Have you ever asked yourself, what is the purpose of investing?

You’ve heard lots of people talk about investing, but you still don’t quite understand the purpose of it.

If you are thinking to yourself, yep that’s me, then this article is for you.

So if you have a little extra money, you can either save it or invest it, those are your two options – save or invest. Many people may lean towards saving because it’s ‘safer’ but investing is where the real earnings happen.

In short, the purpose of investing is to help you grow your money faster. Investing can make middle class individuals or families become millionaires over time. While cash is great to have, saving too much cash will actually cause you to lose money over time due to inflation.

| Ready to Invest? | Our Recommendations | Start Investing Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Start Investing TodayRead our Review |

| BettermentOnly in USA

| Start Investing Today |

Sure, you could put your money in a savings account, but even then it will grow at minuscule rates. Investing, on the other hand, allows you to buy assets at one price and then potentially sell them at a much higher price (or collect dividends), providing you with a solid rate of return.

Still not sure if investing is a smart choice? Compare the average savings rate of 0.06% to the average annual stock market return of 9.2% and you have your answer.

To help further explain the purpose of investing, let me give you a quick scenario.

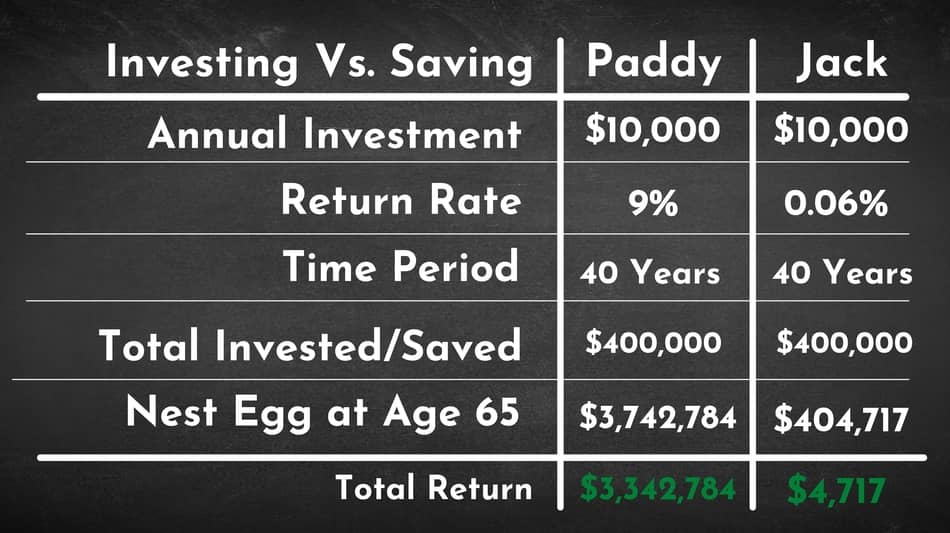

Let’s say Paddy and Jack are 25 years old. Both Paddy and Jack have great jobs and are financially responsible. They both make $100,000 a year and invest/save 10% of their income.

Paddy invests his money ($10,000 / year) for 40 years and retires at age 65. He averages a 9% return over those 40 years.

Jack decides to just save his $10,000 over those 40 years and also tries to retire at 65. His average savings rate was 0.06% for those 40 years.

How much do they each have at age 65?

- Paddy will have: $3,742,784

- Jack will have: $404,717

Isn’t that insane! Despite both Paddy and Jack contributing the same amount of money ($400,000) over a 40 year span, Paddy will end up with over 3.3 million dollars more than Jack. Poor, Jack.

Why? Because Paddy understands the main purpose of investing which is to help you grow your money.

Because of this knowledge, he took $400,000 and made himself a multi millionaire through investing in the stock market combined with compound interest.

What happened with Jack? He made just over $4,000 over those 40 years!

Check the numbers yourself using this compound interest calculator.

So while Jack is still working at age 72 wishing he invested his money, Paddy is down in Costa Rica drinking beer, enjoying retirement.

If that’s not enough to convince you to start investing, I don’t know what will!

Throughout the rest of this article I talk more about the main purpose of investing by discussing its advantages and disadvantages.

Benefits of Investing Money

Investing money has its ups and downs, just like any other personal finance decision you make. When you choose to invest your money, there is an opportunity cost that most people consider – in other words, what else could you be using this money for?

Here are three benefits of investing money.

1. You’ll Stay Ahead of Inflation

If you’ve paid any attention to prices in the last 6 months (2021), you’ve likely seen an incredible increase, right?

A gallon of milk that used to cost $2 now costs $2.50 and the gas you used to pay $2.50/gallon for is now up to $3.25/gallon. We’re feeling inflationary prices across the board right now and it’s honestly hard to keep up.

When you keep your money in savings or any other low interest investment, it’ll be hard to even really keep pace with inflation. With the inflationary rates were experiencing right now of 5.4%, no savings account will even come close to keeping up with this.

But, if you invest in more aggressive investments, such as stocks or real estate, your rate of return will likely outpace the rate of inflation which will make it easier for you to meet your basic needs.

2. Your Money Works for You

You work hard for your money so it just makes sense that your money should work hard for you. Investing puts your dollars to work, allowing them to grow without you doing anything except making the initial investment in whatever asset you decide to invest in.

If you’re investing for the long-term, making money work for you is the absolute best way to reach your goals. Take retirement, for example, with a decent return on your investment (anywhere from 8%-10%), you’ll have much more money available to you during your golden years than you would if just saved your money in a basic savings account.

Remember, don’t be like Jack, be more like Paddy! Be in Costa Rica drinking beer, not at Burger King cleaning tables.

3. You May Save on Taxes

A huge benefit of investing is the tax savings you can get when it’s done right. Short-term capital gains (earnings made in less than one year), are taxed at your ordinary tax rate. Long-term capital gains, on the other hand, are taxed at 0%, 15%, or 20% but can even be lower based on what type of account you invest in.

For example, as a Canadian, I can invest in registered investment accounts like RRSPs or TFSAs and get some great tax benefits on my investment income. Americans on the other hand have similar accounts in the form of a 401k or Roth IRA.

So make sure you take advantage of all these accounts!

For more information on the advantages of RRSPs and TFSAs check out my articles here.

Additionally, you may even be able to offset some of your capital gains with losses. It’s called tax loss harvesting and it’s an investment technique millions of investors use every year to lower their tax liabilities.

With all that said, always make sure you speak with a tax professional before making any big decisions as I am not a tax expert.

| Ready to Invest? | Our Recommendations | Start Investing Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Start Investing TodayRead our Review |

| BettermentOnly in USA

| Start Investing Today |

Downsides of Investing

Every financial decision you make has good sides and bad, so it’s important to understand and evaluate the ‘bad’ so you can decide if investing is right for you.

Here are three downsides of investing to consider.

1. You Could Lose Everything

When you invest, you take a risk. There’s never a guarantee of return unless you’re ‘investing’ in a savings account. But as I showed why in my example earlier, you don’t want to do that.

If you take a risk to get the higher rate of return, there’s always the chance you could lose it all. But, if you diversify your investments, AKA spread your money across different types of investments, you’ll lower your overall risk level.

2. You May Pay High Commissions or Fees

Most investments have an expense ratio, commission or both that you must pay. How much you pay and to who depends on where you buy your investments. If you work with a financial advisor, for example, you’ll likely pay higher commissions and fees than if you used an online discount broker.

But no matter the upfront commission cost, there’s almost always an expense ratio based on your average annual balance when you’re dealing with a financial advisor or some sort of money manager. These total fees can really eat away at your returns and reduce the overall profit to you.

To learn more about financial fees, check out this great 3-minute video of the famous Tony Robbins and his explanation of fees and why they really matter.

3. It Can be Time Consuming

If you handle your own investments, it can be very time consuming. Not only do you have to research what investments to make, but you also have to carefully monitor them so you know when to buy, when to hold and when to sell.

If you’re an emotional investor (sometimes guilty), you may find that you spend too much time ‘stalking’ the market and watching your investment gains or losses. You may even find that you bail out of the investment too early if it dips in fear of losing everything.

Not only can this be time consuming, but it can also drain every last bit of energy you have in your body.

The Opportunity Cost of Investing

Before you decide to invest, consider the opportunity cost. Think to yourself, if you don’t invest X amount of dollars, what would you do with that money instead?

Think about the answer and compare your options. Which option seems better from a long term perspective?

While I don’t speak for everyone, I personally think that everyone can afford to invest, but it’s just about prioritizing your spending.

What matters more, a new iPhone or your financial future?

Even if you don’t have a lot of money to invest, investing in small amounts as I talk about here is still worth it.

Final Thoughts

Investing helps your money grow faster than any other method available to you. If you start early, diversify your investments, spread out the risk, and invest in multiple assets, you’ll be just fine.

Consider it another way to build wealth and increase your net worth over time. While you work hard at your job, your money can work even harder for you.

As always, thanks for reading.

Geek, out.

![The Pros and Cons of an RRSP [5 of Each]](https://thefinancialgeek.com/wp-content/uploads/2021/02/Pros-and-Cons-of-an-RRSP-1.jpg)