In the world of credit cards, payment apps, and contactless banking, many young people may not have much experience with a good old-fashioned paper check. Unfortunately, this inexperience can be exploited by fraudsters.

So if you receive a check in the mail for the first time, you may be wondering:

How do banks verify checks?

Banks can verify checks by examining the funds in the originating account. However, it’s important to note that banks will not verify the check before processing it, which may result in fees for cashing a worthless check. Instead, the bank assesses the availability of funds in the account, and the check will be returned as invalid if insufficient.

While this seems simple, it doesn’t tell the whole story. Banks are not required to -and usually do not-verify a check when deposited. This leaves the depositor at risk of the check bouncing. To help you avoid a bounced check situation, read on to find out everything you need to know about how to verify checks.

How Do Banks Verify Checks?

Banks verify checks by contacting the issuing institution.

However, it is important to note that banks typically do not verify checks before they are deposited. Therefore, it is important to either ask the bank to verify the check before depositing or attempt to verify the check yourself before taking it to the bank.

Every financial institution has a number to call to verify the authenticity of an account.

For example, if a check were written against a Wells Fargo account, customers and/or merchants could visit this page to verify the account.

When contacting a bank to verify an account, the depositor needs to have the following information ready:

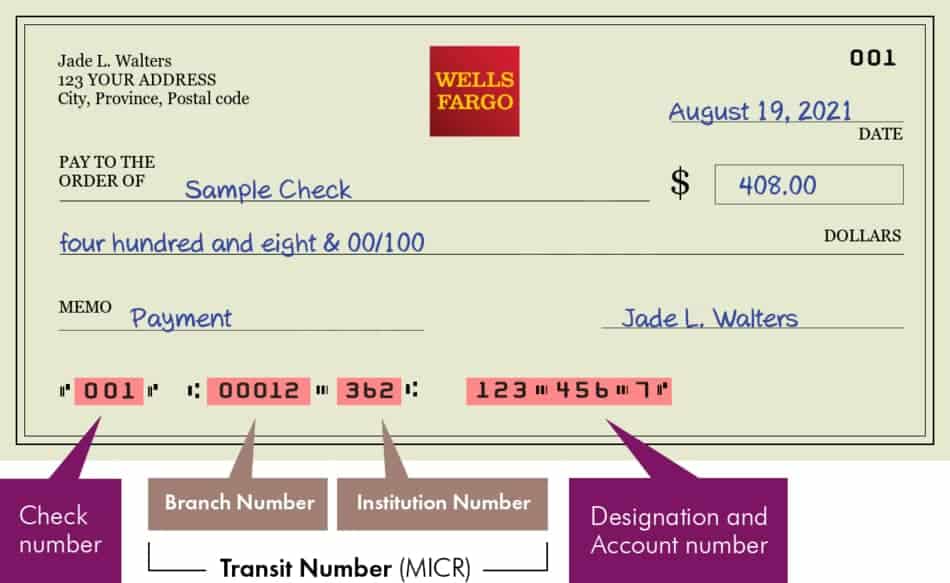

- Routing number – this is a 9-digit number located on the bottom left of the check. It is the first set of numbers you will see on the bottom of a check. Routing numbers usually contain a lot of zeroes.

- Account number – this is another 9-digit number at the bottom of a check. It is the second cluster of numbers immediately following the routing number.

- Check number – this is located in the upper right corner and lower left corner of the check.

- Name on the account.

- Address

- The amount the check was written for.

An absence or irregularity with any of these pieces of information is an indication that the check is not authentic, and you should not attempt to cash or deposit it.

Recommended Financial Geek Article: Do Bank Drafts Expire? Simple Explanation

Can a Bank Detect a Fake Check?

A quality bank and/or banker should be able to detect a fake check before you deposit it and have it bounce.

However, remember that most tellers (the people working at the windows of banks) are usually entry-level professionals in the financial world, so they may not be as trained or experienced in identifying phony checks as the people in the back of the building.

Furthermore, as many banks now offer remote deposit, you may never interact with a teller when depositing a check. While good depositing software should prevent you from depositing a check if something looks fishy, it is hard to tell what will and will not go undetected.

Therefore, it is a great idea for you to train yourself on identifying fake checks before attempting a deposit.

Some telltale signs that a check is a fake include:

- The check lacks perforations.

- The check number is missing or does not change.

- The check number is low – over 90% of bad checks are written against accounts that are less than a year old. Low check numbers would be 101 through 400 for personal accounts and 1001 to 1500 for business accounts.

- There are multiple types of fonts on the check that gives the check a tacky and unprofessional appearance.

- There is non-standard information on the check, such as phone number, email address, or website links.

These are just a few of the many signs of a fake check. A single one of these irregularities may not be much cause for concern, but multiple abnormalities should sound your alarms, and it is worth your time to have the check verified to be on the safe side.

How Long Does It Take for a Bank to Verify a Check?

A bank can verify a check in a matter of minutes if it contacts the issuing institution before deposit.

However, if the check is deposited, it will usually take two or three business days to clear or bounce.

Checks for small amounts ($200 or less) are often verified in less than 24 hours.

If for some reason, it has been more than three days and you are not seeing a deposit showing up in your account, the following could be the reason for the delay:

- You’re attempting to deposit a single check for more than $5,000.

- The account you’re drawing against has been open for fewer than 30 days.

- The account you’re drawing against has a history of overdrafts.

- The bank has reason to believe that the check will not clear.

Does a Bank Have To Verify a Check?

No, a bank does not have to verify a check when you make a deposit.

In fact, most banks will not verify a check at the time of the deposit.

Customers hate spending time waiting in line at the bank. If the bank tried to verify every single check that came through its door before depositing, it would seriously upset clients and slow business operations to a standstill.

Therefore, checks are usually not verified upon deposit and will probably not be verified before entering the clearinghouse unless it is for a large amount or the banker handling it happens to notice irregularities.

Recommended Financial Geek Article: 9 Benefits of Saving Money in the Bank

What Happens If You Unknowingly Deposit a Fake Check?

The consequences of depositing a fake check are not fun–even if you do it unknowingly.

In a best-case scenario, you will simply have to repay the amount of the bad check. Say you deposit a check for $1,000, and it bounces. Your bank would then take that $1,000 out of your account once the check bounced.

Things get much trickier if you have already spent a portion of the bad check and do not have the funds to cover the bank recouping the bad check amount. Some possible consequences include:

- You have assessed a bounced check fee – it is costly for the bank to process bad checks so that they will pass this cost on to the customer in the form of a fee. This will likely happen regardless of whether you have the money to cover the amount of the bounced check or not.

- You are charged an overdraft fee – this is around $30 for most banks.

- Your bank account gets frozen.

- Your credit score takes a hit.

- Your banking history will get flagged, and you become identified as a depositor of bad checks.

While a single attempt to deposit a bad check will unlikely result in criminal charges, repeated attempts will eventually result in a misdemeanor or even felony if performed at the corporate level.

Final Thoughts: How Banks Verify Checks

Banks verify checks by contacting the issuing institution to have the account information analyzed.

While this can be done in a matter of minutes, please be warned that it is uncommon for banks to verify a check before deposit.

To help you avoid the unpleasant consequences of having a deposited check bounce, educate yourself on the signs of a fake check and start depositing with confidence today!

As always, thanks for reading!

Geek, out.