Venmo is an amazingly easy way to electronically transfer money to friends, family, and businesses in the United States. But, is it available in Canada?

Unfortunately, Venmo is not currently available for use in Canada. To create a Venmo account and send or receive money, both parties must be located in the United States and have a U.S. phone number.

So, unfortunately, Venmo is not available anywhere else but in the U.S. However, Canadians have many other alternatives at their disposal which will fulfill many of the same purposes that Venmo offers.

But for now, let’s explore why Venmo isn’t available in Canada and discuss more about what exactly some of the alternatives have to offer!

Why Isn’t Venmo Available in Canada?

After discovering that Venmo wasn’t available in Canada, it got me thinking, why not?

Surely a major company like Venmo could expand its operations into other Countries such as Canada?

So I actually reached out to Venmo directly and asked them.

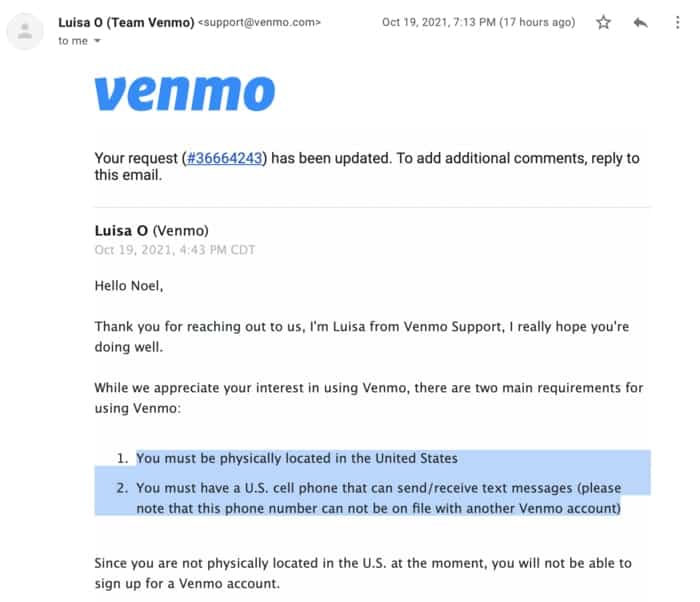

First I spoke with Luisa from Venmo, she confirmed that only Venmo is not available in Canada and then gave the two main requirements for using Venmo.

| Two Main Requirements for Using Venmo |

|---|

| 1. You must be physically located in the United States |

| 2. You must have a U.S. cell phone that can send and receive text messages (the phone number can not be on file with another Venmo account) |

Below is a screenshot of the conversation I had with Luisa.

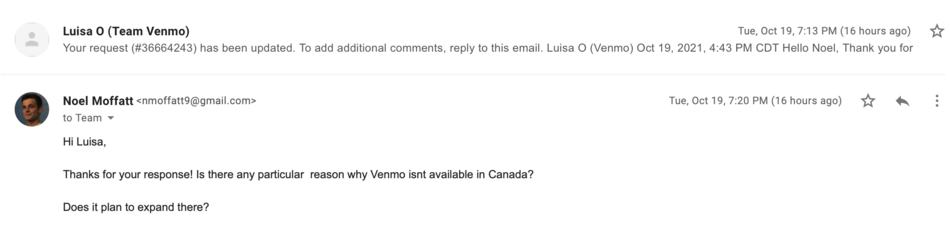

But even this answer, while helpful, it doesn’t quite tell us why Venmo isn’t available in Canada. So I followed up and asked, but why? And I also asked if there was any plans of expanding Venmo into Canada.

This follow up question was also answered by another Venmo Support person named Mark.

Mark (Support Employee at Venmo) went out to explain that:

Venmo is only available for our users who are physically in the US. Since Venmo is a US-based payment app. We don’t have yet the information or any updates if Venmo will be available for users outside of the US.

Mark Ryan – Venmo

So while Mark doesn’t expand on why Venmo isn’t available in Canada, he does indicate that they are no real plans or future expansion goals into Canada for Venmo at this time.

However, what Mark does go on to say is that their parent company PayPal is a great alternative for Canadians to use if they want to send and receive money similar to how it works with Venmo.

Below is a screenshot of the conversation I had with Mark.

Okay, so now we know without question that Venmo is not available in Canada. In order to use Venmo you must live in the United States and have a cell phone that can send and receive texts.

However, while Venmo is great for allowing you to make friends on the app and to pay family or friends with ease, there are some great alternatives to Venmo for those of us who live in Canada.

Venmo Alternatives for Canadians

Being able to pay a babysitter electronically, pay a friend for food electronically, or even pay businesses electronically is a convenience that, let’s face it, everyone needs.

So for people who live in Canada and want to use Venmo but can’t, what else can you use?

Here are 5 Venmo Alternatives for Canadians:

| 5 Venmo Alternatives for Canadians |

|---|

| 1. Wealthsimple Cash |

| 2. Paypal |

| 3. Interac and Apply Pay |

| 4. Wise |

| 5. Shakepay |

1. Wealthsimple Cash

Wealthsimple also has a Cash app for mobile devices that includes money transfering features. I actually use Wealthsimple Cash myself and I love it. I transfer money into my account each month and use that for my day-to-day spending.

Not only that, but it comes with a physical Cash Card that is a Visa debit so it allows me to make online purchases without having to use credit.

And then similar to Venmo, I am able to connect with other friends who have Wealthsimple Cash and send them money (or receive) instantly.

Learn more about Wealthsimple Cash

2. Paypal

Next is Paypal, and as we all know, PayPal is available in Canada.

As stated earlier, PayPal is actually the parent company to Venmo as it acquired them (part of Braintree at the time) in 2013 for $800 million.

Paypal is available in 203 countries and converts payments into 26 different currencies. But, it’s important to look out for any possible charges when you pay for anything internationally.

As Paypal is good for e-transfers, It shouldn’t be an issue, but trading money internationally will always have a small cost, so look out for that before you pay someone from another country.

3. Interac and Apple Pay

You can also use Interac and Apple Pay in Canada. Interac is Canada’s first option with electronic transfers between banks, but Apple Pay is based in the U.S, so how does it work in Canada?

If you are with a bank that participates in Apple Pay, then you can use it. Simple as that.

But here’s the kicker, not all banks allow and use this service, so make sure you call your financial institution to find out if you can if fact use Apple Pay.

The History of Interac

In 1984, Canadian banks came together to make a single shared network for Canadians to access their money. This was called Interac Association and it allowed people to electronically access and transfer their money.

It started with just 5 banks coming together and creating an interface that allowed for e-transfers and for the banks to be able to transfer money to one another more easily.

The founding banks were the Royal Bank of Canda (RBC), Canadian Imperial Bank of Commerce (CIBC), Scotiabank, TD Canada Trust, and Desjardins. Now, many years later, there are over 80 banks and institutions that have joined and are proud members of Interac.

The Acxsys Corporation was founded in 1996 and is a part of Interac. The founders were the same as Interac and they created this sister company that deals with the other side of e-transfers. This company made Interac e-Transfer, Interac Debit for online payments, and mobile deposit for their international services.

The two companies are all part of the same organization, and they are Canada’s best option for e-transfers. Especially because its members are composed of over 80 Canadian banks.

That means that transferring money electronically is quick and easy. As they all use the same system for transferring money, it also makes e-transfers easier on the banks and on the consumers who are actually transferring money.

4. Wise

Wise is a company founded in London, UK and they are an app used for international e-transfers. For instance, if a Canadian wants to send money to someone in America or England, then they can use this app and it will transfer money from one currency to another.

The company will process the amount and translate it into the other countries’ currency. The process should take one day for the money to leave your wallet and enter somebody else’s. That is faster than many banks, and they have no hidden fees. And even if there is a necessary cost for international e-transfers then they’ll let you know right away.

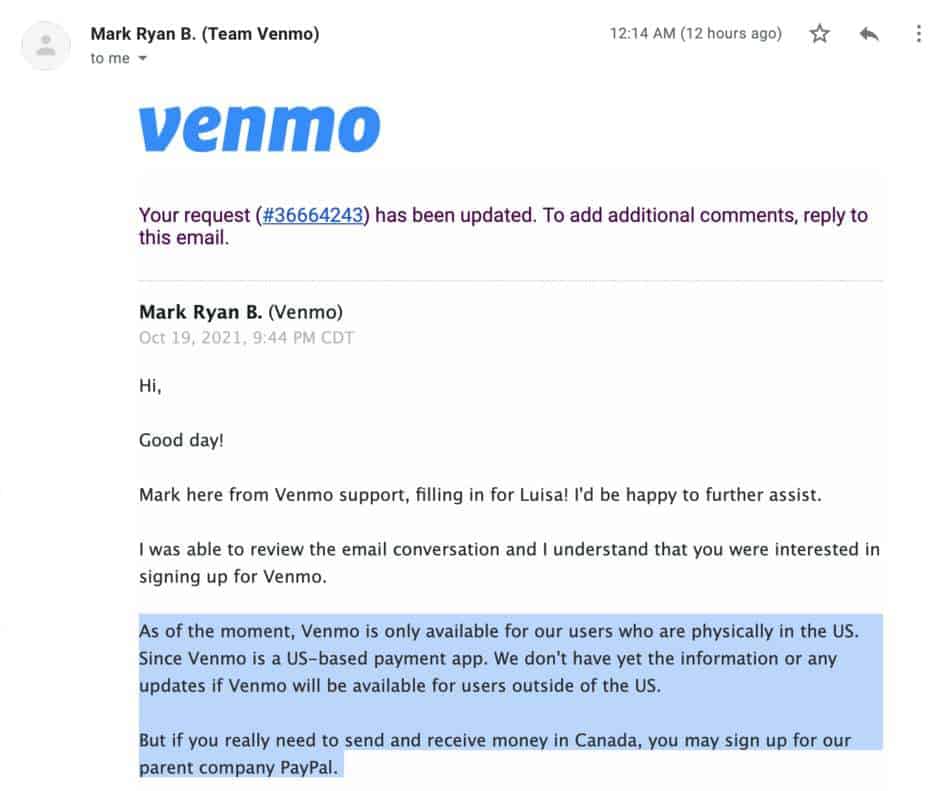

5. Shakepay

Lastly we have Shakepay. Shakepay is a little different from an e-transfer company as they allow you to buy and sell Bitcoin and other crypto currencies.

If you like the idea of using Crypto, then this is a great app to do it on. You can buy and sell, get support, store coins securely, have control over your funds, and you won’t even have to pay commissions.

With all that said, I personally find it easiest to use Interac for all of my e-transferring needs. They have members from over 80 banks in Canada that are ready to help you transfer your money electronically.

If apps like Wealthsimple Cash become more mainstream in Canada than I can certainly see myself using that more regularly, but for now, just not enough of my friends use it.

Options Not Available in Canada

You cannot use CashApp, Venmo or Zelle in Canada.

These apps do not work outside their home county, the United States. If there is another app you want to use, calling your bank and asking what payment apps they allow and don’t allow for their services is a good way to find out if you can and can not use.

Final Thoughts

In summary, Venmo is not available in Canada.

With that said though, there are many alternatives to Venmo, as discussed above, and while they aren’t the exact same, they largely achieve the same task – sending money.

So if you are looking for a Venmo equivalent here in Canada, look no further than Wealthsimple Cash. If you’d rather something more mainstream, stick with Interac e-transfer or Paypal.

Thanks for reading folks! As always, I hope you found the answer you were looking for!

Geek, out.