Have you ever wondered how a teacher can become a millionaire?

If you are a teacher, have you ever wondered how YOU can become a millionaire?

With roughly 4.2 million teachers in North America, I’m sure you’re not the only teacher to ask yourself that question.

As of 2019, the average teacher’s salary, according to edweek.org, is around $61,730 USD.

While that’s a great income, it’s a far cry away from a million dollars, which begs the question – how do teachers become millionaires?

Well, there are a lot of ways really, but some are less likely than others.

I’ll talk more about these less likely ways later in the article, but for now, let’s focus on what I think is the most probable way of becoming a millionaire on a teacher’s salary.

So right away, let’s get into it – Here is a 5-step process to becoming a millionaire as a teacher.

- Become a Teacher

- Earn At Least $60,000 Per Year

- Invest 45% of Your Gross Income for At Least 16 years

- Generate an Average Return of 10% Over the 16-Year Period

- Become a Millionaire

1. Become a Teacher

Okay, so first things first. If you want to become a millionaire as a teacher, you need to first become a teacher.

Now how does one go about becoming a teacher?

Well I assume in most places you need an undergraduate degree and some sort of masters in education.

But let’s be honest, what do I know about becoming a teacher?

If you’re reading this article, I’m assuming you already are a teacher, or you at least know more than me about how to become one.

So let’s just assume I gave a great explanation for how to become a teacher and move on to step #2.

That was easy!

2. Earn At Least $60,000 Per Year

As mentioned at the beginning of this article, the average salary for a teacher in America is roughly $60,000.

$61,730 to be exact, according to edweek.org (As of 2019).

But for simplicity sake, let’s just say $60,000.

So if you’re already making $60,000/year or more, then bravo. Move on to step #3.

If not, that’s okay! You can still become a millionaire as a teacher, but it just might take a little longer. No big deal.

I should also mention, I am referring to your gross income here, so your pre-tax earnings.

3. Invest 45% of Your Gross Income for At Least 16 years

Okay, now step 3.

To become a millionaire as a teacher, invest 45% of your income for 16 years.

In other words, making $60,000 a year, you need to be saving and investing around $27,000 a year. This equates to $2,250 per month.

Not easy, I know. But hey, becoming a millionaire aint easy.

In step 4, I will talk more about what to do with these savings, but for now, just know this will be the foundation on which you grow your fortune.

If you’re thinking, okay, $27,000 a year for 16 years only equates to $432,000, then you’d be right.

But you aren’t just going to save this money and let it collect dust, you are going to make your money work for you and invest it.

By investing your money in the stock market, I’m not referring to making high risk investments, learning how to day trade, or spending 10 hours a day looking at stock charts.

I’m talking about passively investing with an average return rate of about 10% per year. Which brings use to our next step. Step 4.

| Invest for Retirement | Our Recommendations | Start Preparing Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Start Investing TodayRead our Review |

| BettermentOnly in USA

| Start Investing Today |

4. Generate an Average Return of 10% Over the 16-Year Period

Okay, so now that you’ve committed to saving a large portion of your income, it’s time to put that savings to work with the power of investing and compound interest.

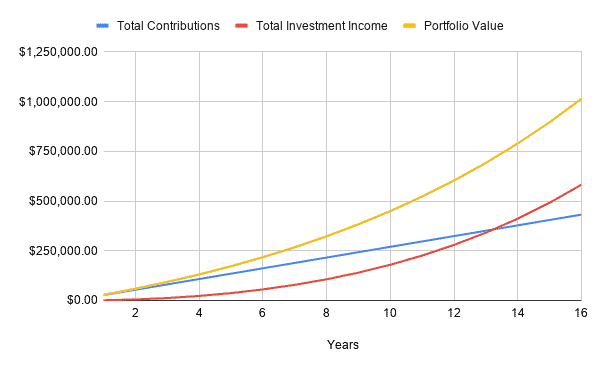

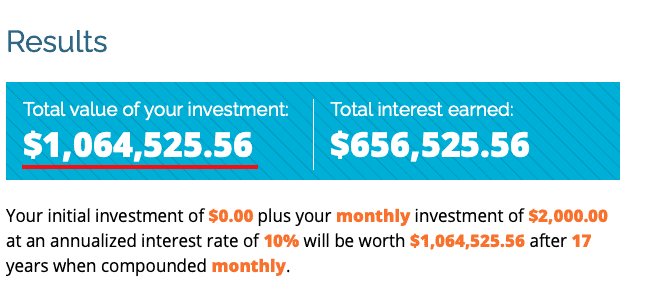

If you can generate an average return on your investments of 10%, over the course of this 16% year period, you’ll have roughly $1,014,365.

Put another way, you’ll be a millionaire.

I know it sounds crazy, but it’s true. This is the power of compounding.

Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it – Albert Einstein

I have included a table and graph below to show you how the math shapes up.

| Years | Annual Contributions | Total Investment | Annual Investment Income | Total Investment Income | Total Investment Income |

|---|---|---|---|---|---|

| 1 | $27,000.00 | $27,000.00 | $1,216.21 | $1,216.21 | $28,216.21 |

| 2 | $27,000.00 | $54,000.00 | $4,037.83 | $5,254.04 | $59,254.04 |

| 3 | $27,000.00 | $81,000.00 | $7,141.61 | $12,395.65 | $93,395.65 |

| 4 | $27,000.00 | $108,000.00 | $10,555.77 | $22,951.42 | $130,951.42 |

| 5 | $27,000.00 | $135,000.00 | $14,311.35 | $37,262.77 | $172,262.77 |

| 6 | $27,000.00 | $162,000.00 | $18,442.48 | $55,705.25 | $217,705.25 |

| 7 | $27,000.00 | $189,000.00 | $22,986.73 | $78,691.98 | $267,691.98 |

| 8 | $27,000.00 | $216,000.00 | $27,985.41 | $106,677.39 | $322,677.39 |

| 9 | $27,000.00 | $243,000.00 | $33,483.95 | $140,161.34 | $383,161.34 |

| 10 | $27,000.00 | $270,000.00 | $39,532.34 | $179,693.68 | $449,693.68 |

| 11 | $27,000.00 | $297,000.00 | $46,185.58 | $225,879.25 | $522,879.25 |

| 12 | $27,000.00 | $324,000.00 | $53,504.13 | $279,383.39 | $603,383.39 |

| 13 | $27,000.00 | $351,000.00 | $61,554.55 | $340,937.93 | $691,937.93 |

| 14 | $27,000.00 | $378,000.00 | $70,410.00 | $411,347.93 | $789,347.93 |

| 15 | $27,000.00 | $405,000.00 | $80,151.00 | $491,498.93 | $896,498.93 |

| 16 | $27,000.00 | $432,000.00 | $90,866.10 | $582,365.03 | $1,014,365.03 |

As you can see, the math works. I wouldn’t lie to you!

16 years of very disciplined savings combined with solid investment returns, and bam, you’re in the millionaire club.

And we’re only talking 16 years here, if you’re a 30 year old teacher, you could retire well before your 50s, can you imagine that?

But what’s the catch?

To be honest, there is no “catch”, but what I will say is that steps 3 and 4 are easier said than done.

First off, saving nearly half of your pre-tax income is HARD. You’ll end up putting away more than you take home.

But hey, maybe you’re a master budgeter and will have no problem with this. Or maybe you’re married and your spouse earns a nice income too, which makes this step not too hard.

And if that’s the case, then that’s great. Now you need to concern yourself with how to average that 10% return on your investment, otherwise known as ROI.

If you’ve read my blog before, you know I don’t give out specific investment advice like “invest in this stock or that stock”, because let’s be honest – nobody knows what will happen in the stock market, especially me.

But here is what I will say, you don’t need to be a professional investor, or give your money to Warren Buffett to generate an average return on investment of 10% over a 16-year period.

Remember, you don’t have to hit this 10% return every year, some years will be lower, and some years will be higher.

If you look at the S&P stock market index, which is basically just a broad view of the entire economy, it’s overall return from 1926-2018 is roughly 10%-11%.

So basically, if you invested in one index fund (hypothetically, they weren’t around back then), back in 1926, you would have averaged a 10%-11% ROI up to 2018.

Simple, easy enough right? Again, easier said than done, but I’d highly recommend looking into index funds and robo-advisors.

I do my passive investing with index funds through a company called Wealthsimple. I highly recommend them – check out my review of them to see why!

And that’s it for step 4, last but not least, actually becoming a millionaire!

5. Become a Millionaire

Becoming a millionaire as a teacher is no small feat, so once you get here, crack a beer (or 10) and give yourself a pat on the back.

But here’s the thing, you still need to be smart with your money.

A million dollars is a lot of money, and depending on your lifestyle and how old you are, it could last you for the rest of your life – but you have to be careful.

Things to be careful of:

- Sleazy financial sales people

- Taxes

- Family members who want money

- Large impulsive purchases

Make sure you speak with a fiduciary finance professional about the best way to manage your money and then determine what kind of lifestyle you want to live!

Are you going to keep working? Retire? Work part-time? Move abroad? Who knows!

That’s the great thing about being a millionaire and having money, you have the freedom to make decisions based on what you want to do and not what you have to do because of financial obligations.

What Age Can I Become a Millionaire as a Teacher?

Okay, so now you know becoming a millionaire on a teacher’s salary is certainly doable.

But at what age can you achieve this millionaire status as teacher?

Well it depends really. It depends on a lot of factors.

The 5-step plan I laid out above assumes you make $60,000 per year, you’re willing to save 45% of your income, and that you don’t mind waiting 16 years.

But what if these assumptions don’t align with your current situation or your future goals? Well that’s okay!

Below I am going to outline a process where you can set your own timelines for when you wish to become a millionaire based on your own unique situation.

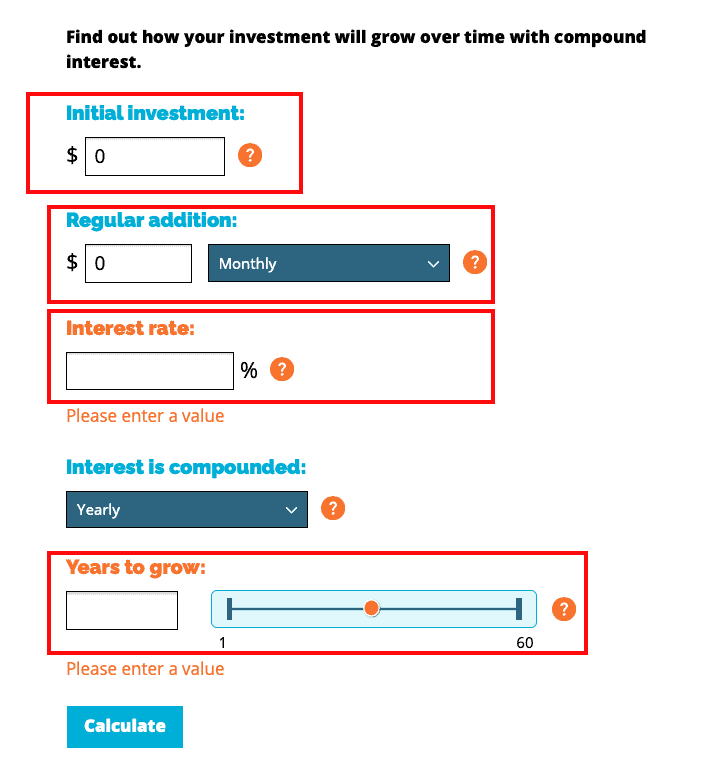

First go to the Compound Interest Calculator linked here and fill out each field as highlighted below.

If you already have money invested, include that in the Initial Investment field.

For Regular Addition, put in the amount of money here that you plan to invest each month. So for example, if you plan to save and invest $24,000 a year, you’d put $2,000 in this field.

Next we have the Interest Rate field.

Now, investment income earned through stocks isn’t actually interest, so you can just ignore the fact that the field is called Interest Rate.

Just pretend as if it’s referring to your return on investment, it’ll all work out the same.

So for this field, it all depends on what type of ROI you expect to generate through your investments. If you are really adverse to risk, it might only be 4%-7%.

If you’re like me, and you don’t mind risk but also want some stability, anywhere from 8%-10% is reasonable.

If you’re like my friends and you love risk, you could put anywhere from 11%-15% in this field. But I wouldn’t recommend aiming for this high of an ROI over a long period of time, it’s very risky and could result in big losses.

Finally for Years to Grow – At what age do you realistically wish to become a millionaire?

Age 40? 45? 60? Who knows! Only you.

Take the difference between the age you wish to become a millionaire at and your current age and then use this number for this years to grow.

Put a timeframe here that you think is realistic. Obviously you can’t just save and invest 10% of your income for 3 years and then be a millionaire.

Once you do all this, click Calculate and see what the total value of your investment would be if you stuck with this plan.

If it’s over $1,000,000, then great – stick to this plan and become a millionaire at the age you decided on.

You can just ignore my 5-step process all together if you like your plan better. I won’t know!

If the total value of your investment is less than your $1,000,000 goal, then that’s okay, but you’re going to need to adjust at least one of three things.

You’re either going to need to increase your monthly contributions, increase your average return on investment, or allow your investments to grow over a longer period of time (let compound interest work its magic).

So play around with these numbers until you come up with a plan that works for you.

Conclusion

To conclude, becoming a millionaire as a teacher is a very realistic goal.

Work, save, invest, repeat. That’s it really.

Do this over and over again and you’ll eventually get there.

While it might take longer than you expected, and the process is sure to have it’s up and downs, I’m willing to bet it’s a rewarding experience.

There are other ways to becoming a millionaire as a teacher besides long term investing.

You could win the lottery, marry into a rich family or receive a huge inheritance, but what are the chances of that happening?

There’s not no chance, but it’s small in comparison to the method I outlined above.

And hey, if you do win the lottery or inherit 40 million dollars from a distant relative like Longfellow Deeds, then good for you. Ignore everything I said and live your best life as a millionaire teacher.

Thanks for reading!

Geek, out.