Investing in the stock market can be both risky and rewarding. By understanding a few basic concepts about trading stocks, and how different factors affect your investment choices, you can determine if buying only 10 shares of a stock is worth it to you.

Buying 10 shares of stock can certainly be worth it, especially when you first start out with investing. While the number of shares you buy does matter, the overall value of your investment and the percentage increase in the share price is what is most important.

| Starting to Invest? | Our Recommendations | Start Trading Today |

|---|---|---|

| Wealthsimple Trade ($25 Bonus)Only in Canada

| Start Trading TodayRead our Review |

| Robinhood InvestOnly in USA

| Start Trading Today |

For example, if you buy 10 shares of stock in a company with a stock price of $100 and you generate a 10% return on your investment, you would earn $100.

On the other hand, you could also buy 10 shares of a penny stock worth $1 and generating the same 10% return would only earn you $1.

Research and planning is the key to investing wisely. Once you determine the total amount you want to invest, the stock you want to buy, the number of shares you can buy, and the fees you’ll pay, you’ll find that it can be worth it to just buy just 10 shares of a stock.

Read on to learn more about some key factors you should know about before buying 10 shares of stock.

Related Financial Geek Article: Is Investing in Stocks Gambling? (Simple Explanation)

Can You Buy Just 10 Shares of a Stock?

There is no minimum number of shares an investor must purchase to get started in the stock market. You can buy stocks through traditional brokerage companies or through any one of the numerous online apps available today. The main differences between most of these services are their fees and resources.

Making small investments in stocks is a good option for a beginner.

Investing can be complex and overwhelming, so purchasing just a few shares provides the opportunity to learn the world of investing but with little risk.

If you’re just starting, you’ll want to understand how to pick a stock that performs well, how to limit your fees, and how investing works to ensure that buying 10 shares is actually worth it to you.

Some experts say that an ideal number of stocks to own is between 10 and 100 shares. They also recommend equal distributions in different sectors or industries to lower the risk of potential market fluctuations adversely affecting your overall investment. But we won’t get into all that diversification stuff right now.

So as I stated earlier, as a beginner investor, the number of shares you buy, in my opinion, really shouldn’t be the question you are asking yourself when trying to determine if your investment is going to be worth it.

What you should really be asking yourself is how much money are you looking to invest, and then see what types of stocks you can afford with that amount of funds.

It wouldn’t make sense for me to say investing in 10 stocks is not worth it. Why? Because what if you invested in 10 shares of Berkshire Hathaway?

That stock is currently trading for $436, 401.

So if you invested in 10 shares of of Berkshire Hathaway your total investment would be close to $4.5 million. Even generating an 8% return on this investment would earn you $349,120. So of course that is worth it!

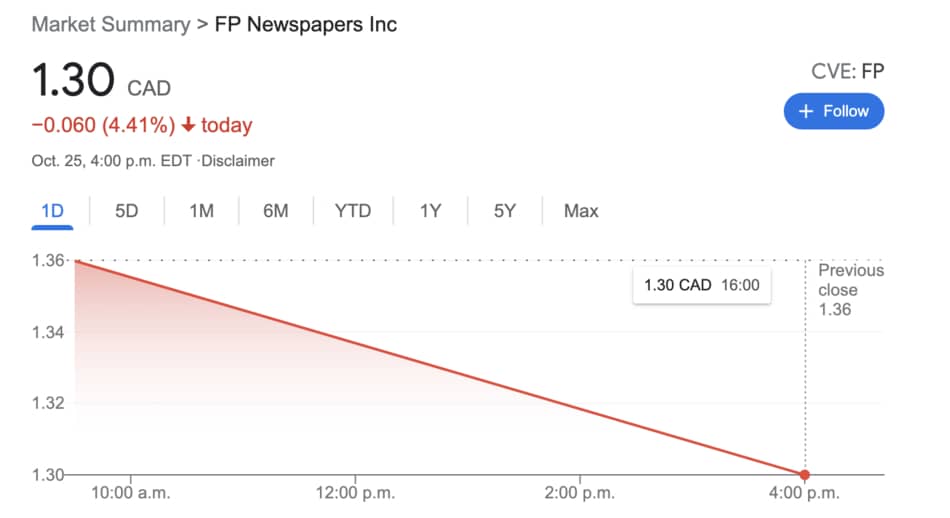

On the contrary though, if you invested in a penny stock like FP newspapers, that is currently trading for $1.30, well then your total investment would only be $13. An 8% return on your investment here would equal $1.04. So in this case, that just really wouldn’t be worth it as your return wouldn’t even cover your trading costs such as your commission fees.

With all that said, it’s more important to figure out how much money you have to invest and then do your research to figure out what you want to buy.

It doesn’t matter how many shares in that company you can buy, if it’s one, ten or hundred, the overall value of your investment is what should be considered when deciding whether or not the investment is worth it to you.

However, I will preface all of that with saying, if you are just doing this to learn the stock market and play around a little, then there is no harm in that! Buy 10 stocks for $1 each and just learn how it all works! That’s worth it in my opinion – consider it the price of learning!

Should You Buy Just 10 Shares of a Stock?

As you begin investing, it’s important to take a close look at your financial situation and what you need to learn in order to determine if you should buy into the stock market.

Can You Afford to Invest in Stocks?

Stocks are considered a long-term investment. You need to be sure you can weather the ups and downs of the market, and resist the temptation to sell when the market drops.

It may take some time to rebound from a market dip, but if you sell when the stock price is lower than what you paid, you lose the opportunity to gain back that loss.

If you don’t have an emergency fund set aside, it may be a better investment to continue saving.

Research is the Key

Buying stock in a company is a decision that requires analysis to ensure your investment is sound. By comparing various valuation metrics you can determine if a company’s underlying value is a good match to the stock’s price.

This is called a fundamental analysis. It basically lets you compare companies on a variety of metrics to determine their financial health and future growth potential.

Online stock screener can be used to help narrow down your choices but be aware of their limitations before using one.

Starting out, I’d use your own analysis to choose the best company to invest in and don’t overcomplicate things. And again, don’t invest too much money off the start, just learn how the stock market works before making any large investments.

Keep it super simple at the beginning.

Cost is Important

To evaluate the cost of buying 10 shares of a stock, determine the price of the shares, the potential for growth and broker and maintenance fees associated with servicing your account. It is important to determine these costs in order to know if you’ll make enough money to cover the fees when you sell.

Determining the Cost

Online brokers usually have the lowest fees, but they also provide no investment advice and can even sometimes have limited customer service. So you’ll need to take into consideration your level of knowledge with investing to determine which type of broker you’ll need.

To determine if the cost of buying just 10 shares is worth it, choose the type of broker that works best for you and evaluate the fees against the potential gains of your investment.

All about Broker Fees

To determine the total cost of your investment, you need to understand what brokers do and how their fees work. Brokers can charge either a percentage of your trade or a flat fee per transaction depending on the types of services they provide. Some Brokerage firms even charge annual fees to maintain your investment accounts.

With the rise of online brokerage firms, more people than ever are able to trade on the stock market with smaller fees and a lower overall investment. If you’re confident in your knowledge of the stock market and you don’t need other investment advice, your fees will likely be lower.

Broker fees vary depending on the services they provide. A full-service broker that provides investment advice and other financial services such as estate planning, tax planning and consultation normally charge 1% – 2% of a client’s total managed assets.

Discount and Online brokers provide limited products, no investment advice and limited customer service. They essentially execute trades, and are best suited to self-directed investors who trade frequently. Most discount brokers also charge a flat fee that can range anywhere from $5 to $30 per transaction.

Should You Buy 10 Shares of Cheaper or More Expensive Stock?

As mentioned throughout this article, the cost per share of a stock is less important than the overall value of your investment and the percentage increase in the share price.

The more expensive the stock, then the fewer shares you can buy. But if you’re able to buy several shares of a cheaper stock with better growth potential than an expensive stock, you’ll be able to do just as well with it, if not better.

Just be aware that if you decide to split those 10 shares between more than one company, you will pay multiple broker fees, which will end up increasing your overall cost of investment.

What Else Should You Consider When Buying 10 Shares of Stock

If you decide to buy just 10 shares of stock in a company, remember that you should determine how much of those 10 shares make up your entire portfolio. For example, you could own 10 shares in Company A and 1 share in Company B but still have Company B account for 90% of your overall portfolio.

With that said, you can see why it’s important to diversify your portfolio as you continue to invest. While one area of your investments may be down, there may be others making gains to help offset overall losses. So diversification is important!

But, if you’re only able to invest enough to buy 10 shares, it’s totally okay to start with that and continue to grow and diversify your portfolio over time.

What are the Tax Implications?

It’s important to plan for taxes on your investments. If you receive dividends, you’ll be required to pay income tax on them. If you sell stocks at a gain, you will have to pay a capital gains tax so it’s important to talk with a tax professional to understand how your investments will affect your annual taxes.

Final Thoughts

There you have it folks!

Buying 10 shares of a stock can certaintly be worthwhile. But what’s worth it to you may not be worth it to someone else.

So instead of asking yourself if investing in 10 shares of a stock is worth it, do your research on stocks you are interested in and invest what you can into stocks you like. Because remember, the number of shares of a stock you buy won’t determine if it’s worth it to you or not. The overall investment value and it’s return or potential return on investment is what you’ll want to consider.

As always, thanks for reading.

Geek, out.

![Are Stocks Just Luck? [Things to Consider Before Investing]](https://thefinancialgeek.com/wp-content/uploads/2021/04/Are-Stocks-Just-Luck-1.jpg)