Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

If you’re reading this article, you likely already know that RRSP contributions are tax deductible.

You may also know that these tax deductions can be deferred for future years for when it makes more financial sense to do so.

People who take advantage of this deferral often wonder whether or not their deductions will expire after a set period of time, so let’s clarify this.

In short, unclaimed RRSP deductions don’t expire over time. While it is usually not recommended you wait too long to claim your contributions, rest assured they will never expire even after you close your account.

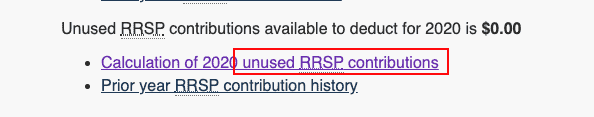

Quick Note #1 – Unclaimed RRSP deductions are referenced on the CRA website as unused RRSP contributions. Different wording but same meaning.

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

Want to open up an RRSP? Try Wealthsimple Today and You’ll get a $25 Bonus with your Sign-up.

Do Unclaimed RRSP Deductions Expire? (Longer Answer)

If you are confused by the answer given above, I don’t blame you, but allow me to further clarify things.

When a Canadian invests money into an RRSP, their RRSP contributions are tax deductible.

In other words, they are able to reduce their taxable income by at least the amount they contributed to their RRSP.

For example, if you contributed $5,000 to your RRSP, you could reduce your taxable income by at least $5,000 in the year (plus 60 days after) you made the contributions.

However, just because you can reduce your taxable income in the year you made your contributions, it doesn’t mean you have to.

The CRA gives Canadians the option to defer their deductions for future years when it may be financially wiser to do so. (Check out this article by The Financial Geek for more information on why someone would defer their deductions)

So if you do decide to defer your tax deduction for a future year, just know there is no expiration date for when you have to make the claim.

Example

Let’s say Hilary contributed $5,000 to her RRSP when she was 23 years old (impressive!).

Because she was a student and didn’t earn a huge income, she saved her tax deduction for a future year when she expected to be in a higher tax bracket.

However, Hilary is a little forgetful and despite earning a higher income the very next year, she forgot about her unclaimed RRSP deduction until an accountant brought it to her attention at age 33.

Luckily for Hilary, unclaimed RRSP deductions don’t expire and at the age of 33 (10 years after she made the contributions), she was able to deduct an additional $5,000 off her taxable income plus the contributions she made that year.

Related Article: 10 Reasons to Open an RRSP with Wealthsimple

How To Find Your Unclaimed RRSP Deduction Amount?

If you’re anything like Hilary and you forgot how much deductions you deferred, don’t wait for an accountant to remind you, check for yourself, here’s how to do it.

Remember – the CRA refers to unclaimed RRSP deductions as unused RRSP contributions, but they mean the same thing.

Step 1 – If you haven’t already, register for your CRA online account.

Step 2 – Login to your CRA online account.

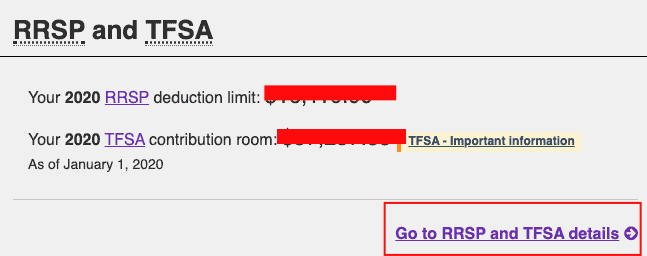

Step 3 – Scroll down to the bottom of your account homepage and click Go to RRSP and TFSA details.

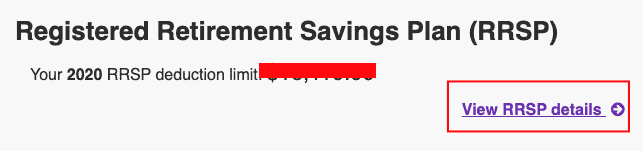

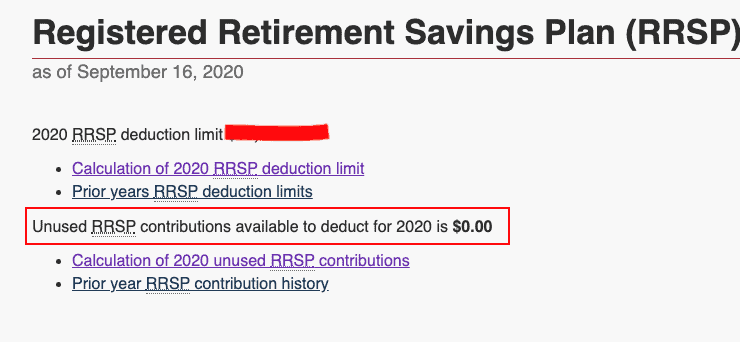

Step 4 – Then click View RRSP Details.

Step 5 – Look at your Unused RRSP Contribution Amount. This is your “unclaimed RRSP deduction”

What if Your Unused RRSP Contribution is $0?

If you’re like me and your unused RRSP contribution is equal to $0, this just means you’ve already deducted all your RRSP contributions from previous years – and there is nothing wrong with this.

Don’t mistake this amount for your unused contribution room as these are very different figures.

The only way this number wouldn’t be $0 would be if you held off on deducting some of your RRSP contributions for future years.

If you’re a little dizzy from trying to figure out the difference between RRSP contributions, deductions limits and contribution room, I don’t blame you, so am I, it’s exhausting.

Luckily for us though, Susan Daly, a Chartered Financial Accountant (CFA) helps clarify this for us in a short video included below.

Can You Deduct Unused RRSP Contributions After Age 71?

Before I get into this, let’s clarify one more time that unused RRSP contributions and unclaimed RRSP deductions refer to the same thing – contributions made to your RRSP that have not yet been deducted from your taxable income.

Okay so back to the question.

On December 31st of the year you turn 71, you must close out your RRSP (Best practices for closing your RRSP).

This begs the question of what happens if you’re over the age of 71 and you still have unclaimed RRSP deductions?

Luck for you, while you can’t exceed your RRSP deduction limit, you can still deduct any unused RRSP contributions from your income even after your account has been closed.

For more information on what happens to your unused RRSP contributions after the age of 71, see what the CRA says about it.

Quick Note #2 – You can’t transfer unused RRSP contributions (unclaimed RRSP deductions) to another person.

Conclusion

The bottom line here is that unclaimed RRSP deductions do not expire, not even when you close out your account!

While I personally don’t recommend you wait too long to claim your deductions, that’s not really any of my business is it. Your money, your life!

If you’re not sure if you’ve deferred any deductions or not, you probably haven’t as you would remember doing so as it requires a bit of paperwork, but hey if you want to check anyway, follow the steps outlined earlier in the article.

If your “total unused RRSP contributions available to deduct for the current year” is $0, that just means you haven’t deferred any deductions and things are status quo.

Finally, if you are a little confused, just remember that despite having the same meaning, the CRA refers to what many Canadians call Unclaimed RRSP Deductions as Unused RRSP Contributions.

To conclude, sleep easy in knowing that you can claim your unused contributions in any future year that you stay above ground (you stay alive).

That’s it for me! I hope you’ve learned something new here today. Now it’s time to deduct a beer from a bottle, an unclaimed beer of course – preferably one that’s not expired.

Geek, out.