and then notifies you when you’re getting close to going over budget.

Examples of spending categories are things like Food and Dining, Shopping, Gas, etc. All things you should budget for!

For example, I set a $400 budget for Food & Dining each month. As you can see from the image below, Mint informs me that I’ve already spent $383 on food for the month, so I can only spend another $17 – yikes!

When you get close to reaching your budget for a certain spending category, Mint will notify you, I love that feature.

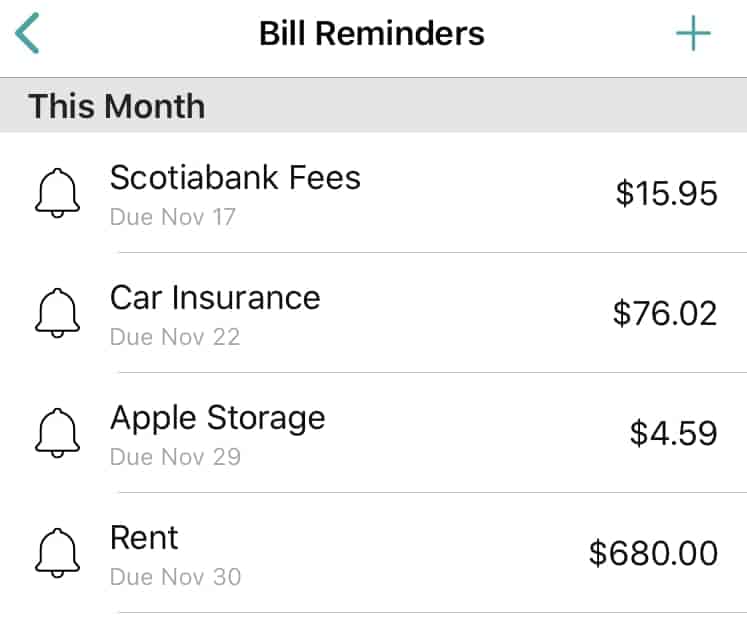

3.Bill Reminder Notifications

Mint is a great for bill reminders, and as someone who needs constant reminders, this is a great feature for me.

You’ll have to initially enter what day of the month bills are due, but then you’ll automatically get the notifications each month.

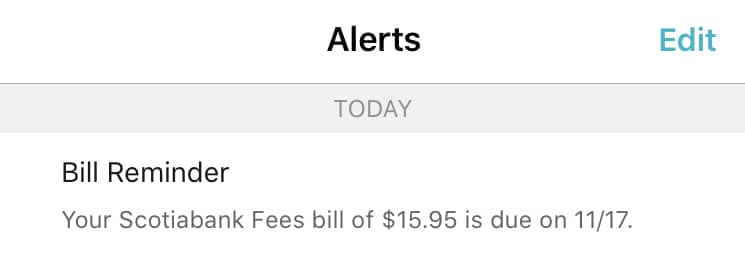

Not only will you have a bill reminders tab in the Mint app for you to go into look at, but you’ll also get alerts from Mint when you have bills coming due.

4.Consolidated Transaction History

Another thing about Mint I really like is the transaction history.

If you’re like me, you have a few different accounts on the go and managing all these accounts can be difficult sometimes.

Mint has a great transaction history page that allows you to look at all your transactions from all your different accounts in one place.

I love it, not only does it save me time as I don’t have to bounce around to different account portals, but it allows me to easily look at what’s going on with some of my accounts that I don’t look at on a regular basis.

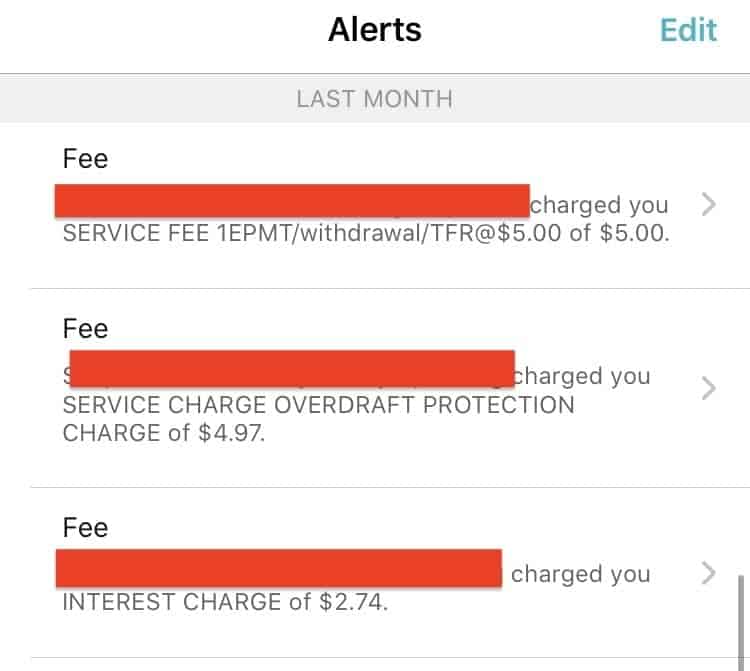

5. Fee Finder and Low Balance Notifications

The fee finder is arguably one of the most underrated things about the Mint app, in my opinion.

Mint is on a mission to find unexpected, hidden fees for you, and I love them for it.

Here’s a screenshot I just took on my phone of what these notification looks like.

The same thing happens when one of your bank accounts starts to get low on funds.

I don’t have a screenshot example of this to show you though (thankfully). But trust me, I’ve been there.

These notifications are honestly great.

Whether it’s a notification on overspending in a certain category, getting charged hidden fees or getting low on funds, these are all things I want to know about, and Mint does such a good job giving me this information.

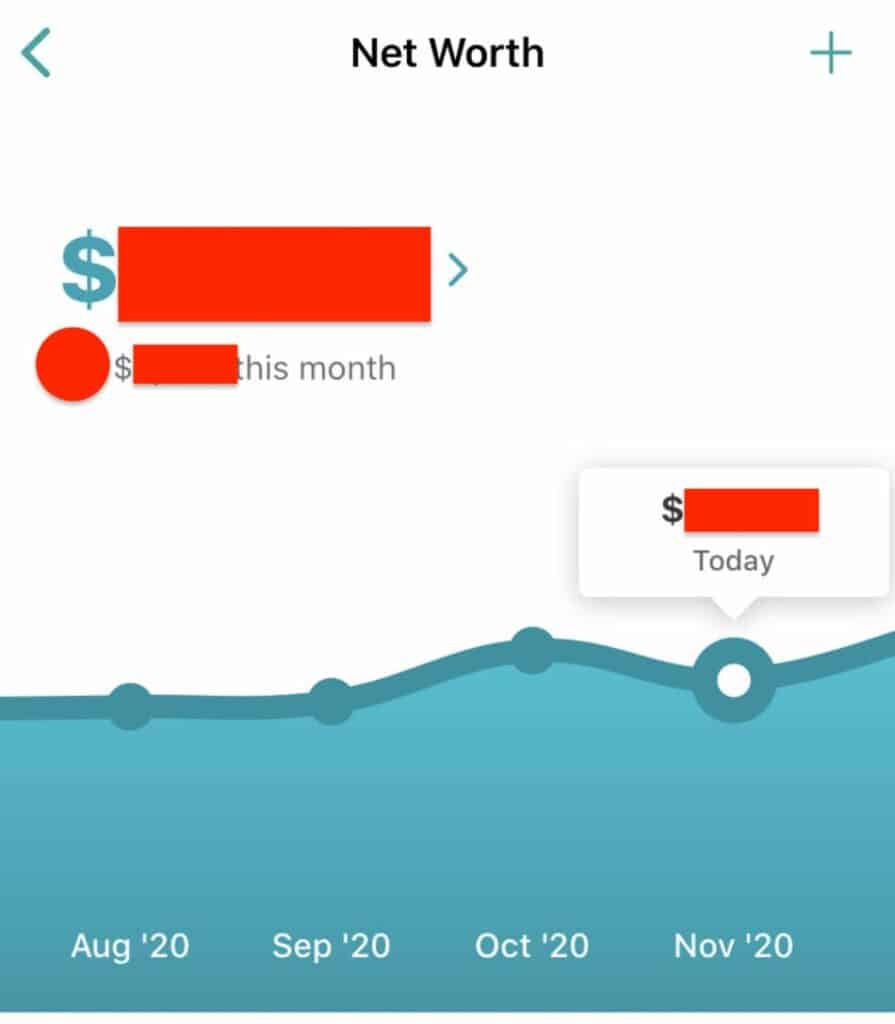

6. Net Worth is Calculated in Real Time

With Mint, you’re able to connect all your chequing accounts, savings accounts, mortgage accounts, credit cards, investments, retirement accounts etc. to your Mint account.

Then, based on all of this information, Mint is able to determine what your net worth is by subtracting your liabilities from your assets.

From my experience, Mint usually refreshes your accounts a few times a day so you can quite literally see what your net worth is to the exact penny at any given time.

Mind you, in order for this number to be accurate, you need to ensure you’ve connected all your accounts and manually added any assets that can’t be automatically connected to Mint. For example, the value of your second hand car.

Anyways, this cool little calculator is something I love about Mint, it might not impact your day to day life that much, but I just like making sure that number keeps going up!

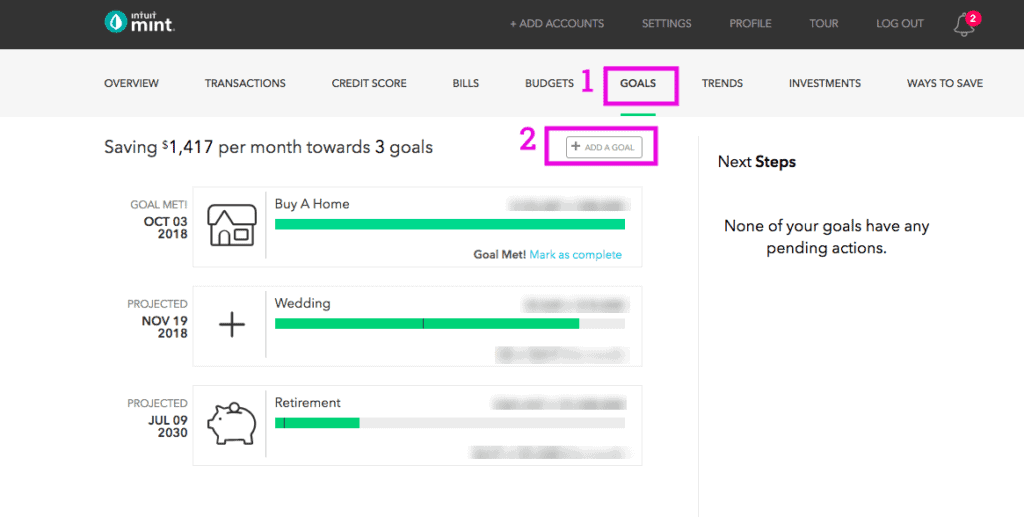

7. Goal Setting Feature

Lastly, I think Mint has a really great goal setting feature.

Mint lets you set financial goals for the future and then gives you savings targets to hit each month in order to reach those goals.

This keeps me accountable and keeps me on track for what I want to achieve.

If I know I want my net worth to be a certain amount by a certain time, then Mint will tell me how much I need to save each month and it provides me with a progress chart as shown below.

Conclusion

So if you’re looking for a free budgeting app, I recommend Mint.

While we talked mainly about the mobile experience here, it also has a great desktop interface that comes with your account.

As mentioned at the beginning, I’ve been using Mint for 3-4 years now, and I can’t ever see myself moving away from it.

The design is sleek, the functionality is bang on trend, and the overall user experience is a really solid.

And again, it’s free! Give it a try, if you don’t love it, you can just delete it.

Anyways, that’s my recommendation on what budgeting app you should download if you’re in the market for you, I hope this helped!

Geek, out.