If you’re like a lot of investors, you’d prefer to invest in stocks that pay regular dividends as opposed to those that don’t.

Investing in dividend paying stocks is a great way to generate a stream of passive income that can last you a lifetime. Who wouldn’t want that?

Not only this, but dividend paying stocks often have less market volatility which makes them extremely attractive to some investors.

With that said, new investors looking to invest in shares of a company often wonder if all stocks pay dividends.

So let’s clear the air.

Do Stocks Always Pay Dividends?

Stocks do not always pay dividends to their owners as companies have no legal obligation to do so. For example, large companies like Amazon and Google don’t pay dividends because they choose to reinvest their profits back into the company for future growth.

| Starting to Invest? | Our Recommendations | Start Trading Today |

|---|---|---|

|

Wealthsimple Trade ($25 Bonus)Only in Canada

|

Start Trading TodayRead our Review |

|

Robinhood InvestOnly in USA

|

Start Trading Today |

How to Tell If a Company Pays a Dividend?

As mentioned above, not all stocks pay dividends. Companies such as Uber, Shopify and Facebook don’t pay regular dividends to their shareholders. These stocks are often referred to as “Growth Stocks”

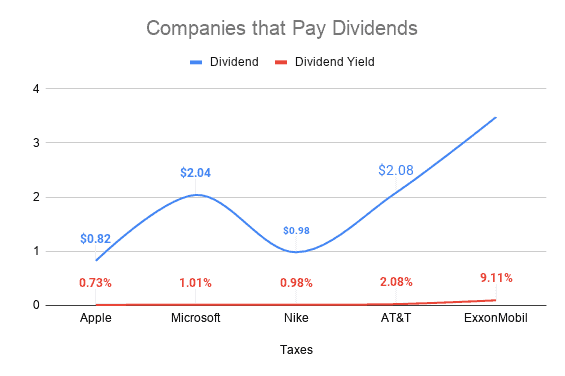

Income stocks on the other hand, such as Microsoft and AT&T, usually pay regular dividends to their shareholders.

With this said, you won’t always know if a company’s stock is considered growth or income, so you may be unclear on if they pay a dividend or not.

In order to know for sure, go to Yahoo Finance and lookup the stock you are wondering about in the search bar.

YAHOO STOCK SEARCH BAR

Then, scroll down and look to see if there’s any information next to the dividend columns.

If there is a “ex-dividend date” and numbers next to “forward dividend and yield” then that stock pays a dividend.

If not, and you see “N/A” next to both chart items, then that stock doesn’t pay a dividend.

For example, look at AT&T’s stock chart here below

AT&T INC. (T) STOCK CHART

As you can see, AT&T’s dividend yield is roughly 7% and their ex dividend date was July 9, 2020.

On the contrary, Shopify is considered a growth stock that doesn’t pay dividends.

As you can see from their stock chart below, “N/A” is next to both dividend columns so you know they don’t pay dividends.

SHOPIFY INC. (SHOP) STOCK CHART

Simple Way to Check If A Company Pays a Dividend

Another easy way to determine if a company pays a dividend is just to google:

“Does stock (xyz) pay a dividend?”

If the company is large enough or at least recognizable, you should get a response right on the search engine results page, as shown below.

Why Wouldn’t a Company Pay a Dividend?

While a lot of investors would prefer to receive a regular dividend from the stocks they invest in, a lot of big companies still neglect to issue a share of their profits back to shareholders.

Typically, a company that chooses not to pay dividends to their shareholders do so in order to grow their company by reinvesting their profits back into business.

By doing so, a company can actually increase the value of their stock and make more money for their shareholders than what a dividend would earn them.

I know what you’re thinking, I have heard that line 1000 times, companies don’t pay dividends because they want to “reinvest their profits”.

But what exactly does this mean? What exactly are these companies doing with their profits?

-

Funding innovation – Creating better products and services

-

Buying up competitors and other companies

-

Paying off debt

-

Hiring more employees

-

Setting up new offices

-

Marketing

-

Building up a Cash Reserve (Check out Apple’s Cash Stash)

When a company decides to reinvest their profits to fund these activities, they can often see an increase in their stock price.

In contrast, as a broad rule, a stock price will usually fall by the amount of the dividend on the ex-dividend date.

So, for those companies in a growth phase, not only do dividends reduce the amount of capital they have on hand for future growth, but they also reduce their current share price which reduces their overall market capitalization – two things growing companies don’t want.

Quick Note #2 – Some investors, Warren Buffett included, don’t like when companies pay dividends as they believe they could earn more by selling off a portion of a higher share price than they could from earning dividends. Plus, taxes paid on capital gains can often be more favourable than dividends.

You might be thinking, why wouldn’t these stocks pay dividends? Each one of these companies generate billions of dollars in revenue every year, surely they can afford a little kickback to their loyal shareholders while fostering future growth.

While this is a valid point, advocates would argue the reason these companies are in fact industry leaders is because they choose to not to pay dividends and instead reinvest for future growth.

Who’s to say what the right approach is.

Warren Buffett, the greatest investor ever, doesn’t like when companies pay dividends while Kevin O’Leary, a well known Canadian investor, flat out refuses to invest in any companies that don’t pay dividends.

2 Comments

Comments are closed.