Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

The main purpose of this article is to help provide you with an unbiased review of the popular Canadian savings account, the TFSA (Tax-Free Savings Account).

Throughout this article we will look at six advantages and disadvantages associated with the TFSA.

Before jumping into the main scope of this article though, let’s do a brief recap on the TFSA.

What is a TFSA?

The TFSA was introduced to Canadians on January 1st, 2009 – Thanks to Jim Flaherty who was the Minister of Finance at the time.

Similar to the RRSP, a TFSA is a special type of savings account registered by the Canadian government that allows Canadians to save and invest money in a tax-friendly manner.

It’s important to note though, standing alone, a TFSA is not an investment. It’s more so like a bucket where you can hold your investments and generate tax benefits for doing so.

Okay enough of the history lesson, you came here to better understand the advantages and disadvantages of the TFSA, so let’s get into it.

| TFSA Advantages | TFSA Disadvantages |

|---|---|

| 1. Tax-Free Investment Income | 1. TFSA Contributions are Not Tax Deductible |

| 2. Easy Withdrawal Process | 2. No Grace Amount for TFSA Over Contributions |

| 3. TFSA Contribution Room is Not Determined By Income | 3. Withholding Taxes Apply for US Dividends |

| 4. Various Investment Options | 4. TFSAs are Not Protected from Creditors |

| 5. Unused TFSA Contribution Room Never Expires | 5. Day-Trading is Not Allowed Inside a TFSA |

| 6. TFSA Withdrawals Won’t Affect Government Benefits | 6. Withdrawal Process is Too Easy |

So as you can see, TFSAs are really great investment vehicles for new investors who are looking to get started.

When your at this beginner stage though, most people (myself included back in 2016) don’t know how to get started, and this is why I always recommend Wealthsimple Invest. Not only is Wealthsimple a Canadian company, but the sign up process is all online, it’s completely free and it only takes a few minutes (literally). Plus, you’ll get a $25 cash bonus with your sign-up. Not bad, hey?

Open a TFSA with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- Tax-Free investment income

- No account minimum

- 100% free to sign-up

- Wealthsimple is designed for beginner investors

- Wealthsimple invests your money for you

TFSA Advantages

1. Tax-Free Investment Income

One of, if not the biggest advantage associated with a TFSA is that you won’t get taxed on any of the investment income you earn.

And unlike your RRSP, you won’t even get taxed when you decide to withdraw your investments.

For example, if i invest $10,000 into a TFSA and I generate an 8% return, I’ve made myself $800! Wahoo.

What’s even better is that that $800 income is completely tax free. I can withdraw it from my account and not have to worry about getting taxed on it. How sweet is that?

Let’s say my friend Daniel also invested $10,000, but he did it outside his TFSA in just a normal investment account.

If Daniel generated the same 8% return I did, well that’s great, but unlike me, Daniel will have to pay taxes on his $800 investment income.

What if Daniel invested his $10,000 into an RRSP and then withdrew his earnings (before retirement)? He’d still be taxed, in fact, he’d be worse off doing that then he’d be investing in a non-registered investment account.

That’s one of the big advantages of the TFSA, not only will your investments grow at a tax-free rate, but you won’t even get taxed on the withdrawal either.

Here is an in-depth article I wrote about TFSA withdrawals and how they don’t impact your taxable income.

Now there is an exception called a withholding tax, but will talk about this later.

2. Easy Withdrawal Process

Another advantage of the TFSA is that withdrawing money from your account is a very easy process.

Unlike your RRSP where you have to deal with things like withholding taxes, buying annuities, opening RRIFs, it’s all just a bit much. Not with a TFSA withdrawal though, the process is so easy, it’s a joke!

It may take a few days to sell off some of your investments and convert them into cash, but that’s the case when you sell any type of security.

So if you’re planning to invest money in the short term, and you haven’t already maxed out your contribution room (which will talk about soon), investing within your TFSA is the way to go.

You won’t get additional tax forms or anything like that, you just withdraw the money and move on with your life.

So how is this different than withdrawing money from an RRSP? Well if I withdraw $1,000 from my RRSP (assuming I’m not retiring), I will be forced to pay a withholding tax fee, plus that income will be added onto my taxable income.

So not only will I not receive the full amount I withdraw, but the added paperwork required come tax season will just be a pain.

On the contrary, if I withdraw that money from my TFSA, no paperwork, no withholding taxes, no nothing, just take your money and enjoy it.

3. TFSA Contribution Room is Not Determined By Income

Another reason why TFSAs are so advantageous for all Canadians is because your available contribution limit is not impacted by your income.

Again, I know I might be picking on the RRSP a little bit here, but the amount you can contribute to your RRSP each year is directly related to your income.

But not with the TFSA. While yes, some people can contribute more than others in any given year, their available contribution room is not determined by how much money they make.

It’s more so dependent on the age of the individual and their previous withdrawals and deposits.

Now that might sound a little confusing, but here’s a video I made on how you can easily check your TFSA contribution room. (It’s super simple I promise)

Every year, the CRA releases a new contribution limit for the following year that applies to everyone.

Below here I’ve included a table of the TFSA limit for every year of its existence.

| Year | TFSA Limit |

|---|---|

| 2022 | $6,000 |

| 2021 | $6,000 |

| 2020 | $6,000 |

| 2019 | $6,000 |

| 2018 | $5,500 |

| 2017 | $5,500 |

| 2016 | $5,500 |

| 2015 | $10,000 |

| 2014 | $5,500 |

| 2013 | $5,500 |

| 2012 | $5,000 |

| 2011 | $5,000 |

| 2010 | $5,000 |

| 2009 | $5,000 |

As you can see, regardless of how much money someone makes, every Canadian over the age of 18 will be given the exact same opportunity to generate tax-free investment income.

Unlike the RRSP contribution limit, this TFSA limit is not a percentage based on your income which is great for lower income earners.

It’s also important to note that you can’t open a TFSA until you turn 18, so your contribution limit won’t start accumulating until you reach the legal age.

Again, if you are confused by what your contribution room is, just watch the video above or check out my How to Check Your TFSA Limit article.

4. Various Investment Options

One more advantage of the TFSA is the flexible investment options that are available.

Unlike a normal savings account that’d you open up at a bank, TFSAs allow you to invest in things like:

- Stocks

- Bonds

- Cash

- Mutual Funds

- GICs

- Index funds

Why is this great?

Because not only can you earn money in a tax-free manner, but you should be able to earn solid returns if you invest wisely.

Now I’m not saying you need to invest in highly speculative and risky stocks to do this, but even a conserative 7% return could earn you a lot of money – depending on how much you have invested.

The thing is though, you can’t generate these types of 5%-10% returns by putting your money in a savings account. Even high-interest savings accounts won’t come close to this.

That’s why TFSAs are great, yes they have the word “savings” in the name – Tax Free Savings Account – but don’t think of it as a savings account because it’s really much more than that (more like an investment account).

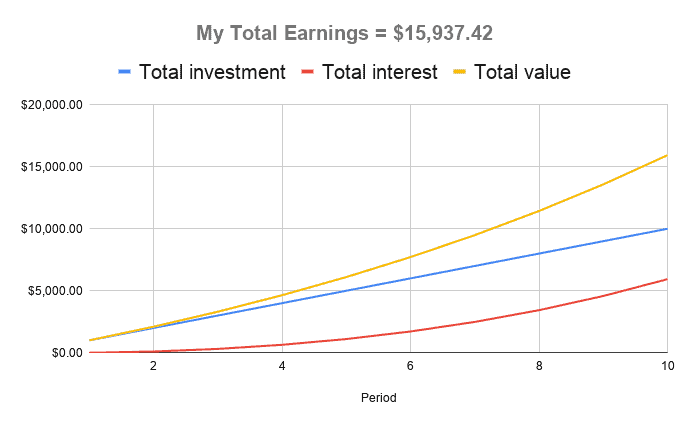

For example, let’s say Daniel and I both want to save money over a 10 year period, we both decide to save $1,000 a year.

I save and invest this money in a TFSA and generate an average 10% return over the 10 year period.

Daniel puts his money in a high-interest savings account and generates a 2% return of the 10 year period.

My Portfolio Value: $15,937.42

Daniel’s Portfolio Value: $10,949.72

So as you can see, after the 10 year period, despite investing (saving) the same amount, I’ll have nearly $5,000 more than Daniel. Not only that, but he’ll have to pay taxes on his earnings every year, I won’t.

Hey, it pays to know things!

5. Unused TFSA Contribution Room Never Expires

Another added benefit of the TFSA is that your contribution room never expires.

So if you don’t max out your TFSA contribution room, no worries, whatever amount you have left over will just carry over to the following year.

For example, in my situation right now, I’m investing more in my RRSP so I’m actually not maxing out my TFSA contribution room every year, but I’m okay with that.

Why? Because I don’t look at it as a wasted opportunity, I know in a few years, as my income continues to grow, I’ll be able to use my contribution limit from previous years and max it out when it makes sense to do so. Remember, it never expires.

Related Article by the Financial Geek: Do Dividends Count as TFSA Contributions?

If you’re financially able to invest in your TFSA, the earlier you start the better.

But if you’re in a situation in your life where you can’t start putting money into this account, don’t worry, your TFSA will be waiting for you, along with all the contribution room you’re entitled to.

Lastly, it’s worth noting that unlike withdrawing money from an RRSP, if you decide to withdraw money from your TFSA, you’ll be able to recontribute that amount in the following year.

In other words, you’ll never lose contribution room.

For example, let’s say my contribution room for 2020 was $12,000 and my total actual contributions for the year were $10,000.

If I decided to withdraw $5,000 of that $10,000 before 2020 ended, then that $5,000 withdrawal will be added back onto my 2021 contribution room.

As the 2021 contribution limit (given by the CRA) is $6,000 this would make my total contribution room for 2021 equal $13,000.

But you really don’t have to worry about doing all those calculations, just check what your TFSA contribution room is for the year and make sure you don’t exceed that amount.

6. TFSA Withdrawals Won’t Affect Government Benefits

A huge upside to investing and earning money through a TFSA is that your withdrawals, and any income generated from them, won’t impact any of your government benefits.

Popular Government Benefits and Credits

- Old Age Security (OAS)

- Employment Insurance (EI)

- Canada Child Benefit (CCB)

- Guaranteed Income Supplement (GIS)

So regardless of how much you make within your TFSA, this investment income will not be included onto your Income Tax and Benefit Form and therefore will have absolutely no impact on your government benefits.

That’s what I love about TFSAs, they are so easy to manage. There is no extra, confusing “paperwork” that is often associated with investing in registered accounts.

Here’s a quick example.

Let’s say I’m retired and over the age of 65. Every year I earn $300 in interest income from my TFSA, as just explained, this money is mine to keep. It will not impact any of my OAS payments, pension income.. etc.

On the other hand, let’s say Daniel is also in the exact same situation as me, the only difference is, he earns his $300 interest income from a normal savings account and not from within a TFSA.

Unfortunately for Daniel, as his interest income was generated outside of a TFSA, his taxable income will have increased (by $300) which could result in him having to repay some of his benefit payments.

Poor Daniel.

To provide you with more information on this, I’ll include a link to the resource page on the CRA website that goes into more detail on the impact (or lack thereof) that TFSAs have on government benefits and credits.

Open a TFSA with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- Tax-Free investment income

- No account minimum

- 100% free to sign-up

- Wealthsimple is designed for beginner investors

- Wealthsimple invests your money for you

TFSA Disadvantages

1. TFSA Contributions are Not Tax Deductible

TFSAs are great, but if you compare them against the RRSP, you will find they have some disadvantages.

One being, unlike the RRSP, TFSA contributions are not tax deductible.

In other words, you will not be able to reduce your taxable income by contributing to your TFSA.

But you can do this with an RRSP, so again, if we’re going to compare the two, this is definitely a downside.

Why? Because the great thing about reducing your taxable income is that it often leads to nice tax returns.

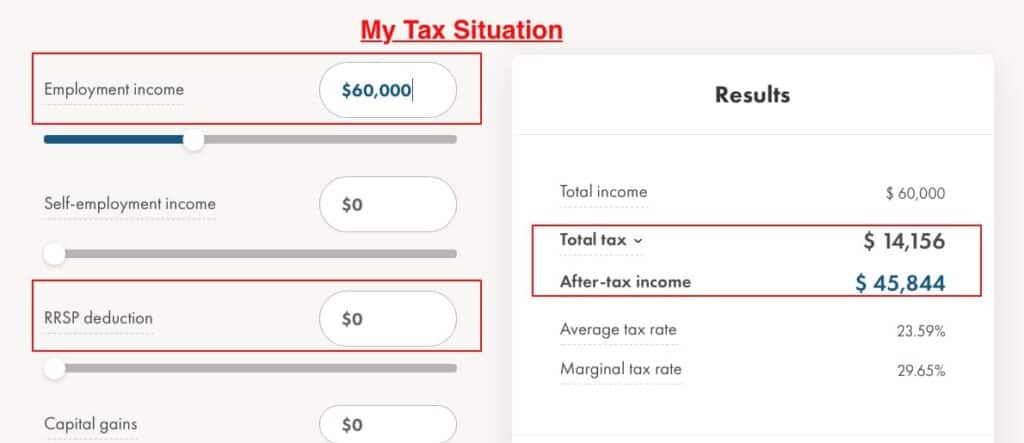

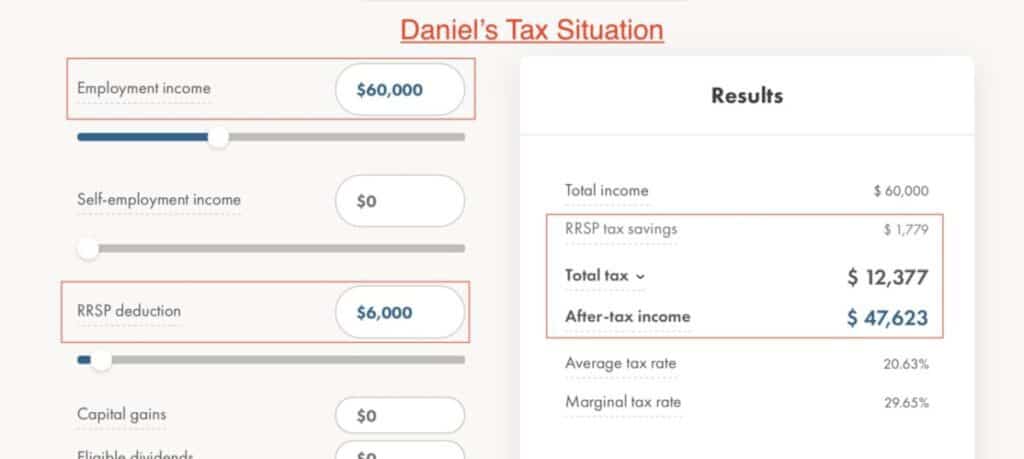

Let’s look at a quick example here using Wealthsimple’s Income Tax Calculator.

Let’s say Daniel and I both work for the same company making $60,000 a year in Toronto.

We both save and invest $6,000 during the year. I invest my money in a TFSA, but Daniel decides to invest his in an RRSP.

Below are both mine and Daniel’s tax situation based on that information.

As you can see, because I invested my money into a TFSA, I pay $1,779 more in taxes than Daniel.

Long story long, TFSA contributions are not tax deductible and therefore have no ability to reduce your taxable income.

2. No Grace Amount for TFSA Over Contributions

Another disadvantage of the TFSA is that you get no leeway when it comes to over contributing to your account.

As mentioned earlier in the article, there’s a certain amount you can contribute to your TFSA every year, but hey, we’re all human and we all make mistakes.

“Not my problem” says the CRA.

For every month you have excess contribution in your TFSA, the CRA will penalize you with a 1% tax.

For example, if your total contribution room for the year is $12,000 and in March you make your first contribution of the year to a sum of $15,000, well then you’re $3,000 over the limit.

So for the remainder of the year (assuming you don’t withdraw your money) you’ll be charged a 1% fee on this $3,000 excess amount.

In other words, it’ll cost you $30 a month.

In my article How to Check My TFSA Limit, I have a section that talks about this TFSA over contribution penalty and how all the math works. It also goes on to explain what you should if you do in fact over contribute to your TFSA.

Quick Note #1 – The 1% tax penalty only applies to the excess contribution amount.

What makes this even worse? There is absolutely no grace amount. If your contribution room is $12,000 and you contribute $12,100, you can count on getting taxed for that $100 excess.

The RRSP on the other hand is a lot more friendly when it comes to over-contributions, they allow for a $2,000 cushion.

Why doesn’t the TFSA allow this? I have no idea, but I think they should.

If you’re ever wondering if you’ve over-contributed to your TFSA (and what to do if so) then refer to my How to Know If You Over-Contributed to Your TFSA? article.

3. Withholding Taxes Apply for US Dividends

Now this one is going to sting a little.

Unfortunately, any dividends you generate from US companies within your TFSA will be subject to a 15% withholding tax.

So it goes without saying that this is another major disadvantage of the TFSA, especially when you compare it to the RRSP.

Due to a tax-treaty between the Canada and US governments, withholding taxes do not apply for US dividends generated within an RRSP. Sadly, TFSAs don’t get the same treatment.

With that said, this 15% tax rate is still a reduced amount that is considered to be part of the Canada – US tax treaty. So even though it sucks to get taxed on American dividends within a TFSA, compared to other countries, it’s really not that bad.

It’s important to note that this withholding tax doesn’t apply when we’re dealing with Canadian dividend stocks.

For example, if I earned $100 in dividends within my TFSA from a Canadian dividend stock like Scotiabank, that $100 is all mine for the keeping.

On the other hand, if I earned $100 in dividends within my TFSA from an American dividend stock like Apple, then I would only receive $85 of that dividend.

So this is definitely a disadvantage of the TFSA.

However, as American companies typically pay out higher dividends than Canadian companies, it’s really not that big of a deal and shouldn’t discourage you from investing in American companies. (In my opinion)

Lastly, before moving on, it’s also important to mention that this withholding tax will automatically be taken off your dividends before entering your account, so you don’t have to worry about anything.

For more information on foreign withholding taxes, here is an article I wrote on TFSA dividends and how they are taxed.

4. TFSAs are Not Protected from Creditors

Another disadvantage of the TFSA is that in the event you have to declare bankruptcy, the money you have in your TFSA will not be protected from creditors.

In other words, you could potentially lose it all.

So if you’re investing money for retirement, your money is better suited in your RRSP as creditors can’t touch it there – with the exception of deposits made in the previous 12 months.

Now this shouldn’t be a reason why you don’t invest in your TFSA, because hey, no one really ever plans on going bankrupt, but if it does happen, you’ll want your retirement fund protected.

5. Day-Trading is Not Allowed Inside a TFSA

Day-trading in your TFSA is not allowed.

So if you were thinking TFSAs would be a great account to day-trade in, this would be another disadvantage.

The CRA does not condone day-trading within your TFSA as TFSAs are meant for generating investment income and not business income.

But how does the CRA distinguish day-trading from investing? Or business income from investment income?

In my article Day-Trading in a TFSA | Is it Allowed? I talk about six factors that the CRA looks at when trying to make this distinction.

These include:

- Duration of Holdings

- Trading Volume

- Time Spent Trading

- Type of Investments

- Experience in Securities Market

- Purchase Intent

If you want more information on each of these factors, I highly recommend you read my TFSA day-trading article I linked above.

I don’t day-trade myself, so this makes no difference to me, but if you do partake in any type of high frequency trading activities, just know it can’t be done in a TFSA.

6. Withdrawal Process is Too Easy

Lastly, another disadvantage of the TFSA is that the withdrawal process may actually be a little too easy!

Now I know I may be contradicting myself here, as in my advantages section, I talk about how the withdrawal process is so easy, which makes it a good thing – but hear me out.

When money is TOO accessible, we tend to use it for things other than what it’s meant for.

For example, maybe you are saving for a down payment on a house, but then all your friends want to go down south for a trip to Mexico. While you know you shouldn’t, you also know how easy it is to access that money sitting in your TFSA that is “meant for a downpayment” and you could cave.

While the trip to Mexico might be a blast, you could end living with your parents for the rest of your life!

Okay, maybe a little extreme, but you see what I’m getting at here.

When you put money in an RRSP, most people, including myself pretend that money doesn’t even exist anymore.

It’s essentially untouchable. Not because we don’t want the money, but because the RRSP withdrawal process is an absolute nightmare, not to mention the added consequences.

And even though we wish we could access that money and spend it on trips to Mexico, we keep it where it belongs and this benefits us long term.

On the contrary, the withdrawal process for the TFSA is anything but a nightmare, I’d go as far to say that it’s actually an enjoyable experience! And while that could benefit us in the short term, it can negatively impact our ability to save and invest money for the future.

Conclusion

The bottom line is that TFSAs are great financial vehicles for Canadians to invest in.

If you’re a Canadian citizen and over the age of 17, I’d recommend opening an account if you haven’t already done so.

I personally invest in my TFSA with an online robo-advisor called Wealthsimple. I will leave a link here to why I recommend Wealthsimple if you want more information.

Before making your investment though, ensure that you understand some of the disadvantages of investing in a TFSA over other registered investment accounts like an RRSP.

But remember this, if the question is – should I invest in my TFSA or not invest at all? then the answer is always to invest in your TFSA.

Geek, out.

![Can You Short Stocks on Wealthsimple Trade? [The Facts]](https://thefinancialgeek.com/wp-content/uploads/2022/02/Can-You-Short-Stocks-on-Wealthsimple-1-1.jpg)