If you are considering getting into the investing world, now is as good a time as any. Why? Because never in history has financial literacy and education been more accessible for investors of all ages and experience levels. Investing is not something you should just jump into. After all, there is always the threat of losing your hard-earned money in a poorly timed trade or investment.

Investing should be looked at as a skill that can be honed over time. You should never be satisfied with your financial literacy and continually work to improve it. It should come as no surprise that Warren Buffett has stated that he still spends more than 80% of his day reading financial materials. Trust me, if Buffett is still working on his financial literacy, you can too.

Even though financial literacy is easily accessible through investing forums or even YouTube, many people simply do not have the time to devote to it. As of 2022, more than 50 percent of Americans still live paycheck to paycheck and a vast majority have no money invested.

You can never be too old to begin your financial literacy journey. Read on, because I have some great ways to get it started!

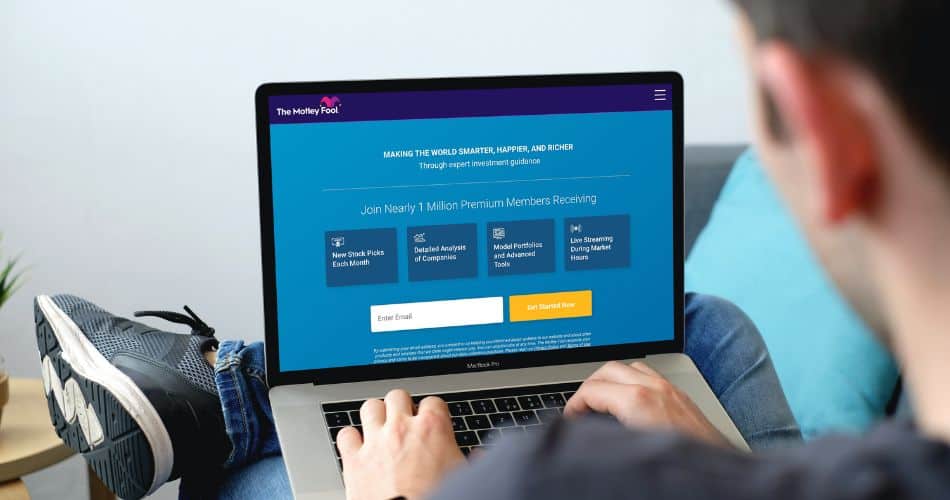

The Motley Fool

Stock Advisor Canada

- Stock Recommendations

- Stock Reports

- Best Buys Now

- Investment Articles

- Online Community

- Money Back Guarantee

What is Financial Literacy?

As I mentioned, financial literacy is all around us. Decades ago, investors didn’t have the advantage of having Google or Reddit to answer their questions. So that begs the question I am sure you are asking: what exactly is financial literacy? Many people erroneously think that financial literacy is complicated and difficult to understand.

In reality, financial literacy is defined as the knowledge and understanding of personal financial management. This can be anything from investing to budgeting to planning for retirement. Knowing that there are tools and assets available at your disposal to passively grow your wealth over time is a valuable life skill.

Unfortunately, financial literacy is not something that is taught enough to people in America. Financial education is rarely taught in schools so there is little opportunity for children to begin investing at a young age. Anyone who has started to invest in their 30s or 40s immediately regrets not doing so in their younger years. It is amazing how much ten extra years of compound growth can mean to your wealth.

How Do I Invest in my Financial Literacy

This is a question I often get asked by readers. Luckily for you, I’ll offer a couple of my favourite ways to invest in your financial literacy.

The internet is an incredibly valuable tool. Financial literacy is all around us if you take the time to look for it. My favourite site that I have personally used to invest in my financial literacy? The Motley Fool.

I am sure that many of you have heard of the Motley Fool. It is one of the premier brands in the financial education industry and provides daily articles, podcasts, and videos for free! You can easily get the latest information and news from the Motley Fool on a daily basis and I’ll go out on a limb and wager that many of us, myself included, read their articles each day.

The best part about the Motley Fool is they have investment services for all types of investors. If you are just looking for market information they have an incredible amount of free content. But if you want to take it one step further, Motley Fool has plenty of premium services as well. From the legendary Stock Advisor services to the market-crushing Rule Breakers service, The Motley Fool has a nearly 30-year track record for building winning stock portfolios!

How Can Investing Play a Part in Financial Literacy

So how can investing play a part in your financial literacy? As many of you know, investing is one of the best ways to grow your wealth over the long term. This does not mean you need to actively trade stocks to make gains. This can be as simple as owning a portfolio of passive ETFs.

Look, 2022 was an incredibly difficult year for many of us. Inflation is sky-high in our economy and the value of your money sitting in a bank account is decreasing by the day. This is where investing your money can not only protect you against inflation but also begin the slow but steady process of compound growth.

Compound growth is a beautiful concept that can take your little molehill of investment and turn it into a mountain by the time you retire.

Learning the basic fundamentals of investing is like planting seeds to grow a forest. Not only can it help you but it can provide wealth for your family for generations to come.

So my suggestion? Start dedicating small amounts of time to learning about your financial management. Instead of scrolling through social media, bring up a couple of Motley Fool articles or throw on their podcast on your commute to work.

The Bottom Line: Investing in Your Financial Literacy

Financial literacy resources are so easily accessible these days that you have no excuse to not use them. I named the Motley Fool as one of my favourite places to continue to develop my financial education. No matter what I am doing there is a form of Motley Fool financial content that I can absorb.

There are hundreds, if not thousands of other places online to get financial literacy. The only thing you need is the dedication of your own time and effort. I like The Motley Fool because it does not overcomplicate things and it makes investing easy to understand.

Why do I continue to enhance my own financial literacy after all of these years? Because I truly believe that an investment in your financial literacy is an investment in your future wealth.

Geek, out.

The Motley Fool

Stock Advisor Canada

- Stock Recommendations

- Stock Reports

- Best Buys Now

- Investment Articles

- Online Community

- Money Back Guarantee