As an Uber Eats Driver, filing taxes in Canada can seem as daunting as navigating a new city without GPS, but with the right knowledge and tools, you can cruise through tax season like a pro.

Just like how you need to follow traffic laws and have a valid license to drive, there are specific rules and requirements for reporting your Uber Eats income and expenses to the Canada Revenue Agency (CRA).

Let’s get started

Disclaimer: the following information is for informational and educational purposes and is not to be taken as tax advice or legal advice. Always consult with your tax advisor before making any business decisions.

Key Steps to Follow

- At the end of the tax year, download your income statement from Uber Apps

- Fill out a T2125 form

- Collect receipts and all your expense items for deductions

- Submit your taxes before the April 30th deadline each year

Let’s go into each one in more detail.

Step 1 – Download Income Statement from Uber

Before you can file any taxes, you’ll first need to get your pay stub from the food delivery app.

Follow these steps

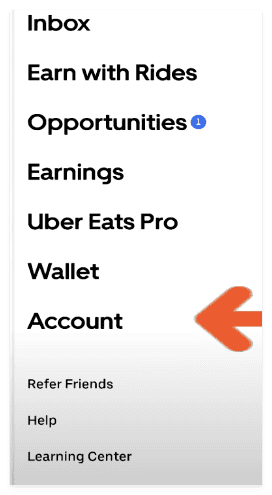

Go into your app settings and click Account

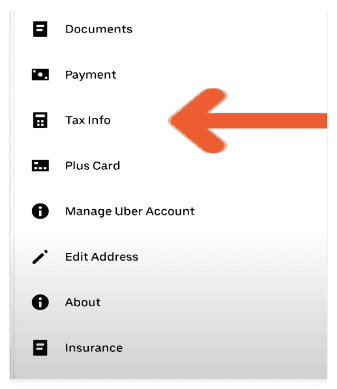

Then click Tax Info

Then for the end of the year documents, click Tax Summaries

Click the “[YYYY] Annual tax summary” option. This is your annual income statement. We do also recommend downloading the monthly statements in case you get audited.

Note that Uber does not keep track of the following

- Your gas expenses

- Auto Maintenance expenses

- Cell phone expenses

- anything else that you can resonably relate to your business as an expense (more on this later)

Once you have the statements, move on to step 2.

Step 2 – Fill out T2125 How to Max Your Return

Unlike working a full time job, where you get a T4 slip at the end of the year, Uber drivers are considered to make self-employment income (also known as an independent contractor).

At the end of the year you will get a T2125 form which is a Statement of Business or Professional Activities form – basically a form to fill out to report your professional income.

This form gets attached to your personal income tax return (T1), so the CRA can see how much money you made and spent on the job

Fill this out along with your tax filings. Watch this to get the most out of your return.

Note, as a ride-sharing driver, Uber does not deduct anything at source like a full time employer might. Again, this is because you are considered an independent contractor so you will receive dollar for dollar what you get from the app (no taxes are deducted by Uber).

Step 3 – Collect Receipts for Business Expenses for Deductions

Here is a mega list of tax deductions that you can consider depending on your particular tax situation.

List of Deductions

- Vehicle expenses: Gas, oil, maintenance, repairs, insurance, registration, washing, detailing, and depreciation are all deductible based on the percentage of kilometers driven for business.

- Mileage: You can use the logbook method to claim vehicle expenses based on the number of kilometers driven for work. The CRA has a standard mileage rate you can use.

- Uber fees: Any fees charged by Uber, such as service fees and booking fees, are deductible.

- Phone expenses: You can claim a portion of your cell phone bill based on how much you use your phone for work.

- Supplies: Bottled water, snacks, and other amenities provided to passengers are deductible.

- Tolls and parking: Any tolls or parking fees incurred while working are deductible.

- First aid kit: You can claim the cost of a first aid kit for your vehicle.

Just make sure you keep detailed records for the next 6 years as you will need them if you ever get audited by the CRA.

Calculate Net Income (aka Taxable Income)

Once you have the list of all your expenses, simply calculate your Net Income.

Net Income = Total Gross Income – Total Expenses

Gross Income = the total income that is on your Uber annual summary

For example, if you made $20,000 this year in Uber Eats/Rides and you had $5000 in total expense deductions. your Net income would be $20,000 – $5,000 = $15,000.

In other words, you would be taxed on the $15,000 and not the $20,000 (this is a very good thing)

Now go back and fill out any missing fields in your T2125 and you’ll be ready to file in step 4.

Step 4 – Submit your Taxes before April 30th

Each year the deadline for taxes in Canada is April 30th (end of April). This is especially important if you owe money to the government as you will incur additional tax penalties for being late.

Submit your T1, T4 (if you are also full time employed), and your T2125 forms with your tax service or accountant of your choice.

That’s it, you’re done for this year. Congrats!

Additional Tips

Are You Considered an Employee of Uber

As a part-time gig operator, you are not an employee of Uber. Unless you actually work for Uber headquarters, you are considered an independent contractor for tax purposes.

Do I Need to Collect GST or HST?

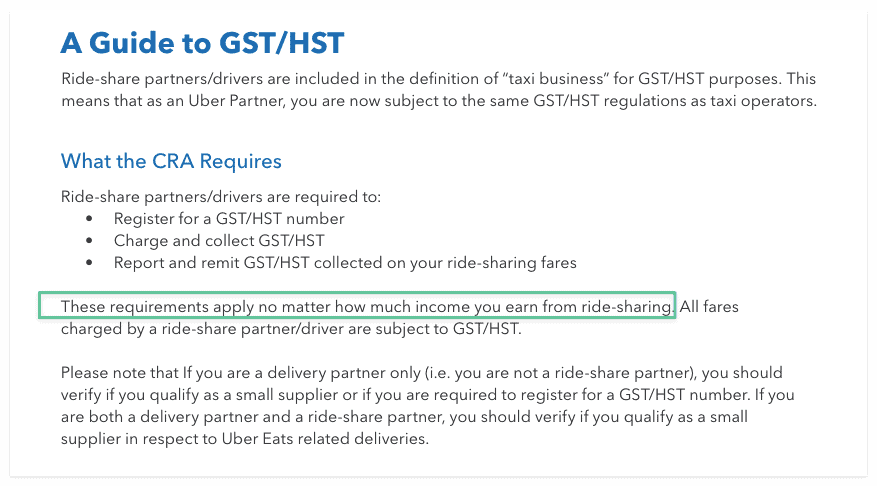

Even if you are doing food delivery services, you are classified as a “taxi” business when you work for Uber Eats or Rides.

Therefore, you are required to register for GST or HST number. Here is an excerpt directly from Uber’s Tax Manual (note that Quebec has a separate Handbook).

Here’s the specific part about HST registration:

There are old sources out there saying you only need to collect it after you reach $30,000 in income which is inaccurate. Always refer back to the Uber manuals for updates.

Can I Claim and receive a GST or HST Return as an UberEats Driver?

Generally yes, but we recommend working with your tax accountant. Here’s what the CRA says

ICTs = input tax credits. The input refers to property or services that are used or sometimes consumed through your business activities. For example, office furniture, promotional items.

Do I Need a Bookkeeper?

This is dependant on your own ability to bookkeep your business. We certainly recommend at least having bookkeeping software to keep you squared away each month. Plus it makes year end taxes much easier to cope with. Whether you hire a part time bookkeeper will depend on the complexity of your setup.

Next Steps

While Uber might be one of the most flexible jobs out there, it doesn’t come without its fair share of responsibilities. As we all know, millions of people use it as an occasional source of side income or sometimes entire income replacement.

As a self-employed worker, it is your responsibility to register for GST and HST along with collecting all of your business expenses.

Once you’ve got that all worked out, your tax filing should be a breeze.

Don’t forget to watch this video to make sure you get the absolute most out of your return.