In the age of instant information, investors have unprecedented access to the financial markets.

Whether it be through free smartphone trading platforms or the ability to look up any piece of information about a company in a matter of seconds, stock trading is no longer reserved for the privileged elite.

However, if you see a Saturday night tweet that could disrupt the share price of your favorite company, can you sell before the panic spreads over the weekend? Well here’s the thing.

The stock market is closed on the weekend. The regular trading hours for the U.S. stock market, including the New York Stock Exchange and the Nasdaq Stock Market, are 9:30 AM to 4:00 PM Eastern time, Monday through Friday.

| Starting to Invest? | Our Recommendations | Start Trading Today |

|---|---|---|

|

Wealthsimple Trade ($25 Bonus)Only in Canada

|

Start Trading TodayRead our Review |

|

Robinhood InvestOnly in USA

|

Start Trading Today |

Below, we will cover when the stock market is usually closed in detail and why they are typically not open on weekends.

Does the Stock Market Close on Weekends?

As mentioned above, the stock market is closed on weekends and is only open from 9:30 AM to 4:00 PM Eastern time, Monday through Friday. The stock market is also closed on most federal holidays, further limiting trading opportunities for investors.

However, since 1985, there are pre-market (4:00 AM to 9:30 AM Eastern time) and after-hours (4:00 PM to 8:00 PM Eastern time) trading sessions available on all regular trading days that allow investors to place trades once regular market hours close.

Why Are Stock Markets Closed on the Weekend?

Although nearly all contemporary stock trades are handled by electronic communication networks (ECNs) capable of working around the clock, the stock market continues to remain closed on the weekends. There are a couple of reasons for this:

1. Weekend Closings Are Stock Market Tradition

The “practical” reason stock markets close on the weekend is that the floor traders who traditionally handled trades could not work 24/7.

Before the widespread adoption of technology to handle trades, professional money managers were the entities that confirmed the bid price, ask price, and quantity between buyer and seller. The weekend gave these professionals the chance to take a break.

However, since modern stock trades are handled by ECNs, the bustle of hundreds of floor traders crowding around a screen at the New York Stock Exchange is mostly symbolic and superfluous.

In terms of the functional practicality of buying and selling stock, there is no reason that the stock market could not be open 24/7 today.

2. The Weekend Provides a Needed Buffer

In modern times, the strongest argument for keeping the stock market closed on the weekend is to create a buffer against widespread panic.

In the event of a national crisis that has the potential to cripple the stock market, the government can work alongside corporate entities to help stop the bleeding before the financial markets enter a full-scale depression.

The weekend is used as a time to discuss stop-gap and bailout scenarios. For example, at the height of the 2008 financial crisis, the government used the weekends to work and save the financial system, convincing powerhouse banks Morgan Stanley and Goldman Sachs to serve as holding companies.

Why Can Some People Trade on the Weekend?

If you hear about people trading on the weekend, there are several possible explanations:

- They are trading Forex – Due to time zone differences, foreign exchange markets are open 24 hours a day in different parts of the world between the hours of 5:00 PM Eastern time on Sunday to 4:00 PM Eastern time on Friday. Once again, though, Forex is not part of the stock market.

- They are trading cryptocurrency – Cryptocurrency can be traded 24/7, anywhere in the world. However, cryptocurrency is not a stock and is not part of the stock market.

- They are trading on an international exchange – stock exchanges in different countries have their own trading hours, which may fall on the U.S. weekend.

- They are trading Friday after hours – if you consider the happy hour after work on Friday to be the start of the weekend, it is possible for people to make trades on their ECN until 8:00 PM Eastern time.

What Happens If You Buy Stocks on the Weekend?

With many modern trading platforms, retail investors can place orders to buy and sell stocks over the weekend. However, these trades will not actually execute until the market opens on Monday morning.

As a result, this poses a significant risk for both buyers and sellers, as the bid/ask gap will likely widen over the weekend, resulting in a high spread—and low liquidity—when the market opens.

- Bid price – the highest price a buyer will pay for a share of stock

- Ask price – the lowest price a seller is willing to accept for the same stock.

- Spread – the difference between the bid and ask price. A high spread will result in low liquidity, while no spread will result in perfect liquidity.

Why Trading Over the Weekend is Risky

You must be careful when trading over the weekend, as more time to digest news will result in greater volatility that can either nullify a trade or cut into your profits.

Consider the following example:

A trader opens up his account on a Saturday afternoon and sees that shares of Company A are trading at $13 per share, up from the $10 per share he bought in at. He would like to capture this 30% gain, so he places a “market sell” order to sell all of his shares of Company A. This means that his ask price will be what the market offers for each share of Company A, which is currently $13.

However, later that night, news breaks that the Company A CEO has been misappropriating funds. This causes immediate uncertainty regarding the leadership of the company, causing the stock price to decline. By the time the market opens on Monday morning, the highest bid that anyone will place is $8 per share—20% less than what the trader bought in for.

Nonetheless, because the trader placed a “market sell” order for his position in Company A, he will sell all of his shares at a 20% loss, despite placing his order when he thought he would be getting a 30% gain.

Tips for Trading on Weekends

The volatility in the above example demonstrates the risk of placing trades on the weekend. Had the trader placed the order during market hours, the spread would have likely been minuscule, and he would have quickly been able to book a profit of around 30%.

However, the markets being closed on the weekends gave the spread a chance to widen, ultimately causing him to trade at a loss. With that said, if you want to place trades on the weekend, there are a couple of best practices to keep in mind:

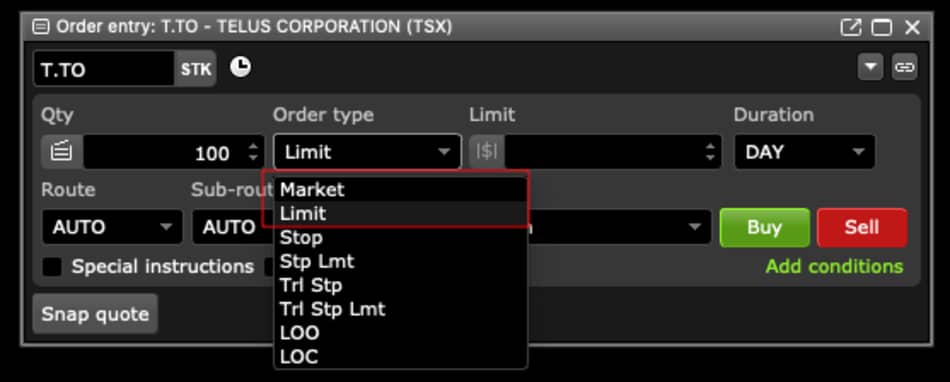

- Set limit orders – a limit order means that you will buy or sell your position in a stock “if and only if” you can trade a specific quantity at a specific price. In the previous example, had he chosen a limit order over a market order, he would have sold his shares of Company A only if he could receive $13 per share. Limit orders help “limit” the downside of weekend volatility.

- Only trade high volume stocks – low volume stocks are inherently more volatile than high volume stocks, with the volatility only magnified over the weekend. If you are trying to unload 1,000 shares of a stock over the weekend that only has a 15,000 share average daily trading volume, finding a buyer willing to take on your position may be challenging.

Conclusion

The stock market is closed on weekends. This has practical roots in allowing floor traders to get some rest from the bustle of trading—an antiquated concept in the era of ECNs.

The most reasonable modern-day rationale is that it gives the government a chance to help stop the bleeding from potential panic momentum. However, customer demand and improved technology make around-the-clock trading a real possibility in the years to come.

In my opinion though, unless you are extremely advanced, stay away from buying and selling stocks when the stock market is closed. Not only is it riskier, but it’s good to give your mind a rest to reset and recharge for the week ahead.

But hey, different strokes for different folks. That’s just me!

Geek out.

![Are Hedge Funds High Risk? [Analyzing the Risk vs. Reward]](https://thefinancialgeek.com/wp-content/uploads/2022/11/Featured-Image-51-768x404.jpg)