Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

If you are reading this article, there is a decent chance you’ve at least heard of an RRSP before.

But like many Canadians, you might not know the advantages and disadvantages that are associated with the RRSP.

And that’s where we come in. The purpose of this article is to give you five pros and cons of an RRSP.

We will start by going through a brief overview of the RRSP and then will jump right into the pros and cons.

If you just want to know the pros and cons in bullet form, below is a table of each point that will discuss in detail throughout this article.

| Pros | Cons |

|---|---|

| 1. RRSP Investments Grow Tax-Free | 1. RRSP Withdrawals are Heavily Taxed |

| 2 .RRSP Contributions Reduce Your Taxable Income | 2. RRSP Withdrawals Are Not Added Back to Contribution Room |

| 3. No Withholding Tax on US Dividends within a RRSP | 3. RRSP Contribution Limit is Based on Your Income |

| 4. You Can Withdraw Money From Your RRSP To Fund Your First Downpayment | 4. You Must Close Up Your RRSP By Age 71 |

| 5. RRSPs are Protected From Creditors | 5. RRSP Withdrawals Can Impact Federal Benefits |

RRSPs really are great investment vehicles for new investors who are looking to get started with their retirement plan. And trust me, the earlier you start the better, even if you only put a small amount away each month.

When your at this beginner stage though, most people (myself included back in 2016) don’t know where to get started, and this is why I always recommend Wealthsimple Invest. Not only is Wealthsimple a Canadian company, but the sign up process is all online, it’s completely free and it only takes a few minutes (literally). Plus, you’ll get a $50 cash bonus with your sign-up. Not bad, hey?

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

Okay, let’s get down to business and dive into each point a little more.

What is an RRSP?

In short, an RRSP is a special type of savings account that is registered by the Canadian Government.

Primarily used by Canadians for retirement savings, an RRSP can hold investments such as stocks, bonds, mutual funds and ETFs, just to name a few.

The reason why an RRSP is what I referred to as “special” is due to the tax-advantages you receive when making investments within your account, which will talk about more shortly.

Similar to the TFSA, RRSPs are not investments themselves. Their special investment accounts that you can hold your investments within.

Do you see the difference here? A stock is an investment where an RRSP is more like a vehicle to hold that investment. A pretty great vehicle I might add.

Pros to Investing in an RRSP

1. RRSP Investments Grow Tax-Free

The first and most important pro of investing into an RRSP is that your investment will grow in a tax free manner.

Now, you will have to pay taxes on this money when you make withdrawals, but until then, your money will grow and compound tax- free.

If you were investing in a normal investment account, typically you’d be required to pay taxes on any investment you earned.

For example if you invested in a stock that cost you $100, and then in three years time you sold that stock for $400, then you’d normally have to pay taxes on that $300 capital gain. But not within an RRSP, remember it grows tax free.

The same can be said for dividends, if you invest in a dividend paying stock like Apple within a normal investment account, you can bank on the fact you’ll be getting taxed on those dividends – the same principle applies for interest income as well.

Side Note: If you are someone who is worried about how you’ll manage your taxes with your RRSP investments, check out my article on the best Canadian tax softwares that I wrote on my personal blog noelmoffatt.com

How does this help us you might ask? Well, by paying no taxes on our investment income, our money is able to grow and compound much faster than it would within a normal investment account as the tax man can’t come in and take a portion of our investment income.

It’s also important to note that this tax free growth only applies as long as you don’t withdraw your money from your account. Will talk more about this later, but as an RRSP is meant to be used for retirement purposes, early withdrawals can cost you a lot in taxes.

So long story long, one of the main upsides to investing in an RRSP is the tax-free growth your money will experience within your account. This should be enough incentive to get you started!

If you haven’t already opened up an RRSP, I’d recommend getting started with Wealthsimple.

If your not quite ready to sign up but you’d like to at least learn more about Wealthsimple’s benefits and the sign up process, I’d recommend checking my article on the 10 benefits of opening an RRSP with Wealthsimple along with a step-by-step guide (screenshots included) on how to setup an account.

2. RRSP Contributions Reduce Your Taxable Income

Another pro to investing money within an RRSP is that your contributions are tax-deductible.

In other words, you can lower your taxable income every year by the amount you contributed to your RRSP.

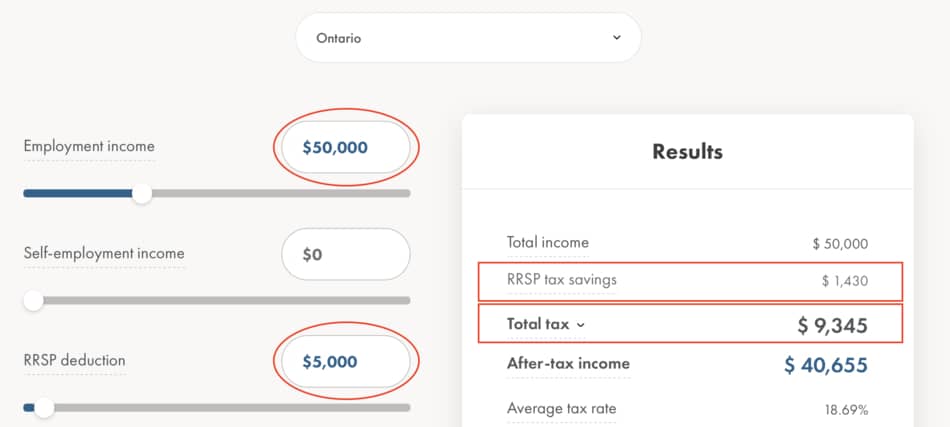

For example, if you make $50,000 next year and you contribute $5,000 to your RRSP, well your taxable income will only be $45,000.

And why is this great? Because you’ll pay less in taxes!

For example, let’s say you live in Toronto and you do in fact make $50,000 a year and you contribute $5,000 to your RRSP. You’ll end up paying $1,430 less in taxes than you would have if you never made any contributions. (Wealthsimple Income Tax Calculator Tool)

Unless stated otherwise by you, your employer will automatically take out taxes from your paycheque based on your $50,000 salary, which means you’re in for a nice tax refund come tax season!

So not only will investing in an RRSP benefit us in the long term, but the CRA also does a great job of incentivizing us in the short term as well.

If you’re like me, you look forward to those tax refunds every year. It’s like you get paid for being financially responsible, who would have thought!

3. No Withholding Tax on US Dividends within a RRSP

An additional pro of investing in your RRSP is that dividends generated from US companies won’t be subject to withholding taxes – thanks to a tax-treaty between the US and Canadian government.

TFSAs don’t even get this kind of treatment! Yup, you read that right.

Even though TFSAs are pretty freaking great, dividends generated within your TFSA from American based companies, such as Apple, will be subject to a 15% withholding tax.

Not with the RRSP though.

Okay let’s look at a quick example. Over the course of the year you and I both earned $100 in dividends from our investment in Apple.

The only difference is you held your Apple investments within an RRSP and I held mine within my TFSA.

Despite both “earning” $100 in dividend income, you’ll end up with $15 more than me as my $100 dividend earnings will be slashed by a 15% withholding tax while yours won’t.

Why? Because you held your investments within a RRSP which is exempt from this withholding tax.

Now this isn’t a main reason why you’d choose to invest in an RRSP over a TFSA, but it is definitely an added benefit.

For more information on this withholding tax matter, here is a full article I wrote on how and why dividends aren’t taxed within an RRSP.

4. You Can Withdraw Money From Your RRSP To Fund Your First Downpayment

Another added benefit of the RRSP is that you can actually withdraw a certain amount from your account tax free to fund a down-payment on your first house.

Thanks to a program called the RRSP Home Buyers’ Plan, the CRA allows you to withdraw up to $35,000 from your RRSP to be put towards a downpayment.

What’s great about this program is that your withdrawal is tax-free. You won’t be required to pay any withholding tax and your added withdrawal will not count towards your taxable income.

So in a way, your RRSP is actually a great account to save up for a downpayment as your investments will grow tax-free which will (hopefully) help you reach your goals quicker.

With all that being said, there are some downsides to the RRSP Home Buyers Plan (strict repayment rules) that should be carefully considered as well.

While I won’t go into them in detail here, this article talks about four disadvantages associated with the RRSP Home Buyers’ Plan. Hey! I just want to be unbiased here! I’m not on anyone’s side.

While this Home Buyers’ Plan is not the main reason why most people start investing in their RRSP, it can be used as a great added resource for someone looking to buy their first home.

Food for thought! Let’s move on.

5. RRSPs are Protected From Creditors

Another upside of investing money in your RRSP is that in the event of you going bankrupt, your RRSP will actually be fully protected from creditors.

Now hopefully things never get this bad! And if you’re financially responsible enough to be investing in your RRSP, chances of bankruptcy are probably pretty slim. But hey – things happen, you really just never know.

So while creditors can come after your TFSA funds, your RRSP will be fully protected. I personally love this law, it makes your RRSP feel like the ultimate bunker for your money.

It doesn’t matter how bad things get, your RRSP will be nicely hidden away from any and all creditors.

With that said, I should mention that there is a 12-month claw back period. So any money you deposit between the time you go bankrupt and the previous 12 months will not be protected from creditors.

But overall, this is a big reason why you should invest in your RRSP for retirement. Of course no one ever plans to go bankrupt, but if life slaps you in the face and this is your reality, you’ll want to make sure your retirement fund is protected.

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

Disadvantages of Investing in an RRSP

1. RRSP Withdrawals are Heavily Taxed

One of the biggest cons of investing in your RRSP is that any withdrawals you make prior to retirement will be heavily taxed.

And I mean heavily!

If you decide to withdraw some cash from your RRSP, you’ll automatically be slapped with a withholding tax. The percentage of this withholding tax is dependent on how much you withdraw, but any way you look at it, it’s not pretty.

| Withholding Rate (%) | Amounts ($) |

|---|---|

| 10% (5% Quebec) | $0 – $5,000 |

| 20% (10% Quebec) | $5,001 – $15,000 |

| 30% (15% Quebec) | $15,001 + |

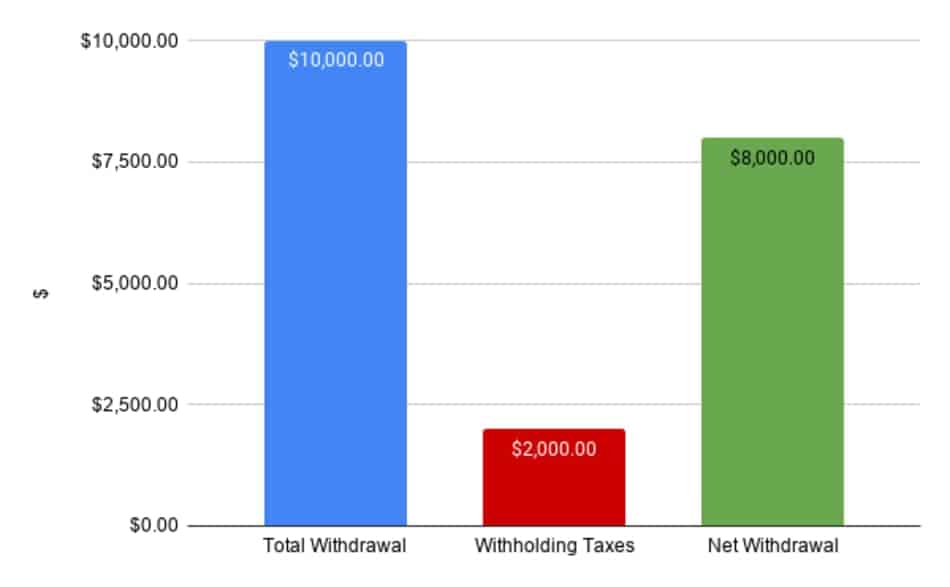

For example, let’s say you decide to withdraw $10,000 from your RRSP at age 30 to fund a dream vacation you’ve always wanted to go on.

Well right off the bat, that $10,000 amount will be reduced to $8,000 (20% withholding tax).

But not only that, you still may have to pay even more taxes if your withholding amount doesn’t account for the taxes you owe (based on your tax bracket).

So if you made $50,000 a year in salary, you’ll actually be taxed at a $60,000 a year income level, which again will result in you paying more in taxes.

And then, if that $10,000 increase in taxable income results in you having to pay more than an additional $2,000 in income tax, then yep, you’ll get taxed even more.

All this to say, withdrawing money from your RRSP is not a tax friendly transaction, and unless the money is being used for further education or to fund your first down-payment, it is highly inadvisable.

Long story long, the CRA always get’s their slice of the pie.

But looking at it another way, having these heavy tax burdens on withdrawals can actually benefit you as I talk about in my Top 9 Reasons to invest in an RRSP.

How? Because it incentivizes you to keep your retirement fund in your RRSP which is exactly where it belongs.

If there was no downside to making withdrawals then we’d be withdrawing and spending this money all the time. I know I would, it’s just human nature.

2. RRSP Withdrawals Are Not Added Back to Contribution Room

A second downside to withdrawing money from your RRSP is that the amount you withdraw will not be added back onto your contribution room in the following year.

So once you make the withdrawal, that contribution room is gone forever.

With a TFSA though, withdrawals are automatically added back onto your TFSA contribution room in the following year.

For example, if you withdraw $5,000 from your TFSA in the current year, that $5,000 amount will be added back onto your contribution room in the following year. But if you withdraw $5,000 from your RRSP in the current year, that withdrawal will have zero impact on your contribution room for the following year.

I would never recommend withdrawing money from your RRSP in any case, but this just adds insult to injury.

3. RRSP Contribution Limit is Based on Your Income

Another con of the RRSP is that your contribution limit is based on your income level.

In short, your RRSP contribution limit is 18% of your earned income reported on your previous years tax return up to a maximum amount ($27,830 for 2021)

Additionally, if you have a company pension plan, this contribution limit will be reduced by the pension adjustment amount.

With all that said, I think having your contribution limit determined by your income level is a disadvantage towards lower income earners.

For example, is it fair that someone making $100,000 a year is able to contribute 100% more than someone making $50,000 a year?

Why should higher income earners be able to benefit more from RRSP than lower income earners? I realize it’s all based on percentages, but still.

The TFSA doesn’t care about how much money you make. Regardless of your income level, everyone is given the same amount of extra TFSA contribution room every year.

So if you are a low income earner, having your contribution limit be based on your income level would certainly be a disadvantage.

4. You Must Close Up Your RRSP By Age 71

Another downside of the RRSP is that, unlike your TFSA, it has an expiration date.

As they say, all good things must come to an end, and an RRSP is no different. By December 31st of the year you turn 71, you must close out your RRSP.

Now just because you have to close out your RRSP by a certain age, this doesn’t mean you shouldn’t bother with one.

It just means that you’ll need to plan for life after your RRSP, and unlike a TFSA, the tax benefits of an RRSP don’t last forever.

Options for Closing Out an RRSP

- Cash out your RRSP as a lump sum

- Convert your RRSP into an RRIF

- Purchase an annuity

I won’t go into detail in this article on each of these options, but check out my article Does an RRSP Have To Be Converted to an RRIF for more information on these alternatives.

5. RRSP Withdrawals Can Impact Federal Benefits

One more con of the RRSP is that withdrawals could negatively affect some federal benefits you may be receiving – for example OAS or GIS.

Unlike in your TFSA, where your withdrawals won’t be added onto your taxable income, it makes no difference, but with an RRSP, as mentioned above – your withdrawals are included onto your income tax report and therefore could result in clawbacks.

Again, this isn’t a reason why you shouldn’t invest in your RRSP, but if you plan on investing your money in an account in which you wish to make withdrawals from, the RRSP probably isn’t the account to do it in.

So just keep this in mind when making your investment decisions.

Conclusion

To conclude, the pros of investing in an RRSP far outweigh the cons.

The main downside of investing money in your RRSP is that getting it out before retirement will prove very costly. (LLP or HBP excluded)

But hey, you don’t want to be able to take your money out of your account anyway. As I mentioned earlier in the article, your retirement savings should be used for..well retirement!

If it was too easy to withdraw we’d just YOLO it and not have a dime left when it came time to retire.

Consider any money you contribute to your RRSP as good as gone until you retire. Remember, your RRSP is like a bunker for your money. If the creditors can’t get at it, neither should you.

So if you’re reading this article wondering whether or not you should open up an RRSP, my direct answer is yes.

Open Up an RRSP With Wealthsimple Today ($25 Cash Bonus)

If you already have it open, great, keep it open and continue to contribute to it.

If you don’t have one open, get one started today. If you’re wondering where and how to open one up, check out my post here on 10 reasons why I recommend Wealthsimple which is followed by a step-by-step guide on how to open an account.

It talks all about why I use them for my RRSP investments and goes on to explain how to get set up with them. It’s a very helpful resource if I do say so myself!

And that’s it for me! As always, I really hope this article provided you with some value and clarity on the pros and cons of investing in an RRSP.

Geek, out.

![Why Does the Stock Market Close? [Quick Answer]](https://thefinancialgeek.com/wp-content/uploads/2022/05/Why-Does-the-Stock-Market-Close-2.jpg)