Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

If you’ve just turned 30 years old, you might be wondering how much money you should have in your RRSP.

Or maybe you’re younger than 30, but you’re still wondering what an ideal amount of money to have in your RRSP by age 30 would be.

If either of these situations describe your scenario, you’re in the right place.

The goal of this article is to give you a general idea of how much money you should have your RRSP by age 30.

So here’s your answer.

By age 30, you should have roughly $3,000 in your RRSP if you wish to retire a millionaire.

Similar to my How Much RRSP Should You Have at 40? article, this answer is based on 4 assumptions.

- You wish to retire with at least $1,000,000.

- You won’t retire until you are 65.

- You will contribute an additional $3,000 a year until you retire.

- You can generate an average annual return of 10%

So, how does this all make sense?

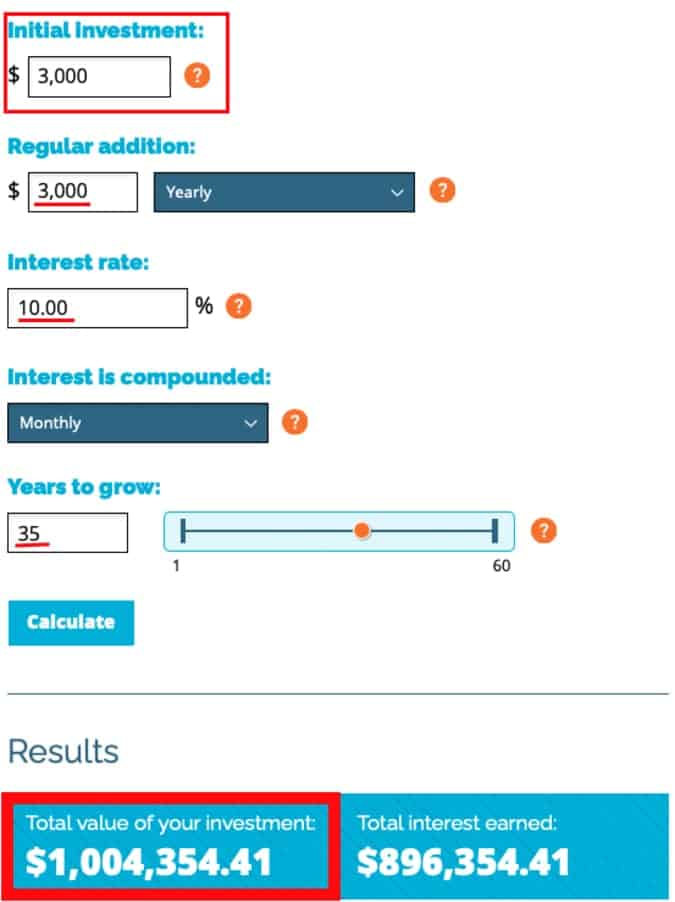

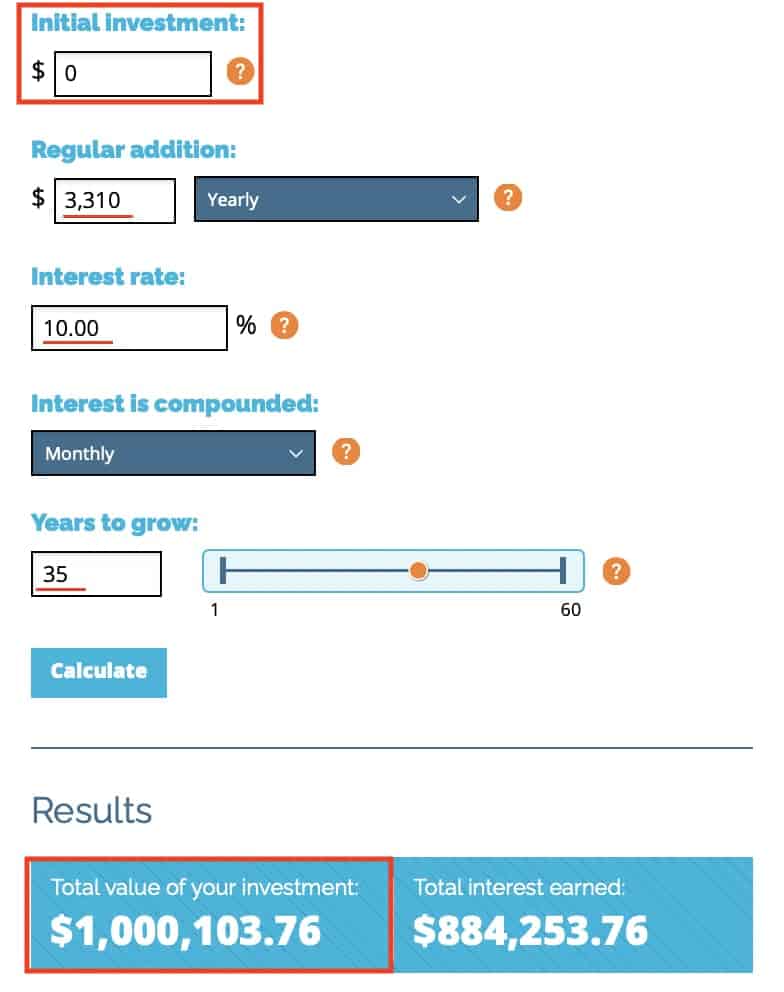

Well have a look at the image shown here below, this is a screenshot from a tool I use called Compound Interest Calculator.

As you can see, all the assumptions are in place. 35 years left to work (retire at 65), an additional $3,000 investment each year and an average annual return of 10%.

And what does that get you? $1,004,354!

Not bad hey!

If you think these assumptions are unrealistic, I would have to respectfully disagree. Here’s why.

- Who wouldn’t want to retire a millionaire? Okay, maybe you were referring to the other three assumptions.

- Stats Canada states that the average year of retirement is roughly 64 years old. Facts are facts!

- An additional $3,000 a year contribution equates to 10% of a $30,000 a year salary (pre tax). Earning $30,000 a year is very attainable in the great country of Canada. We don’t need charts and stats to know that.

- While a 10% return on investment is very solid, it’s also very achievable, especially over a long period of time like 35 years. The S&P 500 index (broad market index) has grown by 10%-11% on average over the last 90 years.

Okay, now we know two things. One, keeping in mind our assumptions, you really only need to have $3,000 saved up in your RRSP at age 30 to retire a millionaire.

And two, compound interest is the freaking best.

So if you don’t yet have an RRSP opened, I’d recommend setting one up as soon as possible. I have my RRSP setup with Wealthsimple and I’ve had a great experience with them. The sign up process is all done online and takes a matter of minutes, you can start with as little as $1, and the user interface on both the the app and desktop is sleek and modern.

My article here talks about 10 benefits of opening up an RRSP with Wealthsimple. If you’d rather just get started, you can sign up here and you’ll get $50 for doing so!

But now moving on now to the rest of the article. In the next two sections I’ll explain what exactly an RRSP is and how you can retire with a million dollars in your RRSP even if you haven’t opened one yet (by age 30).

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

What is an RRSP?

In short, an RRSP (Registered Retired Savings Plan) is a government approved savings and investment account.

It’s very important to note that an RRSP in it of itself is not an investment. I like to describe it as like a bucket in which Canadians can hold their investments in.

For example, I have an RRSP opened up with Wealthsimple – an online financial institution (robo advisor). But again, this is just my bucket. Within this RRSP, I own securities such as stocks and ETFs.

So what’s the difference between an RRSP and a regular investment account you might ask?

Well unlike unregistered accounts, RRSP comes with certain benefits which encourage Canadians to save for retirement.

Benefits of an RRSP

- Contributions made to your RRSP are tax deductible. In other words, if you make $60,000 a year and contribute $5,000 to your RRSP, your taxable income will only be $55,000.

Here is an article I wrote a few months back that further explains these tax deductions.

- Tax Deferred Growth. As long as you don’t withdraw your returns from your RRSP, your returns will grow tax free.

No taxes on dividends, capital gains, interest, you name it. Tax-free until withdrawn.

I would argue to say that these two things are the most beneficial aspects of investing within an RRSP, but there are a few others too:

- The ability to convert your RRSP into an RRIF or an annuity when you retire.

- The ability to withdraw money from your RRSP tax free to buy your first home or further your education.

- The ability to contribute to your spouse’s RRSP which could reduce your combined tax bill.

So there you have it, there is much more you can learn about a RRSP that was not talked about above, so for a more in-depth understanding of what an RRSP is, here is a link to my article – What is an RRSP?

What if You Only Started Investing in your RRSP at Age 30?

Okay, so now I want to talk about the type of situation you’re in if you’re 30 years old but have $0 in your RRSP.

Heck, maybe you haven’t even opened up an RRSP yet.

If this is you, don’t sweat it. You are going to be better than just fine. In fact, opening an RRSP at age 30 still probably puts you ahead of the game.

But for the purpose of this article, let’s look at the numbers below.

As you can see, the only other thing we are changing here from the original example is our annual contribution amount. And that amount has increased to $3,310 as opposed to $3,000.

In other words, if you have $0 in your RRSP today but wish to retire a millionaire, keeping our assumptions in mind, you’ll need to contribute around $3,310 to your RRSP every year.

What should this tell you?

Well two things really.

- Start investing in your RRSP as early as possible. As you can see from this example, having $3,000 set aside at 30 years old would save you $310 a year until you retire.

- If you have $0 in your RRSP at 30, retiring a millionaire is a still very, very realistic goal.

Obviously there are other things you could do as well if you only wanted to contribute $3,000 a year instead of $3,310.

For example, maybe you could work a year longer, or maybe aim for a high average annual return, or probably the easiest option, just contribute $6,000 for your first year and go back to $3,000 for the remaining 34 years.

All this to say, at age 30, you still have plenty of time to get your retirement snowball rolling, but you need to start now! You would be shocked at how much of a difference a few years can make.

Conclusion

Okay, I plan to keep this conclusion pretty brief, but I do want to summarize and potentially clarify what was stated above.

Remember to keep the 4 assumptions in mind when reading this.

How Much RRSP Should You Have at 30? Roughly $3,000 – if you wish to retire a millionaire.

What are Some of the Main Benefits of an RRSP?

- Contributions reduce taxable income

- Tax deferred growth

What if You Only Start Your RRSP at Age 30? You are laughing, retiring a millionaire is still well within your reach. But the later you continue to wait, the harder it gets.

Once you get to 40 years old, things get really difficult, you’ll need to be contributing nearly $10,000 a year to reach that millionaire status, so seriously, start ASAP.

That’s it for me folks, I hope this article provided you with some clarity on how much money you should have in your RRSP at age 30.

Geek, out.