When getting started in the world of personal finance, people often confuse the acts of budgeting and saving.

While these two things work together to strengthen one’s financial responsibility, there are major differences between the two. Let’s set the record straight about what’s what and get you started with budgeting and saving so that you can make smarter financial decisions for you and your family.

Making a budget is simply the act of planning where your money will go. While it doesn’t have to be an exact science, there are common categories that you can split expenses into such as housing, transportation, and food. Your savings on the other hand is simply the cash you set aside after all your expenses have been paid for.

To learn more about how you can get started with managing your budget and a savings plan, read on as we’ll break down some common strategies with well-known pointers.

| Time to Start Saving? | Our Recommendations | Start Saving Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Sign Up HereRead our Review |

| BettermentOnly in USA

| Sign up Here |

Getting Started With a Budget and Savings Plan

So budgeting and saving are two different things, but it’s obvious that the two things coincide as you can’t begin to save money if your budget is out of control. Let’s break down budgeting and saving separately so that you can get a better understanding of the two.

What is Budgeting?

Budgeting is an important concept to understand, considering individuals, businesses, and government organizations all need to budget. You should view a budget as a financial plan of how to spend money over a certain period of time.

Budgets directly rely on how much income or allotted capital is in question. On an individual level, budgets should also factor in the age and lifestyle of that individual.

Some common budgeting categories that people group expenses in are as follows:

- Housing

- Transportation

- Food

- Utilities

- Insurance

- Medical

- Savings

- Investing

- Debt Repayment

- Personal Spending

- Subscriptions

While there are some outliers, these simple categories should be enough for someone to get started with creating a budget. However, budgeting categories and plans will be largely different for corporations and government agencies.

Below is the budget I’ve created for myself and I have had for years. As you’ll be able to see, it’s nothing fancy and I manage it in Google Sheet so it’s completely free.

Related Financial Geek Article: 8 Really Smart Budgeting Tips

Savings

Now let’s talk about savings. When someone creates a budget, there should always be a category for savings.

Your savings should be worked into your budget and treated like any other “expense”. Even though it’s not an expense, you’ll want to treat it like one.

Why? Because many people have tried and failed to “spend what’s left over at the end of the month” but that strategy flat out just doesn’t work.

You need to put away money off the top of your budget as I do in mine above and then work with what you have left over for your every day expenses.

While I’m not going to go in depth on investing in this article – we want to at least mention it. Similar to how savings are directly tied to a budget, investing is directly tied to savings. As you can see in my budget, I have budgeting items for my investments (RRSP, TFSA, Questrade, Real Estate and Business Investments).

Related Financial Geek Article: 18 (Uncomplicated) Smart Money Moves for Your 20s.

Investing is a great way to grow your savings, although to do so you are accepting a level of risk depending on the investment in question.

There are a number of different ways to save your money but the right approach is typically a combination of different types of savings and investing vehicles.

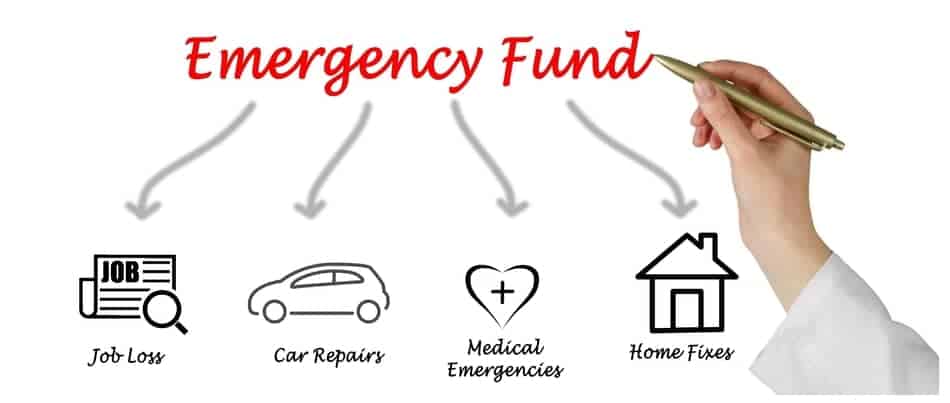

Even for young adults, an emergency fund is one of the most important things to establish. Life is uncertain, and an emergency fund will ensure that you have a financial cushion to assist you in any emergency or unexpected expense.

In addition to an emergency fund, a retirement plan is also a must. If you work for an employer with retirement plan benefits, make sure you get all the relevant information from them and set up a recurring contribution. Some employers even offer a 401(k) or RRSP (in Canada) contribution match, making this saving method superior.

While they have lost the popularity that they once had, it’s still worth bringing up CDs. A CD is a certificate of deposit, payable to its owner at the end of an agreed upon period. Over that period, the CD will accrue interest, meaning the amount of money will slowly grow over that defined period.

With that said, CDs have declined in popularity, because they are reliant on interest rates. Since interest rates on CDs are historically low, many people just invest in vehicles like stocks instead.

Last but certainly not least, there are also regular old savings accounts. You should try to have a savings account separate from your retirement plan, any investment accounts, and your emergency fund.

Common Budgeting and Saving Strategies

Here are some of the more popular methods of budgeting and saving to help get you started. You will most likely find that your ideal strategy is a combination of the following things, and that’s totally fine.

The 50-30-20 Rule

Known as one of the most common budgeting rules, the 50-30-20 rule does exactly what its name suggests.

50% of income goes towards needs, 30% towards wants, and the last 20% goes towards your financial goals. The budgeting rule has become so common because it’s easy to remember and it simply works.

If the 50-30-20 rule doesn’t fit your lifestyle, or you don’t like categorizing your expenses, you can also explore the 80-20 rule. This budgeting rule takes a more simplistic approach, where 80% goes towards whatever you need to spend on, and 20% goes to your savings.

I personally prefer this 80/20 approach, but it’s really up to you! But you do need a budget one way or the other!

Round Up Apps

Round up saving has become a very popular way to save money over the last few years because of how truly passive it is. You simply link your debit or credit cards to your app and then all your purchases will round up to the nearest dollar. And then, that difference will be automatically saved or invested for you.

Some well known round up apps include Acorns, Chime or Wealthsimple Invest.

Acorns has come under fire as a lesser way to save money lately because the app’s fees can provide a demising return over time.

Chime does not charge those fees but you do need to have a bank account and debit card with Chime in order to use their round up feature.

Wealthsimple Invest on the other hand doesn’t charge anything for their round up feature but they do charge a .5% management fee on your overall portfolio.

Related Financial Geek Article: 9 Reasons Why Wealthsimple is Good for Beginners

Use Tech to Assist With Your Daily Finances

Technology has made budgeting easier than it used to be, as we now have a number of different tools we can use to budget and save. One of the most widely used options is spreadsheets, as you can easily input the information you need and take advantage of different mathematical functions to assist you in your budget.

As someone who is some what experienced with budgets and has tried many different forms of budgeting, I still use a spreadsheet (as I showed earlier) for my budgeting purposes. It’s easy, convenient and of course, it’s free!

In recent years, we’ve also witnessed the rise of online banking and smartphone apps that help with daily finances. Online banking makes it more convenient to keep track of your income and expenses.

And then we have budgeting apps.

With budgeting apps, you simply link your credit and debit cards to the app will then the app will keep track of everything for you. This allows you to keep an eye on spending and bills and create a budget that works for you. Spending will automatically be categorized based on the budget that you set up, making it a breeze to keep track of everything.

I also use a budgeting app called Mint which I love as well. While I do like to keep my actual budget in a spreadsheet, I like the Mint budgeting app because it reminds me when bills are due and it actually tracks my net worth in real time as well!

Check out my article Top 7 Reasons Why You Should Use the Mint Budgeting App for more information on why I use Mint and why you should too.

Use a Budgeting Worksheet

If you prefer the old fashioned way of doing things, using a simple budgeting worksheet might be for you. Websites like Etsy have a wide variety of printable PDF files that you can purchase, including many options for budgeting worksheets.

At the end of the day, this method is very similar to what someone would end up doing with a spreadsheet. However, those who sell these premade sheets often put some thought into the overall design and layout of things, and that is important to some people as well.

The Bottom Line

So that’s it on the basics of budgeting and savings!

We hope now that you have a better understanding of what the two things are, and how they work together to ensure financial responsibility. Take action by using one of the outlined strategies in this article, and make sure to explore some of the online tools and resources that you have available to you.

As always, thanks for reading!

Geek, out.

| Time to Start Saving? | Our Recommendations | Start Saving Today |

|---|---|---|

| Wealthsimple Invest ($25 Bonus)Only in Canada

| Sign Up HereRead our Review |

| BettermentOnly in USA

| Sign up Here |