Saving money can be difficult, saving money as a student is even harder – but it certainly can be done.

If you’re like me as a student, you want to spend every cent you earn.

Spending money is fun and it makes us feel good. New clothes, fancy restaurants, expensive coffees and craft beers (all great things).

And while that’s all fine and dandy, students should also learn to save some of their money.

Despite what you may think, saving money as a student is really important.

Allow me to explain why.

Here are 9 reasons why students should save money.

To Have an Emergency Fund

One of the main reasons you should save money as a student is to build up a proper emergency fund.

The concept of an emergency fund is pretty simple, but yet, most people still don’t have one.

Put simply, an emergency fund is 3-6 months worth of expenses set aside in case of an emergency.

As a student, you may not have many expenses outside of extracurricular activities and food, but i’d still recommend trying to set aside anywhere from $2,000 -$5,000.

Why Would You Need an Emergency Fund as a Student?

- Travel costs for an unexpected trip home (funeral, health issue).

- Car breaks down.

- School tuition increases.

- Laptop for school breaks.

You see, having a few thousand dollars set aside for an emergency allows you to not have to go into debt to afford whatever the crisis ends up costing you.

Not only that, but an emergency fund will also give you peace of mind (will talk about this more later) in knowing that an accident or an unforeseen circumstance is going to tip you over the edge financially.

P.S – I should note that a trip down to cancun with the boys after the semester doesn’t classify as an emergency.

To Develop Good Saving Habits

The next reason why students, whether in college, university or high school, should save money is just to develop good savings habits early on in their life.

Saving a percentage of your income is one of the most important habits a person can ever have.

The consequences of not saving can be terrible, check our article 6 Harsh Consequences of not Saving Money.

It really doesn’t matter how much money you make either, just get into the habit of setting aside a portion of what you earn into a savings or investment account.

As you get older, your income should grow, but so will your expenses, so the longer you wait, the harder it is to get into the habit of saving.

You’ll get accustomed to living off 100% of your take home income – this is a dangerous game!

Get in the habit of taking a slice of your income and setting it aside and then living off whatever is left.

Eventually you’ll get to the point where you don’t even account for that piece of income, you’ll just pretend it’s not even yours! This is the point you want to get to.

Develop these habits early on in life, because as I stated, the older you get, the harder it gets.

Setup your savings account separately from your chequing account in a way that you don’t look at your savings amount everyday. This can tempt you to spend it.

Quick Tip #1

To Take Advantage of Compound Interest

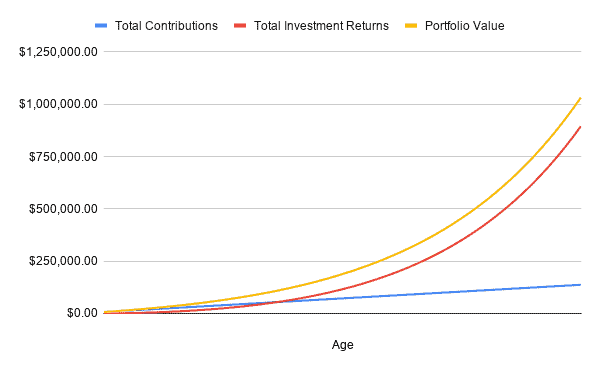

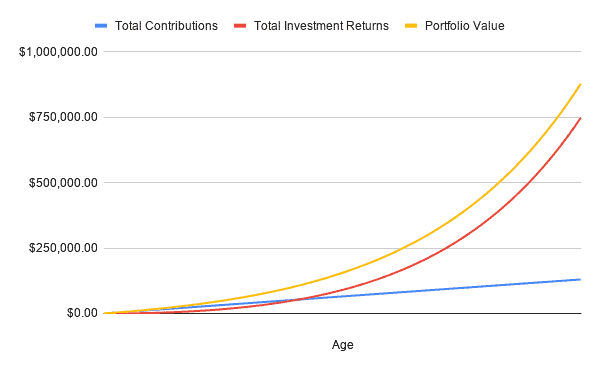

Saving money as a student can make a huge difference to the amount you retire with. In fact, if you play your cards right, you can probably retire earlier than most.

How? 2 simple words. Compound interest.

Put simply, compound interest is when you earn interest on your interest. And the earlier you start, the better.

Let’s look at a quick example here.

If you save $1,000 a year from ages 17-24 (student years – assumption), you’ll have $7,000 by the time you finish school.

If you invest this $7,000 plus another $4,200 a year until age 55, assuming an average 10% return, you’ll be retiring a millionaire at age 55.

You’ll have $1,031, 817.08 to be exact. At age 55!

On the contrary, if your friend makes the same investments from age 24-55, but he didn’t save that $7,000 like you did as a student, he’ll only have $878, 414.64 at age 55.

Can you believe that? That’s over a $150,000 difference, for just an additional $7,000 contribution amount.

Yep, that is compound interest for you, one of the most powerful forces in the universe, or as Albert Einstein coined it “ The 8th wonder of the world”.

If an extra $150,000 and an early retirement doesn’t persuade you to save a bit of money as a student, I don’t know what will.

| Time to Start Saving? | Our Recommendations | Start Saving Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Sign Up HereRead our Review |

| BettermentOnly in USA

| Sign up Here |

To Pay Off Debts

If you’re a college student, there’s a good chance you have to take out a student loan to fund your schooling.

If that’s not the case for you, lucky you!

If it is the case, then you should be saving money now to help pay off your current or future student loan debts.

Yes, you could just wait until you graduate and then deal with it then, but why not start early? The quicker you can get out of debt the better.

So if you’re earning income as a student, put a percentage of it aside, I recommend 15%-20%, and start chipping away at your debt.

I’ve talked to so many people who are so bogged down by their debt that they don’t even know where to begin.

We’re talking 6 figures here, it’s terrible – it kills them inside.

So make sure you avoid this, if you know you’re going to have big debts coming up in your future, prepare for them now.

You’ll thank yourself later.

And don’t worry too much about how much you’re actually saving, just have a process in place where you are in fact saving a percentage of your earnings and stick to that plan. As your income grows, so will your savings.

To Avoid Having To Immediately Get A Job After Graduation

Saving money as a student is vitally important for people who don’t know what they want to pursue after college.

Having a few thousand dollars set aside will give you the flexibility to take your time and figure out what the next chapter of your life will look like.

If you have no money saved up, it might come to the point where you have to get a job just to earn an income, and not because you have career aspirations in that field.

And hey that’s not the worst thing in the world either, but just make sure 30 years doesn’t go by and you’re still working a job you don’t love.

Me personally, I had no idea what I wanted to do after university, I had a few meetings with banks and investment branches, but I could just tell I wasn’t ready for all that yet, I wanted something different.

So I decided to pursue semi-professional basketball, and while I did this for 2 years, my salary from that supported me just fine, but I had no income during the 5-month period between when I graduated university my first semi-pro season.

Luckily though, I’d saved about $8,700 during my undergraduate degree, and that held me over for that 5 month period.

Point being, if it wasn’t for the money I had saved up, I would have had to work a job during that 5-month period which would have taken away from my training schedule.

In other words, my savings gave me the flexibility to do what I wanted to do on my terms, I wasn’t forced into anything.

Money is certainly not everything, but one thing it does give us is freedom to make choices based on what we want as opposed to what we have to do.

To Finance Further Education

Earlier in the article we talked about how saving money is important for students as it will allow them to get a head start on paying off their student loans.

But not only that, saving money as a student can also help you save for future schooling that you might be considering.

Maybe you want to pursue a Master’s degree? Or another undergraduate degree? Med school? Law school? I dunno!

But wouldn’t it be nice not to have to go into debt, or further debt, to fund this further education?

Even if you can’t pay for it all, that’s quite alright, every penny counts.

Not only that, but having money saved as a student will broaden your horizon for what you might wish to pursue.

Put another way, you won’t be as hesitant to consider a program you might want to pursue just because of what it’ll cost.

I’ve heard it before and I’ll hear it again, “ I want to do this program but I just can’t afford it, so I’m not even going to bother”

Related Article: 27 Easy Ways to Save Money as a Student in Canada

When you think about it, that’s really sad, but the unfortunate truth is, money can often prevent people from getting the education they really want.

Having money set aside to avoid this problem is definitely worth it for this reason alone, and if worst comes to worst, and you decide to not pursue further education, well then you still have a bunch of money saved up and there is nothing wrong with that.

Boys trip to Vegas! Jk..Kind of, not really – okay let’s go.

To Enjoy Guilt Free Experiences

So far, all we’ve talked about are responsible reasons why you should save money as a student, emergency funds, debt reductions, compound interest blah blah blah blah blah, boring.

All valid, but even I would admit, a little dry. And if that’s the only reason you save your money, your life could get a little dry too.

That’s why I think you should actually save money to spend money in some cases.

But spend it wisely, spend the money you save on experiences that will add real value to your life. If that’s a boy trip, awesome, if it’s a ladies weekend, perfect, bungee jumping, great if it’s a $500 ticket to a Leafs game, also great.

Obviously only you can judge what things bring you happiness, but make sure when you do indulge, do it on things that maximize your happiness! Don’t spend your hard earned savings on “meh” experiences.

Get as many happiness units as possible for every dollar you spend.

As you get older, you’ll start having more responsibilities and doing cool things will get harder (so I’m told), so as a student, this is a great time to see the world and do things you’ve always wanted to.

But here’s the kicker to it all, spending this money with cash (debit card) and not debt will make your experiences so much better. You won’t feel guilty about spending all this money on gratifying experiences, you’ll actually feel proud of yourself. As you should!

Life is short, who knows what tomorrow will bring, so make sure you don’t save all your money and avoid living an experiential life, but just make sure you do it in a financially responsible manner.

To Prepare for Your Future Life

Another reason why students should save money is to prepare for their future life.

Student life is a great one, but it doesn’t last forever – some would say unfortunately.

As you get older and move into the next chapter of your life, expenses and payments will start coming at you from all directions.

Down payments, car payments, insurance fees, mortgage payments, weddings, day care expenses, 7 day benders (wait, what?!) whatever it is, life gets expensive quickly, so it’s a good idea to be prepared for this.

Having to go into debt after your done school for anything other than a mortgage, in my eyes, is a bad idea.

But if you’re not financially prepared for the next phase of your life, you could end living well outside your means and begin living a lifestyle you can’t afford.

Take it from me, life happens quick. I’ve been out of university for 5 years now and it still feels like yesterday.

I’m not saying you need to save every penny you earn to prepare for things like car payments and weddings, but having some cash flow available so you can hit the ground running once you start adulting is always a good idea.

To Maintain Your Peace of Mind

Last but not least, one of the main reasons you should save money as a student is to maintain peace of mind in knowing your being financially responsible.

If you don’t save any money as a student, you won’t be financially equipped to deal with things that life throws your way, and this uncertainty can be very stressful.

And let’s be honest, you don’t have to be a doctor to know stress has negative effects of its own. According to Healthline.com, increased stress levels lead to serious health issues such as high blood sugars, headaches, insomnia and a higher risk of heart attack.

So seriously guys, no one wants to have increased stress levels, having a few thousand dollars saved as a student can make you feel much calmer and in more control of your life.

Think about, imagine having $5,000 in a savings account that is only to be used in case of emergency. Wouldn’t that be nice? I bet you already feel better just thinking about it.

Furthermore, if (and when) something does come up, you’ll likely have to go into debt to deal with the issue. And that just compounds the issue as now we have debt too – tough day!

Debt.org states that having debt can trigger emotions such as depression, anger and stress!

Now the stress is just recycling itself.

But you see, all this can be avoided by having money set aside in a raining day fund.

If you take anything from this article, make it be this. Having a fully funded emergency fund, or some level of savings stored away that isn’t to be accessed unless for unusual circumstances will improve your quality of life.

You’ll think clearer, food will taste better, you’ll sleep better and you’ll just live a better life. I can’t explain why, but you just will, I promise you.

| Time to Start Saving? | Our Recommendations | Start Saving Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Sign Up HereRead our Review |

| BettermentOnly in USA

| Sign up Here |

Conclusion

To conclude, if you’re a student earning any kind of money, try and save a percentage of it.

It doesn’t have to be a lot, but atleast 10%.

Believe it or not, and I’ve said this in other posts too, having a little less money to spend on the things you want won’t negatively affect your happiness. In fact, it could actually do the opposite.

People who live within their means and don’t live outside their comfort zones tend to be happier human beings! So keep that in mind.

Being financially stable as a student and having a few thousand dollars set away is a much better alternative to living an extravagant lifestyle when you really can’t afford it.

Okay, that’s enough out of me for one evening, as always, thanks for reading. Student or not, I hope this article has motivated you to start saving.

Geek, out.