Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

This article is all about different ways Canadian university students can save money.

I usually like to start an article off with some sort of story, or analogy, but as we have 27 different things to go through, why don’t we just jump right into them.

Here are 27 easy ways you can save money as student in Canada:

Avoid Spending Money for 2 Days Each Week

Weird one to start with, but hear me out.

A great way to save money as a student in Canada is to dedicate two days out of each week (try and keep them the same) where you don’t spend a dime.

Not one cent, pretend as if you don’t have any money. This will drastically reduce the amount you spend and will save you hundreds of dollars over the course of a semester.

I’d recommend Monday and Thursday. Weekends are tough as most college and university students are degenerate partiers.

Make sure you properly prepare for these days though. If you need groceries, go the day before, if you need gas for your car, go the day before, beer for the weekend, day before, funnel for the party…okay you get the point.

Give it a try!

Find Cheap Entertainment

Finding cheap entertainment in your area, whether on campus or not, is a great way to cut back on spending as a Canadian university student.

While we’d all love to sit courtside at a Raptors game, or center ice for a Leafs game, that’s just not going to work financially!

Universities often give students free, or really cheap tickets to go watch their varsity teams play, so definitely consider that. Saving money while showcasing school spirit, double win!

Other forms of cheap entertainment include half price movie nights, non-profit events, amateur sporting events, local music shows, and my personal favorite 3 for 5 beer special nights.

Apply for Scholarships

Similar to American colleges, Canadian universities offer a ton of scholarships to current and potential students, so take advantage of these opportunities and start applying.

I’ve mentioned this before, but I used to take one weekend at the start of every semester and apply for every single scholarship that I was eligible for.

I didn’t get all of them, but I did get some and wow, what a difference it made. I practically got my tuition paid for plus an extra few thousand dollars.

Student’s today don’t bother to look at what’s available so they miss out on these great opportunities.

Action item – Search “scholarship opportunities” on your university’s website and apply for every single scholarship offering that you have even a 1% chance of winning.

Don’t be surprised if you win some!

Stick to a Budget

To save money as a university student in Canada, or anywhere for that matter, try setting a monthly budget and then stick to that budget as best as possible.

While you won’t be perfect, and you’ll sometimes go over budget on somethings, at least you’ll be conscious of what you’re spending and you’ll be less likely to spend well outside your means.

I use a budgeting app called Mint for my budgeting, I did a review of the app in a post that you can find here.

Prep Your Meals for the Week

Preparing your meals on Sunday of each week is a great way to save money as a student living in Canada.

Most university campuses in Canada are flooded with take out options, fast food joints, food trucks, and other quick service restaurants. Everywhere you look you can get a fat, juicy burger for under $5.

So what do you do when you’re tired and hungry? Well if you’re like me, you cave in and buy food from these delicious places.

And while we love the taste and convenience, our bank accounts take a hit each and every time.

So you need to avoid this, and in my opinion, having pre-made meals that can be heated up and eaten within 5 minutes is the best way to do it.

Not only is buying food and making it yourself a great way to save money, but learning how to cook is a great skill to learn, so what better time to do so than as a student?

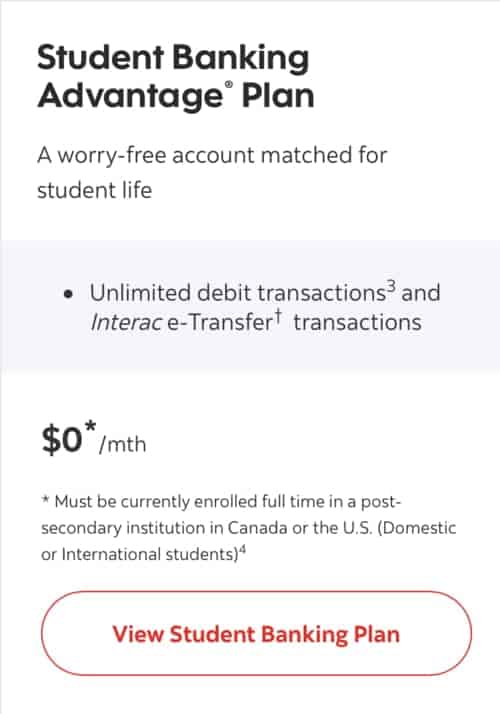

Claim Student Banking Discounts

All of Canada’s big 5 banks have student banking options that you should take advantage of as a university student.

For example, below is a picture of Scotiabank’s student banking plan. I actually used this exact plan as a student and it was great.

It was the exact same plan as what I use now, only now I pay $15.95 because I’m not a student anymore.

And you might think, whatever, $16 a month, no big deal. But it all adds up – as my mother would say “count the pennies and the dollar will take care of themselves”.

Buy Stuff You Need on Second Hand Marketplaces

Over the course of your student life, you’re gonna need to buy new things at some point.

But for most things, underwear not included, you can find these things on second hand marketplaces like Craigslist, Kijiji, or my new personal favorite, Facebook Marketplace.

You can literally get anything on these marketplaces! Phones, clothes, cars, furniture, books, shoes, boots, jackets, appliances, you name it.

So whenever you need something new, instead of going straight to Amazon, check out these local marketplaces and see if you can find whatever it is you need for a fraction of the price.

Don’t Use Credit Cards

As a student living in Canada, a great way to save money is to just not overspend money.

And when are you most likely to overspend money? When you use credit cards. And that’s not a theory, that’s a fact. People spend more than they normally would when spending with credit.

While I won’t get into the whole philosophy of it here, spending money with credit cards is SO EASY nowadays.

It’s such a painless process that it doesn’t even make you feel like you’re spending money, and this is very dangerous from a financial standpoint.

It often causes us to spend well outside our means which can kill any saving goals or budgets that we’ve previously set for ourselves.

So my one piece of advice, unless you really have too, just don’t use them. Cut them up and cancel them if needed.

Scary thought I know, but you’re not gonna die. I’ve lived without a credit card for over a year now, and I’m still here! Alive and well I might add.

Live at Home

To save money as a student in Canada, consider staying close to home during your university years and live at home with your parents.

As long as you weren’t a terrible child, rent should be pretty affordable (if not free), and while you should offer to pay some living expenses such as food, I’m willing to bet your parents won’t mind funding most of those expenses either.

I’m proud to say I lived home for my five year undergraduate degree and it was great. I lived a five minute walk from campus, so I basically had no expenses.

And who cares? You’re a student? It’s okay to be cheap.

Live home and don’t judge yourself. It’ll quite literally save you thousands of dollars.

Start a Side-Hustle

Another great way to save money as a student in Canada is to make money.

Have you ever considered starting a side-hustle business? You don’t even really need to call it a business, but just something that earns you extra money.

If you are looking for some ideas, here’s an article I wrote on 9 Easy Ways to Make Money Without Owning a Business.

I bought and sold Instagram accounts and started a clothing brand while I was in University. I didn’t get rich off either one of them, but I made a nice little side income that allowed me to save more money than I normally would have been able to.

Another side-hustle you could start is a blog. Take it from me, you can make great money with blogs. And what’s even better is that they’ll cost you less than $100 a year to operate.

Not only that, but creating and building your own blog is honestly fun and a very rewarding experience. It’ll take some time to build a following, but once you do you’ll reap the benefits.

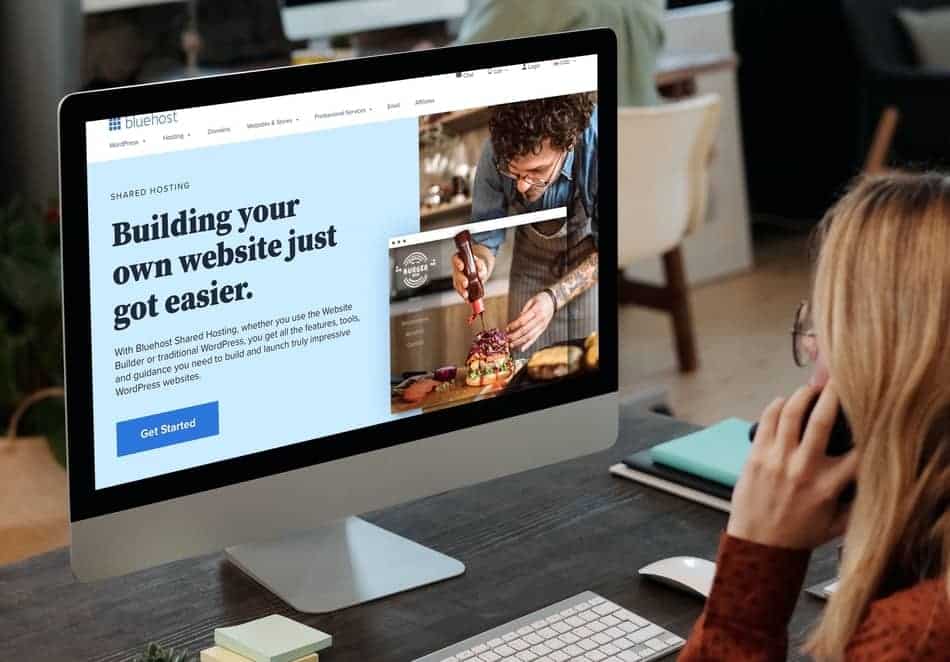

Looking To Start Your Own Website or Blog?

Try Bluehost Today (Less than 5$/Month)

- 70% Off with Sign up Through the Financial Geek

- 1-Click WordPress Install

- Free Domain Name with Sign Up

- 300+ Design Templates

- 24/7 Expert Support

Take Advantage of Free Stuff on Campus

A great way to save some money as a student in Canada is to take advantage of free stuff that universities give away.

Have you ever been to a freshman orientation? Holy gosh, it’s like a sex shop/pharmacy. I got a bag filled with birth control, a box of 20 condoms and I think I even got a small tub of lube back when I was a freshman.

Okay, maybe the lube is made up, but universities give away a ton of free stuff, especially at the start of every semester. So take advantage of this free stuff!

Whether it’s coupons, t-shirts, condoms, lip chap, coffee, tickets to sporting events, just take it. Anything free as a student is good, remember that.

It might not save you thousands of dollars, but hey, you do the math on a box of 20..nevermind.

Buy a Bike

Depending on what Canadian school you attend, and what time of year it is, buying a bike can be a great way to save money as a student.

While you’ll have to make an upfront investment at the start, you don’t need to get anything expensive, just a bike that is functional.

As discussed above, check out secondhand marketplaces and find one for cheap.

Having a bike will allow you to whip around town quickly without having to buy a car or call an Uber everytime you need to go somewhere.

Claim Your Student Costs

In Canada, university students can claim student costs like tuition, debt on student loans and even moving expenses if applicable.

So take advantage of these tax benefits and claim everything you possibly can. It might sound complicated but it really isn’t.

It’ll take a few hours to figure out what you can claim and how you can claim it, but it’ll save you hundreds, if not thousands of dollars, so it’s definitely worth it.

Now I’m not a tax expert, far from it, so make sure you speak with a professional before doing so.

Don’t Upgrade Your Electronics

To save money as a student in Canada, don’t upgrade any of your electronics unless you absolutely have to.

Canadians love staying up to date with the latest and greatest technology, so it can be hard to walk around with the iPhone 8 when everyone else is on the 11, but come on guys, these are first world problems.

There are plenty of times in one’s life where upgrading your iPhones, Macs, Tablets, etc can be a great idea, but not when you’re a student.

Every penny counts as a starving student, so as long as what you own now works, run it into the ground.

In other words, keep using it until it no longer works.

A new iPhone might be cool for a few days, but after that, it’s just a phone and it’ll bring you no more value than whatever you currently own, so what’s the point?

Fast-Track Your Degree

I love this one, because it can arguably save you more money than any of the other options discussed in this article.

Have you ever considered fast tracking your degree? In other words, completing your studies in 3 years as opposed to 4? Or doing a 5-year program in 4 years?

While this option might not be feasible for everyone, check out your situation and see what your options are.

Your total tuition costs might not change as you’ll still need to complete the same number of courses, but finishing early will allow you to get out in the workforce earlier which in turn will increase your purchasing power.

Being a student is great, and I would personally never fast track my own experience, but purely from a financial perspective, the less time you’re a student, the better.

Buy Used Textbooks

Buying used textbooks is a great way to save money as as Canadian student.

Buying textbooks first hand is an absolute fortune, so if you don’t have to, then don’t do it.

Over the course of your entire degree, choosing to buy used textbooks over new ones will save you 4 figures, no doubt about it.

Not only should you buy textbooks second hand, but you should also turn around and sell what are now double used textbooks.

While I don’t agree with ripping anyone off, try and break even on your textbooks each semester and resell them for what you bought them for.

This is all pretty common sense, I know, and I’m sure you already thought of it, but I did just want to briefly mention it.

Look for Cheaper Electronic Versions of Your Textbooks

Before purchasing a textbook you need for class, look online and see if you can get the exact same textbook but in an e-version.

These versions are always way cheaper despite providing you with the exact same material. Paper ain’t free!

As you can see from the screenshot below, this Medical Physiology book is over $70 cheaper for the Kindle version.

So do a bit of research online before buying a hardcover book, it could save you some big bucks.

Exercise on Campus

I’ll keep this one pretty brief, but I would venture to say every mainstream university in Canada has a gym on their campus.

Not only that, but the cost of accessing these gyms are usually incorporated into your tuition fees.

So take advantage of these “free” facilities and cancel your other gym memberships if you have them.

Not to mention the convenience factor, you’re hopefully already on campus for class, why not stay in one place and get your training in too?

Take Advantage of Student Discounts

In Canada, and around the world I presume, university students get discounts on almost everything.

Make sure to look around your local area for student discount opportunities like 10% of groceries on Tuesdays or “half price prints with a valid student ID!”

Not only locally though, huge companies like Netflix, Amazon and Apple offer student rates for their streaming services.

Action item – Canada has what is called a SPC card which stands for Student Pricing Card. This card gives students special discounts all over the country. You should create an account.

So again, don’t leave any stone unturned, you should be asking the cashier everytime you buy something if student rates apply.

Student discounts rock, take advantage of them, over a 3-5 year period, student discounts will easily save you over $1,000.

Ask Your Parents to Pay for Things

To save money as a student in Canada, don’t be afraid to ask your parents to pick up some expenses for you.

Whether it’s food, transportation or an entertainment allowance, ask away.

What’s the worst that could happen? They say “no”. Okay then if that happens, just move onto another option, but at least try.

If your parents can afford to help you out anyway they can, I’m sure they’ll be more than willing to help.

There is a good chance that they’ve been in your shoes before. They’ll understand that saving money as a student is not easy and that every little bit helps.

So don’t be afraid to ask, and definitely don’t feel too old to be asking your parents for help financially, you’re a student for goodness sake!

Avoid Coffee Shops

If you’ve lived in Canada for any period of time, you know that coffee shops are basically unavoidable.

It seems like there at every street corner nowadays, god damn it Tim Hortons, enough!

And as a student, coffee is like oxygen, it’s a necessity, so that just makes things even harder.

Unfortunately though, buying coffee at coffee shops isn’t free, and depending on where you go, it’s not cheaper either.

These small $2-$3 coffee purchases are silent killers to one’s bank account.

Over the course of a few semesters, you’d be shocked at how much you’’ll have spent on little coffee shop purchases.

So try your best to avoid these places, easier said than done I know, but check out my article 6 Tips to Help You Avoid Coffee Shops for some pointer on how to do this!

Live with Roommates

Aside from living at home, living with roommates is the cheapest way to live as a student.

In Canada specifically, paying $400-$600 a month in rent is very possible if you’re willing to live with other people.

While you may not love the idea of living in a house with other people, potentially even strangers, remember that it’s all temporary. Short term pain for long term savings.

Deciding on what your living situation will be like is one decision that can either cost you, or save you, thousands of dollars.

So choose wisely.

Attend Networking Events

Networking events and conferences are great places to meet like minded people, but they are also great places to get a free meal every once in a while.

If you’re lucky, they may even serve alcohol. If you’re really lucky, it’ll all be free.

Look on your universites website and search up networking events or conferences that they’re hosting, if there’s something there that peaks your interest, try to attend.

At the very least you’ll get a bite to eat of it.

I used to crash these things like crazy back in the day. “Noel, you’re not on the Dean’s list, why are you at the Dean’s list supper?”

Oops.

Limit The Amount You Party

Canadians love to party, and as a university student in Canada, you’ll probably party more during your university years than you will at any other time in your life.

And that’s okay, but make sure you set a monthly budget for how much you’ll allow yourself to spend on partying and do your best to stick to this budget.

Remember, the keyword here is limit.

I’m not saying not to party at all, because that would be just darn right rude, but just try and limit it to a reasonable amount each month.

And I’m not trying to be a stickler here either, I love to party, but going out three times a week for four straight years is going to limit the amount you can save as a student.

Get a Part-Time Job

Have you ever considered getting a part time job to earn a little extra money as a student?

Because you live in a prosperous country like Canada, opportunities for students wanting to earn just a little extra income are endless.

Here are some common examples:

- Retail Stores (Any Lululemon nearby?!)

- On Campus Jobs (Gyms, Libraries)

- Fast Food, Casual Dining Restaurants

While this option isn’t really specific to saving money, and more so about earning it, the end goal is the same – having more free cash flow to spend on things that really matter.

Use Public Transit

Don’t be afraid to take public transit as a means for transportation as a student – it’ll be cheaper than getting cabs or Ubers, and it goes without saying it’s less expensive than owning your own vehicle.

And while riding public transit might not be the most glamorous thing in the world, who cares? You’re a student, no one expects you to be rolling around in a Boogotti

Action Item – Make sure you check for student discounts on public transit passes, they’re almost always available.

Be Frugal

And finally, this is more of a generic point, but don’t be afraid to be frugal.

Canada is an amazing, prosperous country, but it isn’t the cheapest place in the world to live, so save money anywhere you can.

Don’t buy brand name things, drink water, buy groceries on discount days, use public transit, steal beer from parties (kidding on the last one – but I’ve done it).

But seriously, it’s 100% okay to be frugal as hell while you’re a student living in Canada.

I’ve said this many times throughout the article but I’ll say it again, you’re a student, you’re not supposed to have any money.

Now I’m not saying that you should be cheap, but you should be frugal.

Conclusion

And that’s it for this article. Those are 27 ways you can save money as a student while living in Canada.

Now you won’t be able to incorporate all of these saving tips into your day-to-day life, but that’s okay, choose 4-5 of these things and commit to them, you’ll be shocked how much money you end up saving.

Recap – 27 Easy Ways to Save Money as a Student in Canada

- Avoid Spending Money for 2 Days Each Week

- Find Cheap Entertainment

- Apply for Scholarships

- Stick to a Budget

- Prep Your Meals for the Week

- Claim Student Banking Discounts

- Buy Stuff You Need on Second Hand Marketplaces

- Don’t Use Credit Cards

- Live at Home

- Start a Side-Hustle

- Take Advantage of Free Stuff on Campus

- Buy a Bike

- Claim Your Student Costs

- Don’t Upgrade Your Electronics

- Fast-Track Your Degree

- Buy Used Textbooks

- Look for Cheaper Electronic Versions of Your Textbooks

- Exercise on Campus

- Take Advantage of Student Discounts

- Ask Your Parents to Pay for Things

- Avoid Coffee Shops

- Live with Roommates

- Attend Networking Events

- Limit The Amount You Party

- Get a Part-Time Job

- Use Public Transit

- Be Frugal

Thanks for reading, or should I say, skimming the headlines.

We all know that’s how these list articles work. No one is reading this whole thing.

Geek, out