Do you ever find yourself wondering how you can spend your money more wisely?

Money is a sensitive subject for a lot of people, they work, they earn and they spend – rinse and repeat.

But rarely do people put much thought into how they could spend their money in a wiser manner so that they maximize the benefit of every dollar spent.

The goal of this article is to give you 11 quick tips on how you can spend your money just a little more wisely

So let’s jump right into it.

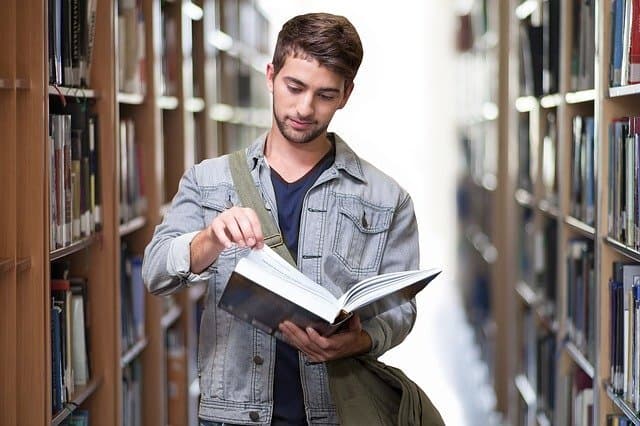

Spend Money on Self Improvement

One way to spend your money more wisely is to spend it on things that support self improvement.

This could include things like buying and reading books, taking online courses, learning a new language, taking music lessons or trying out a new sport.

I never look at spending money on self improvement as “spending money”, as I look at it more of an investment in my future self.

While these investments may not always result in monetary gains such as a higher salary, they can result in a happier you.

Research shows that we’re happier when we’re learning and improving at something.

Think about a time you did something for the first time that you’ve been working really hard on, isn’t that a great feeling?

As people get older, they tend to stop learning and looking for ways to self improve as much as they used too, but this shouldn’t be the case!

Spending money on self improvement is one of the best things you can spend your money on in my opinion, and again, your return on investment doesn’t have to be from a financial viewpoint.

You return on investment could just be a happier you, and from my perspective, that’s even better.

I’d recommend budgeting a portion of your income every month towards self improvement. It doesn’t have to be a lot, but even $25-$50

Quick Note #1

Invest a Portion of Your Income Every Month

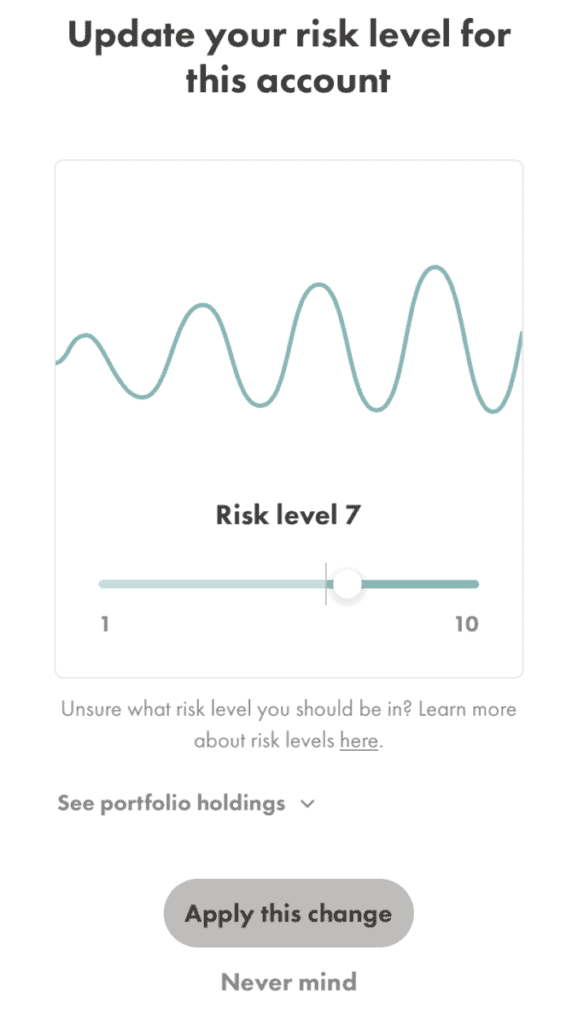

Another great way to spend your money more wisely is to invest it.

Similar to self improvement, money you “spend” on investments is more so an investment in your future life as opposed to an expense.

I’d recommend saving 10%-15% of your pre-tax income for retirement. So if you make $40,000 a year, you should be investing at least $4,000 a year for retirement.

If you don’t have a retirement account open yet, I’d recommend opening one up with Wealthsimple for the reasons I explain in my article here, that’s who I invest my money with and it’s so easy.

I just select my risk level, deposit my money and move on. It costs no money to open and fund your account and the entire sign up process, it’s really simple.

If you don’t have that much extra money to invest every month, that’s completely okay, but every one can afford to invest a little, even if you are living paycheck to paycheck.

Thanks to compound interest, you’d be very surprised at how much a little bit of money can accumulate into over the course of a few decades.

For example, let’s say you are 30 years old and you invest $200 a month into a retirement fund until you retire at age 65.

Assuming a 10% average return over that 35-year period, do you know how much you’d have at retirement?

$759,327.61!!

Despite your total contributions only equalling $84,000 [$2,400/year x 35 years], you’ll be retiring with over three quarters of a million dollars.

Not bad hey!

Disclaimer: This 10% return on investment is by no means guaranteed. This number is based on what I think is possible over a 35-year period.

So please people, invest a portion of your income every month. From a long term perspective, this is the best way to spend your money.

And again, it doesn’t have to be a lot. $200 a month is 10% of a $24,000 a year salary. I know you can do this.

Not only is investing your money a wise move financially, but you’ll actually probably be happier too in knowing that your financial future is looking bright.

| Ready to Invest? | Our Recommendations | Start Investing Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Start Investing TodayRead our Review |

| BettermentOnly in USA

| Start Investing Today |

Maximize Happiness Units With Every Dollar You Spend

In order to spend your money as wisely as possible, try and maximize your happiness units with every dollar you spend.

If you are wondering WTF is this guy talking about, I apologize.

But basically all I mean is that you should try and avoid spending money on things that don’t add much happiness to your life.

For example, if you love to travel more than anything in the world, then spend your money on travel.

If you absolutely love reading fiction novels, then spend some of your money on fiction novels.

We don’t have to complicate this.

I love to play hockey so I spend a lot of my disposable income on ice time registration fees. I also love to do Crossfit, and I spend close to $200 a month to do it.

Why? Because even though I may be paying a lot of money to do these things, if I don’t spend it on things that make me happy, then I’ll just end up spending money on random things that don’t add any value to my life – which is never a good idea.

So be proactive with your spending and spend your money in a way that makes you happy.

No one is here to tell you what makes you happy, all I’m saying is don’t feel bad about spending money (even over spending) on things that add true value to your life.

Of course, you need to spend money on life’s basic essentials like food and shelter, but after the necessities, start looking at ways you can spend your money in a manner that maximizes your happiness.

For example, instead of buying the new $800 iPhone, think about how much happiness your current phone brings you, and then think about what else you could do with that $800.

In other words, determine the trade-off you’re making when you make big purchases and ask yourself “am I maximizing my happiness with this purchase?”

If you are, then great, pull the trigger and buy whatever it is you’re considering.

But if not, and you think this money is better spent somewhere else, than you might want to reconsider.

Buy Things on Second Hand Marketplaces

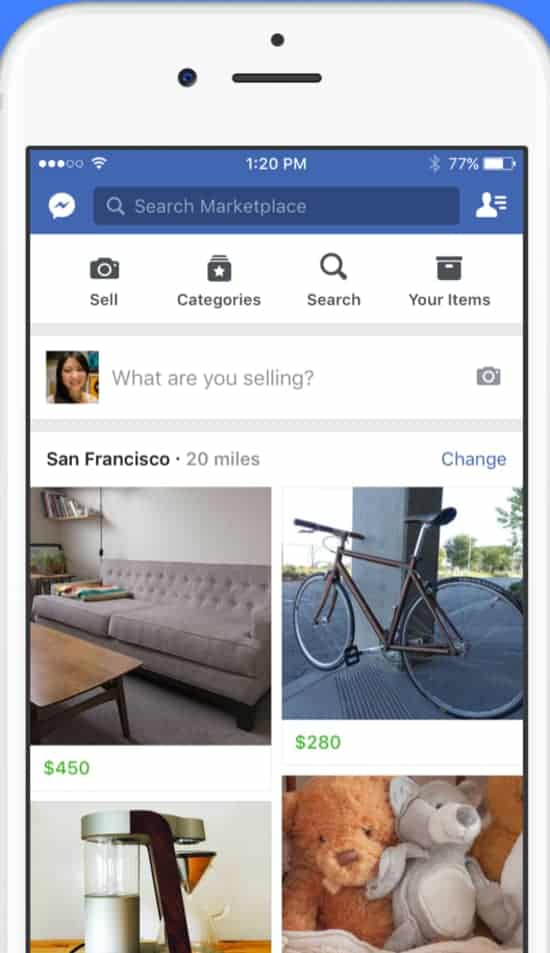

Another great way to spend your money more wisely is to buy things through online second hand marketplaces.

You would be shocked at what you can find on these platforms.

Some common second hand marketplace platforms include:

- Facebook Marketplace

- Craigslist

- Kijiji (Canada)

- Letgo

The great thing about buying things on second hand marketplaces is that while you can often find amazing deals, you also don’t pay sales tax.

While most things on these marketplaces will be in fact, second hand, this doesn’t mean that they’re automatically any lesser of a product.

For example, I love golfing and I get all my golf clubs second hand on places like Facebook Marketplace and Ebay. While my handicap would indicate otherwise, these clubs are as good as new, yet they sell for a fraction of the price.

I’ve included an image here below of two golf clubs I got this year, a Taylor Made Driver and an Odyssey Putter, I got them on Ebay for roughly $155 each, they were essentially in mint condition and only been used a few times.

If I were to buy them new, it would have cost me close to $800.

So always look for things on second hand marketplaces before buying them brand new.

Common things people buy on these platforms are sports equipment, consumer electronics, furniture, jewelry and of course clothes.

Obviously you can’t buy everything second hand, sometimes it’s just more convenient (and sanitary) to buy things at a retail store, but if you are buying something over $50 in value, I’d always suggest at least looking on a few marketplaces first.

You’ll be surprised at what you find, as the old saying goes, “one man’s trash is another man’s treasure.”

Spend Money on Health and Wellness

A great way to spend your money more wisely is to spend it on your health and wellness.

Now, health and wellness can mean a lot of different things and I’m not a doctor, a psychologist, a counselor, a health and wellness coach or anything like that, so I don’t want to overstep here – but all I will say is that when I spend my money on things that improve my overall mood and general feeling of healthiness, I never regret it.

Whether it’s exercise, nutrition, meditation, yoga or whatever, it really doesn’t matter. Spending money to improve your overall state of wellness is rarely a bad idea.

Similar to self improvement, health and wellness is an ongoing choice people make on a daily basis. It’s not a one off event, it’s a lifestyle.

Because of this, I always recommend making room for your health and wellness choices within your budget – we’ll talk about budgets soon.

Spend A Little More For Higher Quality Items

In my opinion, spending a little extra money on higher quality items is a wise money move.

I know most of this article is about how to spend less for more, but I actually think buying quality things in the long run will save you money.

With that said, this doesn’t apply to everything. For example, buying a $200,000 Mercedes G-Wagon, although a high quality car, probably won’t save you money in the long run.

But buying quality, durable clothes that will last you a few years, now that’s money well spent!

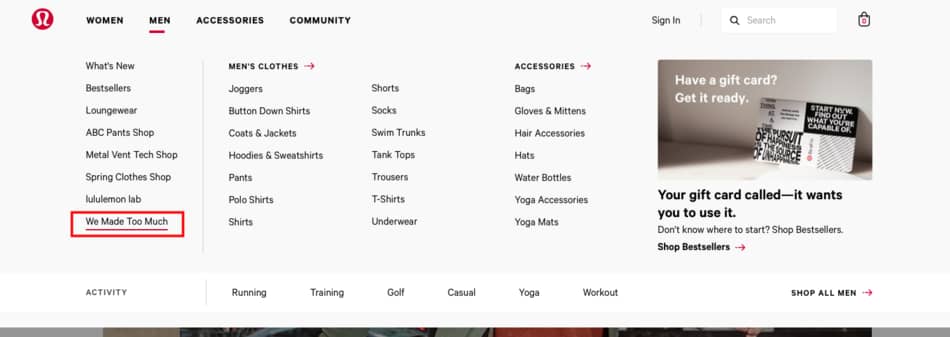

I love a good deal more than anyone, but when it comes to clothes for example, I am Lululemon all the way.

The shirts don’t shrink, the pants don’t wrinkle and the boxers fit perfectly.

Am I paying more than a typical pair of pants cost? Yes, most definitely, but I’ve been wearing the same pair of Lululemon ABC pants for years now.

Because they’re great quality, I don’t have to get new ones every few months, so in the long run, I really feel like I’m saving money, plus I feel good about what I’m wearing.

Again, I don’t always pick quality over price, if I’m buying a whiteboard for my kitchen – Dollarama I go. Golf balls for the summer – Walmart (fore left!!).

But I truly do think you’re better off spending a little extra money on higher quality items in some cases.

Some Items I Don’t Mind Paying More For:

- Clothes

- Sports equipment

- Coffee Makers

- Furniture

- Headphones

And remember to look on second hand marketplaces for quality items too, that way you get a high quality item for a cheap price, win win!

Budget Your Spending

Budgeting has been discussed throughout this article a few times already, so I thought it would be a good idea to include it as a stand alone tip.

While it may be boring, creating and following a budget is a crucial part of being a responsible spender.

Budgeting your money helps give every dollar you earn a job, and I think that is so important when trying to spend your money more wisely.

If you haven’t already, I’d strongly recommend building your budget in something like Excel or Google Sheets.

I’ve included an image below of the budget I created for myself.

As you can see, I don’t complicate this at all.

Besides taxes (which are automatically deducted), the first thing I budget for is my investments. Then based on what I have left over after my taxes have been paid and I’ve paid myself (investing), then I live off what’s left.

As you can see, I have a free cash flow section, that is my unbudgeted spending I give myself every month.

This is for things like gas, food, eating out, movies, beer, travel, etc. So it’s not all work, no fun!

What I love about this budget is that it gives me the ability to spend money in a guilt free manner.

I actually have a separate chequings account that I transfer my free cash flow to every month. That way I know whatever I have in that account is my money to spend as I please. My goal is for that amount to always be increasing

So not only will creating a budget help you better save and invest your money, but it will also give you more freedom to spend your money without feeling any remorse.

Another win-win situation!

Buy Used Vehicles

Buying used vehicles as opposed to brand new ones is a wise way to spend your money.

As I mentioned earlier in this article, just because something is used, that doesn’t mean it is damaged.

The average car payment in America today is $568 per month. $568 per month – you read that right. Isn’t that just insane?!

Unfortunately, most people treat a car payment like a house payment, they think it’s just a part of being an adult.

But it really doesn’t have to be that way, there are more used cars for sale these days than dealerships know what to do with.

Not to mention all the used car websites available like Cargurus and AutoTraders.

Or my personal favourite, and where I got this beauty below. Facebook Marketplace.

For $2,500 I might add

With that said, I’m just generally not really that into cars. Outside of taking me from point A to point B, they don’t add much value to my life.

If on the other hand, you really love cars (trucks, whatever), who knows maybe that $568 a month is worth it to you.

I’m not here to judge, just something to think about.

Remember, try and spend your money in a way that maximizes your happiness. I personally would much rather spend that near $600 a month on a few extra vacations each year.

Listen, I have no problem driving a 2008 Nissan Pathfinder if that means two more trips somewhere sunny every year.

But again, different strokes for different folks, most of you probably think I’m insane for spending $200 a month on a gym membership.

In any event, here are a few things you should know when buying a used car.

Pay for Things in Cash

Paying for things in cash as opposed to credit is a great way to spend your money more wisely.

Spending money with cash is a much more painful experience than just swiping your card, which in the short term, might seem like something you’d want to avoid (pain = bad), but in the long run, it’ll save you from over spending.

Think about your own spending habits now, would it be easier to hand over $150 in cash to a cashier, or to just swipe your credit card?

Duh, swiping the card.

But again, while this experience can be a very convenient one, it can cause people to live a life they can’t afford.

Banks and credit card companies make money off your debt, so they’ll basically approve credit to anyone and their dog, avoid this trap!

Most of us highly overestimate our ability to pay back high credit card balances.

Quick Note #2

So why not just buy things with cash? and if not actual physical cash, use your debit card. While it’s not as painful as paying for things in cash, it’s better than using a credit card.

Want to know another reason why spending money with cash is a wise decision? Due to the experience being more “painful”, we tend to savour and appreciate whatever it is we buy just a little bit more.

Avni Shah (a Duke University grad student) talks about this theory in a Forbes article from 2016 titled Paying Cash Is Painful, And Makes You Value Your Purchase More.

So not only will you appreciate your purchases more when you buy things with cash, but you’ll also be more financially responsible with your money and be less likely to live outside your financial means.

Buy Things On Sale

Not this tip is a pretty obvious one, but I can’t not include it. People who are great at spending their money wisely often buy things on sale as opposed to paying full retail price.

While a 10%-15% discount on a one time purchase might not be a lot of money standing alone, over the course of 20-30 years, you’ll end up saving thousands of dollars.

But here’s the thing, you don’t always have to wait for things to go on sale, there are proactive ways you can go about consistently buying things at a discounted price.

For example, if you shop online a lot, I’d highly recommend installing the Honey extension onto your browser.

I will leave a video here below on what Honey is and how you can install it, but in short, Honey basically scours the internet to find you discounts and coupon codes for anything you have in your online cart.

Another proactive approach to buying things on sale is to look for the clearance or discount section on a retailer’s website.

For example, on Lululemon’s website here they have a “We Made Too Much” section, the deals you can get here are pretty great, but oftentimes they’re only offered on the website and not in store.

So always look online before buying something in store, you’ll often find better prices.

Another quick tip for doing this is to subscribe to your favourite stores email newsletter. This way you’ll get notified when things go on sale. And trust me, they’ll notify you to death.

As mentioned earlier, buying things on sale won’t change your life overnight, but over the course of your lifetime, it can make a significant financial impact.

Be Generous with Your Money

Last but not least, generosity. Being generous with your money is something you’ll rarely, if ever, regret.

Similar to tips like spending money on health and wellness and self improvement, being generous with your money is more of a lifestyle then a one off event.

So whether it’s donating money to a local charity, getting your family members Christmas gifts or picking up a round of beers for your friends, it’s always a good idea to spend money on other people as opposed to just yourself.

As I talked about earlier in this article, it’s important to try and maximise your happiness with every dollar you spend, and I think financial generosity can play a big role in that quest.

Phillipe Tobler (a neuroeconomics professor) talks about this topic in a Times article titled Being Generous Really Does Make You Happier.

He says that “ research has indicated that spending money on others can be as effective at lowering blood pressure as medication or exercise.”

Additionally, he goes on to say that giving a way a little bit of money will give us those same warm fuzzy feelings that you’d get when giving away a lot of money.

So what does that tell you? You don’t have to become the next Bill Gates with your philanthropy. Even commiting $10-$20 a month towards generosity will have a huge impact on your happiness.

Tobler goes on to claim that being generous is actually the primary route to boosting one’s happiness.

So not only is being generous with your money a great way to help other people, but it’ll also have a huge impact on your own overall happiness and well being.

Yet another win-win situation!

Conclusion

Spending money more wisely doesn’t have to be complicated, but it is something you’ll have to work at.

The bottom line is that you want to spend your money on things that add value to your life, while at the same time not over spending for things that don’t.

My first suggestion would be to make a budget and set up an investment account. That’s a solid foundation to start from.

From there, you need to pay for your basic living necessities, and then with whatever you have left over, spend it wisely (maximize happiness).

Not only will spending money more wisely put you in a better position financially, but if you follow some of these tips I discussed above, it should also improve your overall well-being.

Dare I say…Win Win!

Geek, out.