Are you considering hiring a money coach?

Or maybe you’ve considered becoming a money coach?

Or maybe neither? Maybe you just like learning useless knowledge on the internet, that’s okay too!

Regardless of your circumstances, if you’ve thought about the money coaching profession at all, you’ve probably wondered how much they charge their clients.

So, how much do money coaches charge for their services?

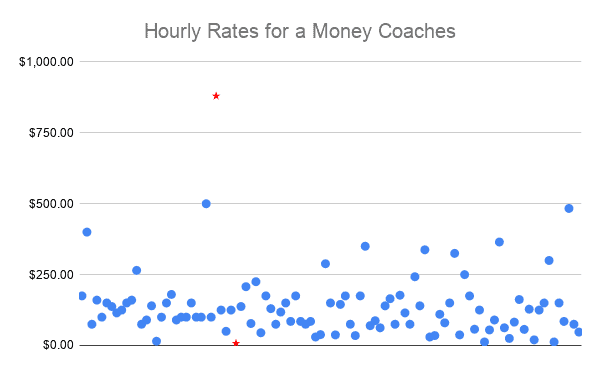

In short, the average money coach charges $139.45 USD for an hour-long session with their client. Some money coaches charge as much as $880 USD per hour, while others charge as little as $7.50 USD per hour.

HOURLY RATES

It’s always possible to find holes in blanket statements like this, but these numbers should give you a general idea of what money coaches charge for their coaching services.

This data was derived from aggregating the average hourly rate of hundreds of money coaches around the world. (Source of raw data: Noomii Professional Coaching Directory)

Below here we have s scatter plot that shows the prices of 100s of different money coaches hourly rates. As you can see, there is no standard price for what a money coach can charge their clients but the majority of coaches come in around the $100-$200 range.

DATA SOURCE: NOOMII.COM

It’s important to note these average prices are based on 1-hour sessions.

Typically though, money coaches will offer a cheaper hourly rate if their client commits to more than one hour – we will talk about this in the next section.

Quick Note #1 – You may see me refer to a money coach as a finance coach throughout the article as I consider them the same.

Pricing Structures Offered by Money Coaches

A money coach will charge their clients in one of 3 ways depending on how they choose to run their business.

Hourly Rates (Average Cost – $139.45/hour)

The majority of money coaches include hourly rates as a part of their service offering.

Why?

Because some clients may only need a few hours to better their financial situation.

For example, a potential client may just want a second opinion on a new monthly budget that he’s developed.

Or maybe a client wants to hire a money coach to advise them on what financial institution they should invest their money with.

These potential clients don’t need robust coaching products and services, they just need a few hours of the coaches time, some guidance and a second opinion.

In situations like this, hourly rates can be beneficial for both the coach and the client.

Monthly Packages ($250 – $2500/month)

Money coaches can offer some very valuable coaching within a few hours, but for those people who need more than just a little advice, coaches often offer monthly packages.

Depending on who you hire, money coaches charge their clients anywhere from $250-$2500 for a one month package. While there are monthly coaching packages that fall outside of this range, this is reasonable range for what most money coaches will charge for their services.

These monthly packages often include things like scheduled one-on-one calls, access to online tools and budgeting softwares, homework checks, text message support and more.

Longer Term Commitment ($1,000 +)

Some coaches need more than a month’s plan to get the results they promise their clients.

For that reason, some life coaches only offer their services if the client makes a long term commitment.

These “long term commitments” can range anywhere from 3 months to a year or even longer.

If the timeframe is unclear for how long a client will need coaching services for, then the coach may charge the client some sort of monthly retainer fee where they pay an upfront monthly fee to ensure commitment by the coach.

On the other side of things, if a client purchases a 6-month plan, then the money coach will likely charge a fixed price for their services that can be paid up front or on a monthly basis.

While it’s hard to put a blanket price on these long term coaching services, you can be sure money coaches will charge more than $1,000 for any plan that extends more than 3 months or longer.

What Makes a Great Money Coach?

Okay, so now we know money coaches come in at all different price points.

Some coaches essentially give away their time by offering hour long sessions for $7.50, while other finance coaches charge their clients upwards of $880 for a single hour!

We also know coaches like to book multiple sessions with their clients by offering them short and long term packages at reduced hourly rates.

Logically speaking though, the more money a coach is able to charge their clients – the better services they can provide.

But what makes these high income money coaches so good at what they do?

Here a few qualities that set some coaches apart from others.

Educated

First and foremost, a good money coach needs to know their stuff. If they don’t know what they’re talking about neither will their clients.

While a money coach doesn’t need a binder full of finance designations and certifications, they should certainly have some background in personal finance.

Coaching Skills

Wayne Gretzky is the greatest hockey player of all time, but he was a terrible coach.

It doesn’t matter how well someone knows a subject matter, they won’t be an effective coach if they can’t articulate their thoughts and explain best practices.

Experience

When choosing a money coach, make sure you’re not dealing with a complete newbie, I understand every coach needs to have their first client, but DON’T let that be you.

While experience doesn’t guarantee good performance, chances are if they’ve been around for a number of years they’re doing something right , if not they’d be out of business.

Who would you feel safer with while flying in a helicopter – a pilot with 15 years experience or a 19 year kid that just finished flight school? (My attempt at a metaphor, or is that a simile? What am I even doing here)

Great Reviews

At the end of the day, the proof is in the pudding.

While it might be easy to boost your credentials or exaggerate your coaching resume, it’s not easy to persuade a large group of people to leave fake, positive reviews about your coaching services.

Money coaches who have great reviews are usually very reputable and they’re typically the ones who charge higher fees. But hey, you get what you pay for.

Quick Note #2 – Make sure you check client reviews and ratings outside of the coach’s website. Look at their social media channels or 3rd party review websites.

With all this said, it’s super important to do your due diligence before hiring a money coach as it will save you money in the short and long term.

Personalized Coaching

Don’t settle for a money coach that manages their clients at scale.

As a money coach, you can’t automate a solution when the problem is different for each client.

Make sure your money coach deals with you 1 on 1, whether in person, on Zoom, over the phone, through carrier pigeon, I don’t care, but make sure the coach is providing a solution for you and your situation – not a one size fits model.

Conclusion

To conclude, an hour long session with a money coach will cost you anywhere from $7.50 USD to $880 USD per hour with an average hourly cost of $139.45 USD.

With that said, money coaches usually offer their services in one of three ways, by the hour, by the month or by agreeing to a longer term commitment (usually 3 months of me) with their client.

Like most coaching services, you will likely be rewarded with a cheaper hourly rate if you are willing to commit more hours to the coach.

Finally, if you’re planning on hiring a money coach, do your due diligence beforehand. Read reviews, look at their experience, and see if their services suit your needs.

Top tier money coaches will charge top dollar for their services, but think of it as investment opposed to an expense, an investment in your financial future.

You know what they say, a penny saved is a penny earned. Is that relevant to this article? Absolutely not

![Is $1,000 a Week Considered “Good Pay”? [ANALYSIS]](https://thefinancialgeek.com/wp-content/uploads/2022/08/Featured-Image-36.jpg)

2 Comments

Comments are closed.