Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

Due to their great tax advantages, an RRSP is the best financial vehicle available to Canadians looking to save for retirement.However, with most tax friendly accounts, RRSPs included, they often come with contribution limitations that can’t be ignored.

Having said that, it’s important you understand what counts as an RRSP contribution and what doesn’t.

Many Canadians often wonder whether or not dividends generated within their RRSP count as RRSP contributions.

Allow me to explain.

Do Dividends Count as RRSP Contributions?

Dividends generated within your RRSP do not count as RRSP contributions and therefore they have no impact on your contribution room. In other words, your RRSP contributions room will not decrease as your dividend income increases your overall account value.

The CRA only recognizes RRSP contributions as cash or securities that are deposited into your account – not by any returns generated within it.

Additionally, because dividends generated within your RRSP don’t count as contributions, you aren’t able to claim them as tax deductions like you can with normal RRSP contributions.

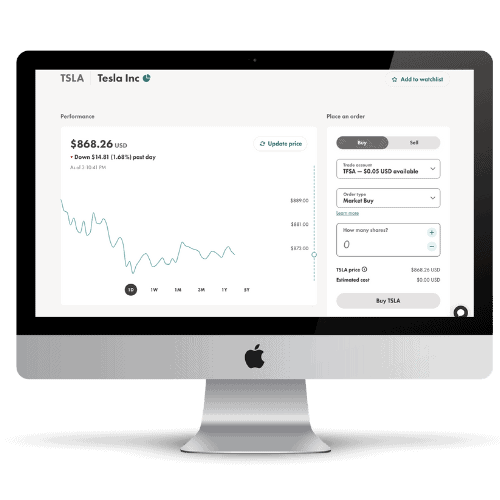

Start Buying Stocks in Your RRSP Today with Wealthsimple Trade

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No Minimum Balance Requirements

- No Commission Fees

- Investors Can Buy Fractional Shares

- RRSP funds can be used for a down payment on your first home

Example #1

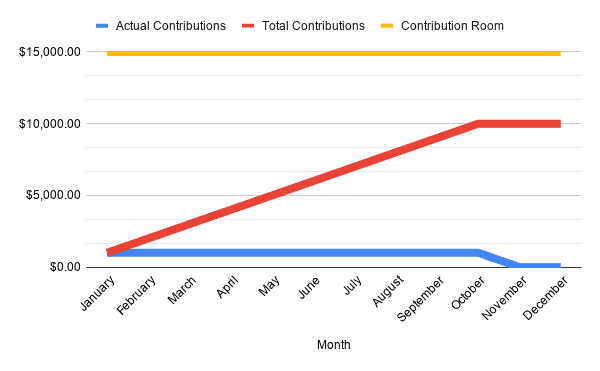

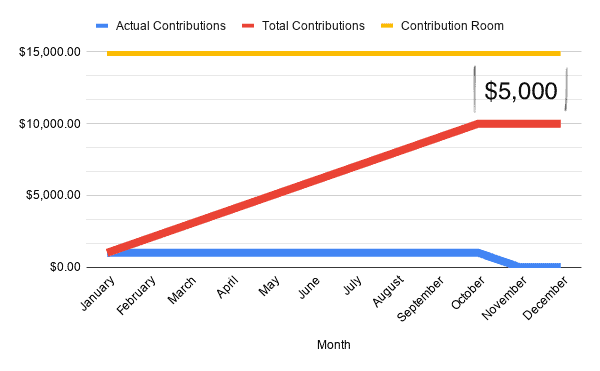

Let’s say Daniel’s RRSP contribution room for 2020 is $15,000.

From January to October of 2020, Daniel contributed $1,000 a month (nice job!) into his RRSP.

By October 31st, his total RRSP contributions for that year equalled $10,000 – at this point he decided that was enough for the year.

In December however, Daniel received a big $5,000 bonus from his work that he wanted to use to max out his remaining RRSP contribution room.

However, Daniel’s previous RRSP investments had already earned him an additional $5,000 in dividend income throughout 2020 – so he worried that he had already maxed out his contribution room.

What Daniel didn’t know was that the dividend income he earned within his RRSP didn’t count towards his contribution room, because of this, he didn’t invest his work bonus.

To clarify, Daniel’s total RRSP contributions remained at $10,000 despite his dividends adding an additional $5,000 to his account.

If Daniel knew that his dividend income generated within his RRSP didn’t count as contributions then he could have easily contributed another $5,000 to his RRSP and not have over contributed.

Quick Note # 1- Check out this article by The Financial Geek to learn more about how dividends impact your TFSA contribution room.

Example #2

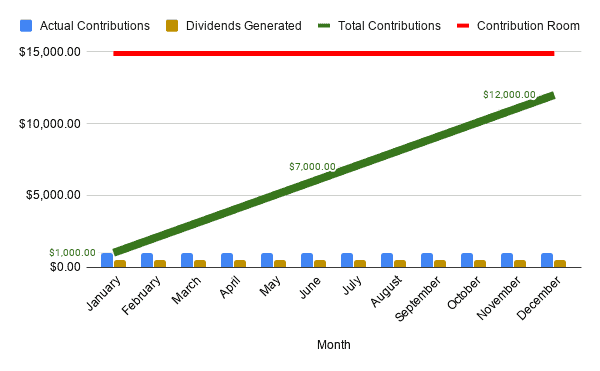

For 2020, Jack has $12,000 in RRSP contribution room.

Jack, similar to Daniel, decides to contribute $1,000 a month into his RRSP.

Throughout the year, Jack notices the investments within his RRSP performing very well as he earns around $500 a month in dividend income.

Come December 1st, Jack realizes the total amount added to his RRSP between his own contributions and the dividends generated within his RRSP equates to $12,550.

Unlike Daniel, Jack understands that the dividends generated in his RRSP don’t count towards contributions and therefore won’t impact his contribution room.

Therefore, Jack knows his total contributions for the year only equate to $11,000 and he can add his final $1,000 contribution (in December) to his RRSP – worry free.

Quick Note #2 – The CRA shows your deduction limit on the homepage of your online account, unless you’ve made RRSP contributions and decided to save the tax deductions for future years, your RRSP contribution room will be the same as your deduction limit.

If you are still a little confused, don’t worry, this stuff can be tricky.

Here’s the bottom line, any investment returns, whether it be dividends, capital gains or interest that are generated within your RRSP won’t count as RRSP contributions.

Remember, only cash or securities that are deposited into your account are recognized as RRSP contributions.

So as long as you don’t contribute more than your RRSP contribution room allows for, you’re going to be just fine.

How to Check Your RRSP Contribution Room

You should now understand things a little better.

But your next thought might be, “how do I check what my RRSP contribution room is?”

Great question, as mentioned above, unless you have unused RRSP contributions (deferred deductions) from previous years, your RRSP deduction limit should equal your RRSP contribution room.

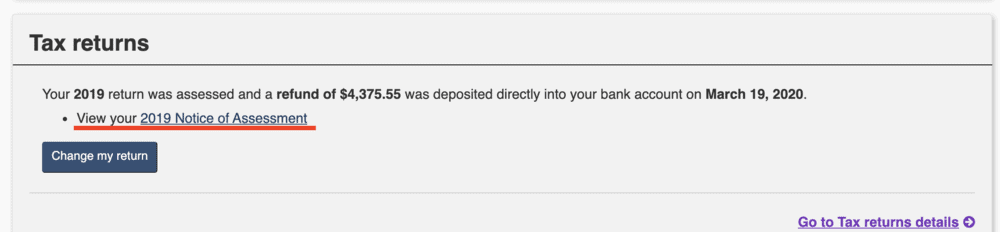

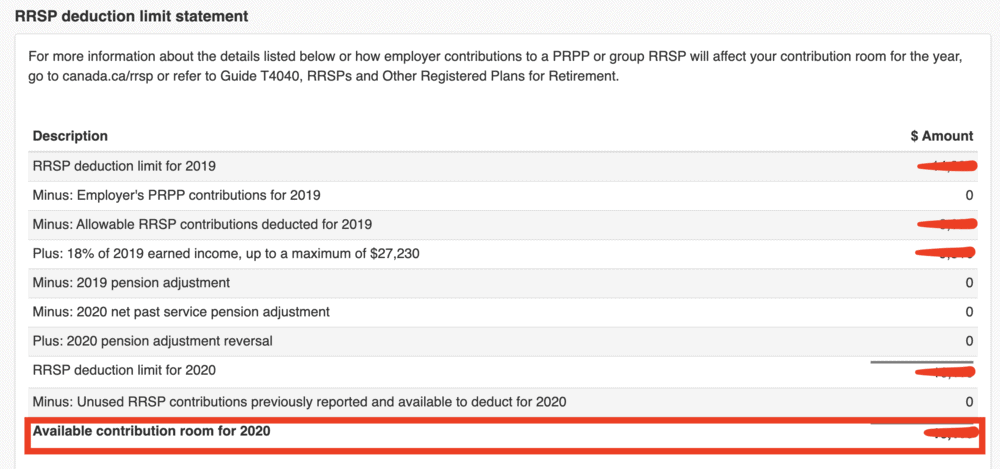

So, a really quick way to check your deduction limit (which also should be your contribution room), is to just login to your CRA account and scroll to the bottom on the homepage until you see this:

Here is an explainer video by Susan Daley that further explains the relationship between your deduction limit and contribution room.

However, if you really want to validate this number and check your actual contribution room, you will have to click your mouse one additional time (the horror!!), but it’s still a very quick and easy process.

Step 1 – If you don’t have a CRA account, create one.

Step 2 – Login to your CRA account.

Step 3 – Click – {Last Year} Notice of Assessment.

Step 4 – Look at the amount next to – Available Contribution Room for {Current Year}.

Step 5 – Subtract any contributions you’ve made to your RRSP in the current year from your Available Contribution Room for {Current Year}.

Step 6 – Whatever amount Step 5 gives you is your current RRSP contribution room as of today.

To avoid any penalization, avoid contributing in excess of this amount.

Quick Note # 3 – When completing step 5, make sure you don’t account for contributions made in the first 60 days of the current year if you already accounted for them in your previous years tax return.

Conclusion

Okay, I think we’ve beat this question to death enough, but let’s give one final recap for all the conclusion readers out there.

Dividends generated within your RRSP do not count as RRSP contributions.

If your RRSP investments earn you $10,000 in dividend income, this does not impact your contribution room whatsoever, as long as you keep it within your RRSP.

So if you are worried about your investment returns causing you to over-contribute to your RRSP, just remember that dividends don’t stand alone in this matter as capital gains and interest also don’t count as RRSP contributions – as long as the return was generated within the RRSP itself.

Furthermore, if you planned to reduce your taxable income by claiming RRSP generated dividends as contributions, just know you can’t do that – good try though!

Cash or other eligible investments need to be actually deposited into your RRSP account for them to be considered contributions.

Lastly, if you want to be 100% confident in what your RRSP contribution room is, make sure to check it by logging into your CRA online account and going to your notice of assessment document for the previous year.

If you don’t yet have an RRSP open, I’d recommend opening one up with Wealthsimple for the 10 reasons and benefits I talk about in my article here.

Start Buying Stocks in Your RRSP Today with Wealthsimple Trade

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No Minimum Balance Requirements

- No Commission Fees

- Investors Can Buy Fractional Shares

- RRSP funds can be used for a down payment on your first home

If you’d rather just skip right to the sign-up stage, you can do so here and get a $25 bonus with your sign-up.

Thanks Financial Geekers! I hope you learned something new here today.

Time for a beer, or 10.

Geek, out.