Wealthsimple Taxes

Cons:

Nobody likes to file a tax return and see their entire refund (and then some) forked over to the tax preparer. On the same token, it is just as counterproductive to go cheap during tax season and live in fear of communication from the CRA due to an incorrect submission. We’re here to review the best tax softwares in Canada, both free and paid, for 2023.

Fortunately, innovative tax preparation software has made it possible for Canadian citizens to mitigate both of these concerns.

Gone are the days when filers of all income levels had to pay $250 or more to file their taxes, with most modern platforms offering free filing for all low-income filers and reasonably priced upgrades for those with more complex filing statuses.

However, the low cost does not come at the expense of quality, with the best software services offering audit protection, automatic error and inconsistency tracking, and ReFILE capabilities.

As with anything technology-related, competition in the tax software realm has gotten fierce over the last decade.

To help you sort through the contemporary landscape, keep reading our following breakdown of the 15 best tax software in Canada in 2023.

What Is the Best Tax Software in Canada?

1. Wealthsimple Tax

Wealthsimple Tax, formerly known as Simple Tax, comes from one of the most trusted financial names in the Canadian market. In addition to the plethora of investing and savings features offered through Wealthsimple, the platform now offers Canadian filers a simple, safe, and affordable way to file their taxes.

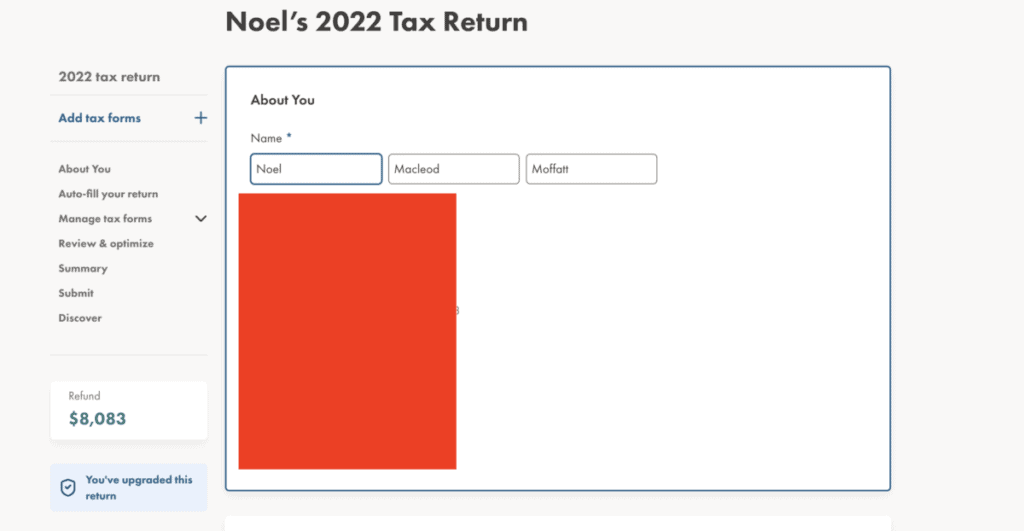

I actually just finished doing my taxes with Wealthsimple Tax for the thrid year in a row was once again a great experience – in fact, they helped me get a refund of nearly $8,000! See screenshots below for proof!

Key Features

- Step-by-step guidance – answering a series of simple questions helps users along the path toward filing the correct return.

- Cryptocurrency autofill – automatically populates your crypto gains and losses from over 300 different wallets.

Pros

- Outstanding flexibility to handle even complex tax situations.

- Intuitive interface that can help guide new users through online tax filing for the first time.

- Extremely convenient to import information for users who also have brokerage and other types of financial accounts with Wealthsimple.

Cons

- Customer support is not as robust as other platforms.

Pricing

Wealthsimple Tax is completely free. However, they do ask for donations so they can help keep the service running smoothly:

- The standard donation request is $19.

- Average filers will donate between $10 and $20.

Start Filing Your Taxes With Wealthsimple Tax Today

2. TurboTax

If name recognition is your top priority, TurboTax Canada takes the cake. With over 50 million people using their Intuit platform globally, TurboTax is among the world’s most trusted leaders in DIY finance. Offering both free and paid versions, TurboTax is sure to offer a package to meet your needs this coming tax season.

Key Features

- TurboTax Live – this allows the customer to share a screen for live chat with a tax professional. This is ideal for customers who like human interaction prior to filing.

- Intuitive Navigation – the software guides new users through a series of easy-to-follow questions. This funnels them down the right path and ensures that they file the correct return.

Pros

- 100% accuracy guarantee on all tax returns. This gives filers the confidence of knowing they are protected in the event of an audit.

- A maximum refund guarantee. The software will double-check for any and all tax breaks for its customers.

- The system can upload W-2 information directly from partner businesses, allowing customers to avoid manual input.

Cons

- Users pay for name recognition, as it is one of the most expensive tax software products in Canada.

- It is hard to understand how much it will cost for the service until you have gone through the entire filing process, which can take hours for more complex filings.

Pricing

TurboTax Canada offers three pricing tiers:

- Free – for simple tax returns only

- Deluxe (19.99) – maximum tax deductions and credits

- Premier ($34.99) – Investments and rental property

3. H&R Block

Another household name in the tax world, H&R Block is making a strong push to back its extensive network of physical branches with an elite online presence. It offers comprehensive support and a wide range of features to help all types of Canadian tax filers.

Key Features

- Elite Customer Support – a vast network of professional tax consultants backed by more than 900 in-person offices in Canada.

- Enhanced Free Filing – the free version of the software is better at picking up tax breaks than free versions on other platforms.

Pros

- Despite robust free filing features, immediate professional consultation can be added for under $20.

- Advanced accuracy checks to protect online filers against an audit.

Cons

- The self-help and DIY content on the platform is not as in-depth as its competitors.

- Still trying to identify core competencies between in-person and online services.

Pricing

There are three price tiers for H&R Block Canada:

- Free – available for all types of tax scenarios.

- Assistance (19.99) – additional support from a real-life tax professional.

- Protection ($44.99) – the highest level of support and protection.

4. StudioTax

One of the pioneers in online tax filing, StudioTax has been a major player in the Canadian tax game for over a decade. Though it is lauded for its streamlined platform, it is undoubtedly one of the top options for all types of filers, including self-employed and small businesses.

Key Features

- Device Compatibility – available for use on basically any type of device, including Windows, Mac, Android, and iOS.

- ReFILE – allows users to revise or amend a return that has already been submitted in the event they suspect a mistake.

Pros

- Available for download directly to your hard drive, offering more security than cloud-based applications.

- Has a French version of the software, which helps thousands of users in Quebec.

Cons

- Inferior customer support compared to TurboTax and H&R Block.

- May not be able to handle some unique tax situations.

- After years of being a completely free service, it recently switched to a fee model for most of Canada.

Pricing

- $15 per year licensing fee for up to 20 returns.

- Free for Yukon Territory, Northwest Territories, and Nunavut.

5. UFile Windows

UFile Windows is a software program available for download that is not connected to the internet. Perhaps not as well-known as its sister UFile Online product, it gives users peace of mind knowing that their sensitive tax data is not floating around on the internet.

Key Features

- Triple Guarantee – all submitted tax information is checked for accuracy, satisfaction, and the absolute best tax result.

- Local Storage – all information in the software is stored on your local hard drive, with nothing floating around on the cloud.

Pros

- Auto-fill features allow for convenience when importing tax documents to the software.

- Compatible with all types of tax returns, regardless of the complexity.

Cons

- No telephone support, and it can be difficult to get a timely response via email.

- Only compatible with Windows, excluding it as an option for Mac users.

Pricing

There are a couple of pricing options for UFile Windows:

- UFile 4 for Windows has a suggested retail price of $22.99

- UFile 12 for Windows has a suggested retail price of $34.99

6. UFile Online

Similar to its sister software UFile Windows, UFile Online offers convenience and some additional perks through the online version of its program. With over one million users and 20 years experience, UFile Online is a major player in the Canadian tax market.

Key Features

- UFile Premium – upgrade to receive priority chat, telephone, and email support.

- Free Start – begin importing your tax information immediately and only pay when you are ready to NETFILE.

Pros

- Can store and access past tax returns on the cloud for up to 9 years.

- Autofill allows user to automatically download information from most tax slips directly into the software

Cons

- The free version of the software is not adequate for Canadians with multiple streams of income.

- Some users report having to update their version of Windows to use the program.

Pricing

The pricing for UFile Online is a little more complex than other services:

- Free for individuals or families who make under $20,000

- $19.95 for the first family member or head of household

- An additional $13 for adding a spouse

- $7 for any other dependents added to the software

7. CloudTax

CloudTax is one of the most intuitive and easy-to-use tax software in Canada. Offering both free and paid versions, CloudTax has users answer a few simple questions to funnel them down the correct filing path toward the maximum possible refund.

Key Features

- Express NOA – the NOA (Notice of Assessment) is the summary of your tax situation, and CloudTax’s ExpressNOA offers streamlined feedback that is easy for users to understand.

- Mobile Support – one of the few free filing services in Canada that is supported by both Android and iOS apps.

Pros

- More support features in the free version of the software than in its competitors.

- Video tutorials that guide users through the filing process.

- Can file two tax returns on a single free account.

Cons

- Free filing is not available in Yukon, Northwest Territories, Nunavut, or Quebec.

- Cannot file for free if you are self-employed or receive a rental income.

Pricing

- CloudTax is Free for simple tax returns.

- CloudTax Plus costs $29.99 for premium support and more complex tax situations.

8. GenuTax

Although many tax services offer free versions of their software, GenuTax is one of the only completely free tax filing platforms in Canada. The program offers free updates every year to stay current with the latest tax laws. In addition, it also stores information from previous tax years, letting people who fall behind on their taxes file as far back as 2003.

Key Features

- Multiyear Filing – file tax returns from any year between 2003 and 2023.

- ReFILE – update and amend previously submitted returns.

Pros

- Completely free tax software, with no upper-income limits or soliciting toward paid upgrades.

- Can file for free with up to 20 returns, with no restrictions for self-employed, rental income, or other complex tax situations.

- Step-by-step guidance and autofill make filing as easy as possible.

Cons

- Cannot be used to file Quebec Provincial tax returns.

- Some users report that customer service is lacking.

Pricing

- GenuTax is completely free but does encourage patrons to donate to help support the costs of operations.

- Donations can be made via credit card, PayPal, or personal check.

9. AdvTax

If you are looking for no-frills tax software that can help keep your filing costs as low as possible, AdvTax may be the platform you seek. Certified by the Canadian government for NETFILE, many users report being able to complete their taxes in as little as 5 minutes using AdvTax.

Key Features

- Demo Videos – the platform offers mobile, single-person, and family demo videos to show filers exactly how to complete their return as expeditiously as possible.

- Mistake Correction – whenever users realize they have made a mistake or receive a re-assessment notice, the software makes it easy to go back, locate the error, and make the revision.

Pros

- Completely free for low-income filers, and free or low cost for most others.

- One of the only free software that is available for Quebec citizens.

- Can handle complex tax situations such as rental income or foreign revenue.

Cons

- The interface is very dated, text-heavy, and visually unappealing.

- Like most services with limited paid upgrades, customer support is lacking outside of tutorial videos and FAQs.

- It can be challenging to find out if or how much you will have to pay.

Pricing

The pricing for AdvTax is a bit difficult to understand:9

- Completely free for low-income filers.

- 50% of filers above the low-income threshold will pay a fee, selected at random.

- The platform is not clear on the exact amount of this fee, saying only that it is “small.”

10. TaxTron

In a world where nearly all business is conducted online via cloud software, TaxTron is truly unique in that it offers Canadian tax filers a wide range of product offerings. With both personal and professional versions of Windows download, Mac download, or web-based software, TaxTron provides a unique product for every possible tax scenario.

Key Features

- Computer Assist – once you enter some introductory information, the software begins walking you along the correct path for submitting the correct return to the CRA.

- Video Tutorials – watch in-depth videos for explanations of the specific TaxTron product you are using.

Pros

- The online version is available on any type of browser without the need to download locally.

- Robust customer support for all versions.

Cons

- Users will spend more on TaxTron than most other services.

- No audit support or NETFILE guarantees.

Pricing

TaxTron pricing will vary widely by version. The web-based versions will offer free trials before requiring a licensing fee:

- Individual – $12.99 for Windows and $19.99 for Mac

- Family – $24.99 for Windows and $39.99 for Mac

- Professional – $249.99 for Windows and $595 for Mac

11. EachTax

Another nuts-and-bolts tax software for Canadians is EachTax. Capable of handling both simple and complex tax situations, most users will be able to NETFILE their returns for free. Even if your tax status requires you to pay a fee, the amount is exceptionally low (likely no more than $6.99).

Key Features

- ENOA – this express notification of assessment keeps filers continually apprised of where their return stands with the CRA.

- Audit Assistance – better protection against audit than most free tax services.

Pros

- Compatible with both Windows and Mac.

- Can handle complex tax situations, including self-employment and rental income.

- ReFILE features for streamlined error correction.

Cons

- Interface appears a bit amateurish and is more text heavy than modern users will prefer.

- Can be difficult to get customer support outside of email.

Pricing

- Free for new customers (regardless of income), free for new immigrants (regardless of income), free for seniors over 70 (regardless of income), and free for anyone with an income of $25,000 or less.

- If you do not fall under one of these categories, it costs $6.99 to file your first return, with an additional $3.99 per return for more than one.

12. MyTaxExpress

MyTaxExpress is one of the most established names in the online tax filing game, servicing the Canadian market since 2002. While it may not look as fancy or have all of the bells and whistles of newer products, it has maintained a loyal following throughout the years and is the preferred choice of many filers familiar with its products.

Key Features

- E-Delivery – electronically sign and NETFILE your return to the CRA from any type of computer.

- ENOA – express notice of assessment helps filers know exactly where their return stands with the CRA.

Pros

- Supported by all provinces and territories other than Quebec.

- Can handle both simple and complex tax situations.

Cons

- Outdated, text-heavy interface.

- Can be difficult to understand how much you will have to pay.

- Downloading the software is the only option for individuals.

Pricing

- $6.99 for a one-return license.

- Multiple returns cost $13.99, for up to 10 returns.

- Various other fees and price scenarios can be found at MyTaxExpress.

13. Tax Chopper

Another one of the most established players in the online tax filing game, Tax Chopper, formerly known as Cute Tax Online until 2009, makes it simple for Canadians to file their taxes. With a long history of satisfied customers, the intuitive layout of Tax Chopper has allowed it to develop customer loyalty that newer platforms are trying to establish.

Key Features

- Integrated Family Return – file up to 15 returns on a single Tax Chopper account, regardless of complexity or income level.

- Cross-Province Transfer – Tax Chopper will apply applicable rules if the filers on your account live in different provinces.

Pros

- Exceptional customer support infrastructure.

- Customers love the simple, intuitive interface.

Cons

- A bit more expensive than other services if you don’t qualify for free NETFILE.

- Like most other services, it is not available for Quebec residents.

Pricing

- Free for new Canadian residents, students, and low-income filers.

- $9.98 for the first return.

- $15.98 for two returns.

- $19.98 for 3-5 returns.

- $25.98 for 6-15 returns.

14. FastNEasyTax

Noted for its fast and simple online tax filing, FastNEasyTax is an emerging name in the Canadian market. Mobile-compatible, it is an excellent option for younger, tech-savvy filers who need to get their taxes completed on the go.

Key Features

- Autofill – works directly with the CRA to populate as much of your return as possible to streamline filing.

- Free Support – professionals are available to answer all questions related to filing in 24 hours or less.

- Revenu Quebec Certified – one of the only options for Quebec filers to file online.

Pros

- Mobile compatibility makes it a great choice for first-time and on-the-go filers.

- Commitment to helping you receive your refund in less than 10 days.

- A favourite platform for users with limited tax knowledge.

Cons

- Fewer options for free filing than on other platforms (only if you make less than $20,000).

- Not as long of a history as other software on this list.

Pricing

FastNEasyTax notes that its plans are all-inclusive with no hidden charges or add-ons:

- Free for incomes under $20,000.

- $11.99 for individual returns.

- $17.99 for family returns.

15. TaxFreeway

Finally, TaxFreeway is another no-frills software that may appeal to DIY tax filers. With an ability to handle all types of tax situations, it has a leg up on other old-school programs that are much more limited in their reach.

Key Features

- Interview Module – guides users step-by-step through the tax return process.

- Integrated Spousal Return – automatically splits T3/T5 slips and stock/mutual fund transactions between spousal returns.

Pros

- Carry forward feature to save you time on subsequent returns.

- ReFile support to easily amend returns.

Cons

- Very dated interface.

- Must download the software, with no online options available.

Pricing

- Windows – $9.95 for up to 20 returns.

- Mac – $14.95 for up to 20 returns.

Conclusion

Online tax software has made filing fast, affordable, accurate, and safe for Canadian residents. With a bevy of products offering their own unique features, choose one of the 15 top products listed above for maximum satisfaction this coming tax season!

We hope this helps you when it comes time to file your taxes this year!

Geek, out.