Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

While many Canadians have at least heard the term “RRSP” before, many of them have no idea what they are or what they do.

And that’s okay! Because the purpose of this article is to briefly explain what an RRSP is and to go into detail on why you should invest in one.

| 9 Benefits of Investing in an RRSP |

|---|

| 1. Contributions are Tax Deductible |

| 2. Tax-Free Investment Growth |

| 3. Early Withdrawal Has Consequences |

| 4. Tax Friendly Conversion Options Upon Retirement |

| 5. To Help Fund Your Partner’s Retirement (Spousal RRSP) |

| 6. To Fund Your First Down-Payment (Home Buyers’ Plan) |

| 7. Flexible Investment Options |

| 8. To Fund Future Education (Lifelong Learning Plan) |

| 9. For Financial Peace of Mind |

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

What is an RRSP?

An RRSP (Registered Retirement Savings Plan) is a savings account registered by the Canadian government to help Canadians save for retirement.

In other words, it’s a special type of savings account specifically made to help Canadians save for retirement.

Unlike a normal savings account though, RRSPs allow you to invest in securities such as stocks, bonds and index funds (to name a few) within the account itself.

So don’t think of an RRSP as an investment in it of itself, picture it like a bucket that holds your retirement investments within it.

Now you might be wondering, why wouldn’t I just open a normal investment account then?

Great question!

It’s because RRSPs come with many special benefits and advantages that aren’t offered in normal savings or investment accounts.

To learn more about the basics of an RRSP, check out our article What is an RRSP?

But for now, let’s get into this article.

9 Benefits of Investing in an RRSP

1. Contributions are Tax Deductible

One of the main advantages of investing in an RRSP is the instant tax benefits you’ll receive.

I think part of the reason people aren’t excited about putting money away in their RRSP is because they can’t see the short term benefit of it.

Who wants to sacrifice something now for something that won’t benefit us for 30 or 40 years! We all want instant satisfaction – it’s just human nature.

And I totally understand that, but luckily, investing in your RRSP will actually benefit you financially in the same year you make your contributions.

You see, RRSP contributions are tax deductible. So if your taxable income is $50,000 and you contribute $5,000 to your RRSP, you’ll actually only have to pay income tax on $45,000 and not your entire $50,000 income.

For example, let say Danny and Geoff both make $50,000 a year and they both live in Toronto, Canada.

Danny contributes $5,000 to his RRSP but Geoff doesn’t, he’ll “worry about retirement later”.

Let’s look at Geoff’s tax situation first. As you can see from the screenshot below, on a $50,000 salary with no RRSP deductions, Geoff paid $10,775 in taxes. This makes his after-tax income $39,225.

Danny on the other hand, being the financially responsible guy he is, contributed $5,000 to his RRSP and because of that, was able to deduct those contributions from his income.

As shown in the screenshot below, Danny only had to pay $9,345 in taxes which means his RRSP tax savings were $1,430. Leaving him with an after tax income of $40,655.

These screenshots are from Wealthsimple’s Canadian Income Tax Calculator.

If their employer took taxes out of their paychecks equally (most likely situation), then both Danny and Geoff would pay the same amount in taxes during the year, but Danny would get a $1,430 tax rebate come tax season, Geoff wouldn’t.

So not only is Danny setting himself up nicely for retirement, but he’s also paying less in taxes than Geoff.

Win-win situation really.

To learn more about how these deductions work, here is an article I wrote called Do RRSP Contributions Reduce Taxable Income?

This RRSP benefit was enough to win me over, but if you’re still not sold, keep reading.

2. Tax-Free Investment Growth

Another great advantage of investing in your RRSP is that your investment gains will grow tax free.

Unlike a TFSA though, you’ll eventually have to pay taxes when you withdraw your money, but your marginal tax bracket will likely be lower in retirement than it is during your working years.

If you’re unfamiliar with investment income, they basically come in three forms – interest, dividends and capital gains.

And like any type of income, investment income is usually taxed. However, if your investments grow inside your RRSP, this growth won’t be taxed as long as you don’t make any withdrawals.

Let’s look at another example using our friends Danny and Geoff, we’ll keep this example pretty simple.

Danny invests $10,000 in his RRSP and earns $3,000 in investment income during the year.

Geoff also invests $10,000, but he invests within a standard investment account and not an RRSP, Geoff also earns $3,000 in investment income during the year.

Come tax season, Danny will not have to pay any tax on his $3,000 investment income, Geoff will.

Poor Geoff! But at least he’s investing this time around, it’s a start!

As mentioned earlier, the three types of investment income are interest, dividends and capital gains. For more information on dividends within an RRSP, check out the article.

If you know anything about taxes, you know it’s one of the absolute guarantees in life, so whenever the Canadian government gives you some sort of tax-benefit, take advantage!

Open up a RRSP with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- RRSP contributions are tax deductible

- Very simple sign-up process

- No account minimum

- Account creation is 100% free

- Modern user interface

3. Early Withdrawal Has Consequences

If you thought you read this wrong, you never. Believe it or not, the consequences associated with withdrawing money early from your RRSP will actually serve as a benefit you.

You see, withdrawing money early from your RRSP (before you retire) has some pretty significant downsides.

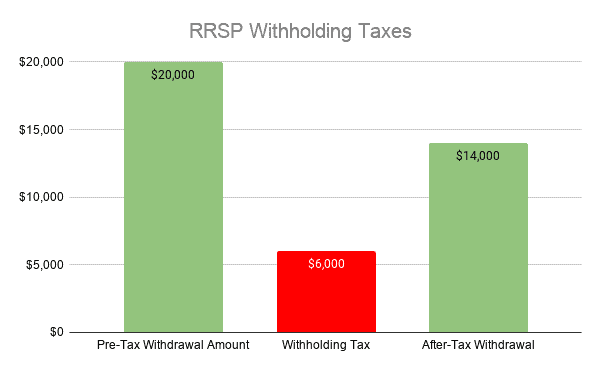

One being that right of that bat, you’ll have to pay a withholding tax fee.

- If you withdraw between $0-$5,000, you’ll pay a 10% withholding tax rate.

- If you withdraw between $5,001-$15,000, you’ll pay a 20% withholding tax rate.

- If you withdraw $15,001 or more, you’ll pay a 30% withholding tax rate.

|Same taxes don’t apply to Quebec Residents|

Let’s say Geoff had $30,000 in his RRSP (How? Who knows, just go with it), but he decided to withdraw $20,000 of it, well before this money even hits his account, Geoff will end up paying $6,000 in withholding tax and will only be left with $14,000 of the original $20,000 withdrawal.

Geoff is getting crushed.

But the taxes keep coming, not only will Geoff have to pay this withholding tax, the amount withdrawn will also be added to his taxable income and therefore it’ll be taxed again.

There’s also a good chance your RRSP issuer (whoever you set your RRSP up with) will charge you an early withdrawal fee – but that’ll be the least of your concerns at that point.

On top of all this, before you can actually get cash out of RRSP, your securities will need to be converted to cash and then deposited into your account, so this process alone will take a few days.

Should I go on? Okay sure – you’ll also drastically slow down your compound interest snowball and your contribution room will be forever gone.

To conclude, withdrawing money from your RRSP is an absolute gongshow of a process, not to mention the long term consequences associated with it.

All this to say, these drawbacks are actually great benefits for why you should invest in your RRSP.

By having all these roadblocks associated with withdrawing money from your retirement fund, you’ll be much less likely to do so – which is good! You never want to take money out of a fund that is being used for retirement.

If you’re like me, withdrawing money from your RRSP early won’t even cross your mind even in dire circumstances.

It’s basically untouchable. Not only do I not want to get taxed aggressively, but I also understand the loss of potential growth in my RRSP from making a withdrawal would cost me BIG TIME.

Despite all that, there are actually two main exceptions for when you can withdraw money from your RRSP and not get penalized for it, the First Time Home Buyers’ Plan and the Lifelong Learning Plan, will talk more about those later.

Open Up an RRSP With Wealthsimple Today ($25 Cash Bonus)

4. Tax Friendly Conversion Options Upon Retirement

Another benefit of investing in an RRSP is the tax friendly conversion options that are available when you decide to close it out.

Convert it to an RRIF

One of the most popular options available to those looking to close out their RRSP is to convert it into an RRIF.

An RRIF stands for Registered Retirement Income Fund. Similar to an RRSP, it is registered by the Canadian government. Unlike an RRSP though, you can’t directly contributie to an RRIF except for when you convert your RRSP.

The great thing about an RRIF is that it allows your retirement fund to continue to grow tax-free. Additionally,there are no taxes associated with converting your RRSP into an RRIF.

Now you will have to withdraw a minimum amount from your RRIF every year, but you’re gonna need it, so that’s not really a big deal.

In many ways, an RRIF is similar to an RRSP as it allows your investments to grow tax-free, but in order to open an RRIF, you first have to have an RRSP.

You need to close out your RRSP on December 31st of the year in which you turn 71.

Quick Note #1

In my article, Does an RRSP have to be Converted into an RRIF (which no it doesn’t), I talk more about the benefits of converting your RRSP into an RRIF.

Convert it to an Annuity

Another attractive solution for closing out your RRSP is to purchase an annuity.

In short, an annuity is an insurance contract that will guarantee you regular income either immediately, or in the future. These financial products are used mostly by retirees.

The great thing about buying an annuity with your RRSP is that, similar to converting it into an RRIF, there will be no taxes withheld when making the purchase.

Don’t take my word for it though, here is a screenshot from the CRA’s website on this topic.

Not only that though, but knowing you’ll have guaranteed income until you die will give you financial peace of mind that is often worth more than money itself.

5. To Help Fund Your Partner’s Retirement (Spousal RRSP)

There is a special type of RRSP called a Spousal RRSP, which basically allows one person (usually the higher income earner of the household) to contribute to their spouse’s RRSP.

What’s great about a Spousal RRSP is that although the higher income earner is contributing to their spouse’s RRSP, they still deduct that contribution amount from their own taxable income.

In other words, the higher income earner can reduce more of their taxable income – resulting in a greater tax refund – while at the same time balancing out their spouses financial assets with their own (Similar Amounts in both RRSPs).

Not only that, but when you do start making withdrawals from a Spousal RRSP during retirement, the withdrawals will be taxed under the lower income earner’s tax bracket.

If you didn’t catch all that, it’s okay – it’s all a bit dry and confusing and I’ll be the first to admit I may have not done a great job of explaining it.

So I’ve included a video here below that might help explain it better.

The advantages associated with a spousal RRSP should be taken into consideration when deciding on how to responsibly invest for retirement as a couple.

6. To Fund Your First Down-Payment (Home Buyers’ Plan)

The Canadian government implemented the RRSP Home Buyers’ Plan in 1992. This plan basically allows Canadians to withdraw up to $35,000 of their RRSP tax free in order to fund a down-payment on their first home.

So this is another benefit of investing your money in an RRSP – even if you don’t plan on using that money for retirement.

Think about it, you can basically invest your down payment savings into an account that will grow at a tax-free rate. Not only that, but along the way, you can reduce your taxable income and generate nice tax rebates.

Canadians often won’t plan on using their RRSP for this purpose, but then they’ll find themselves needing a couple extra thousand dollars to make a downpayment and they’ll turn to their RRSP for help.

As mentioned before, money in your RRSP should usually be untouchable, treat it almost like it’s sacred. But in the case of buying a home, you won’t be hit with a withholding tax, and as long as the money you withdraw is used towards a down-payment, it won’t be considered income. So this is definitely an exception.

Furthermore, as talked about earlier, withdrawing money from your RRSP has pretty significant downsides. So similar to saving for retirement, an RRSP also makes for a great down-payment savings account.

Why? Because you won’t be tempted to withdraw this money for anything else than what it’s meant for, and in return you’ll be able to achieve your savings goal quicker and buy your starter house that much faster.

Lastly, it would be unfair to only give one side of the story so I do want to make a note that there are some downsides of this program as well.

While I won’t dive into them here, make sure you also read about some of the disadvantages of the RRSP Home Buyers’ Plan, then based on all your information, make a decision on what’s right for you.

7. Flexible Investment Options

Another benefit of investing money in your RRSP for retirement is that you’ll have a wide range of investments options available to you.

As I mentioned at the beginning of the article, an RRSP isn’t an investment itself. It’s more like a special type of account that you can hold your investments within.

Luckily though, the Canadian government allows us to invest in a wide range of securities within the RRSP. To be honest, there is nothing I want to invest in that I’m not able to do within my RRSP.

Eligible RRSP Investments

- Stocks

- Bonds

- GICs

- Index Funds

- Mutual Funds

- Treasury Bills

- Options

- Cash

In other words, if you’re a typical investor, you can be sure that most things you want to invest in can be done so within your RRSP.

You see, if you just decided to save for retirement in a typical high-interest savings account, you might generate a return on your investment of 2%, maybe 2.5% if you’re lucky. And to be frank, if you account for inflation, you basically won’t make any money.

But with an investment account like an RRSP, you can invest in securities that over time could conservatively yield you 7% – 9%.

For fun, let’s look at the math on that. Danny and Geoff both start saving for retirement at age 25.

Danny saves $3,000 a year and invests it in stocks and bonds within his RRSP.

Geoff saves $3,000 a year and just puts it in a high-interest savings account.

Both Danny and Geoff retire at age 65, over the course of 40 years, Danny generates an 8% return and Geoff generates a 2% return.

At 65, Danny has $841,211.40.

At 65, Geoff has $181,931.90.

So despite putting away the same amount of money over the 40-year period ($120,000), Danny ends up with $659,289.50 more than Geoff.

Poor Geoff. But hey, it pays to know how important an RRSP is for your retirement

Disclaimer: Just because you invest money in an RRSP doesn’t mean you’ll generate an 8% return, it all depends on what you invest in within your RRSP.

8. To Fund Future Education (Lifelong Learning Plan)

Similar to the Home Buyers’ Plan we discussed earlier, the CRA also allows Canadians to withdraw money from their RRSP for educational purposes. This plan is called the Lifelong Learning Plan (LLP).

Being able to withdraw money from your RRSP to fund future education is an awesome exception implemented by the Canadian government.

If you take advantage of this plan, you basically invested in your future education in a tax-free manner while reducing your taxable income at the same time. Sweat deal, right?

In other words, unlike a normal RRSP withdrawal, you won’t be taxed for withdrawing that money from your RRSP as long as the money is used for educational purposes.

If you’re not the academic one yourself, that’s okay, because believe it or not, you can actually fund your spouse or common law partner’s education expenses with your own RRSP…….lucky you!

With that said, the CRA doesn’t just let you run wild with your withdrawals, there are some rules in place that you need to follow.

For one, you must enroll in, as the CRA puts it “a qualifying education program at a designated educational institution”.

While I won’t go into the details of what criteria you and the educational institution must meet, I’ll include a link here to what the CRA qualifies as a qualifying education program at a designated educational institution.

Additionally, you can only withdraw up to $20,000 over a 4-year period and up to a maximum of $10,000 per year.

Other rules include:

- The program must last for at least a 3-month period.

- Your workload must be at least 10-hours per week.

Lastly, when it comes to repaying your withdrawals, you have a 10-year period to do so with an minuum amount you must pay back each year. Failure to do so will result in you having to include the difference (Minimum Payback Amount – Amount Paid Back) on your income tax return (line 12900).

So yes, there are some drawbacks to this plan, but all in all, it’s a pretty generous offer by the federal government.

It’s essentially an interest-free loan against yourself. To learn more about the LLP, check out this video by Susan Daley.

Additionally, for more information on Canada’s Life Long Learning plan, here is a link to CRA‘s Lifelong Learning Plan resource page.

9. For Financial Peace of Mind

And last but not least, a major benefit you’ll get from investing in an RRSP that others who don’t won’t get is financial peace of mind.

Peace of mind in knowing that your future looks bright financially.

People often say, “ I can’t afford to invest money for retirement”, and my counter argument is that you actually can’t not afford to invest for retirement.

While yes, sacrificing a percentage of your income today does mean you’ll have less money to spend in the short term, but believe it or not, this sacrifice will not impact your happiness at all.

In fact, from my experience, it’s been quite the contrary. I’m actually happier as I’m not stressed about how I’ll be able to support myself during retirement.

While I don’t max out my RRSP contributions every year, I invest 15% of my income.

QUICK NOTE #2

Lastly, if you struggle to find money to invest every month into your RRSP, check out my article on how to invest while living paycheck to paycheck.

Financial peace of mind is something many people struggle with, so hopefully this benefit alone is enough to get you set up and investing in an RRSP.

Conclusion

To conclude, here are the 9 benefits of investing in an RRSP

- Contributions are Tax Deductible

- Tax-Free Investment Growth

- Early Withdrawal Has Consequences

- Tax Friendly Conversion Options Upon Retirement

- To Help Fund Your Partner’s Retirement (Spousal RRSP)

- To Fund Your First Down-Payment (Home Buyers’ Plan)

- Flexible Investment Options

- To Fund Future Education (Lifelong Learning Plan)

- For Financial Peace of Mind

I use an online robo-advisor called Wealthsimple for my RRSP account, I’ll include a link here on why I recommend them followed by a step-by-step guide on how to get started if you wanted to.

I know I’m beating a dead drum here now, but please, to all my fellow Canadians, if you don’t already have one, get yourself an RRSP.

The Canadian government doesn’t give out tax breaks and benefits frequently, so take advantage of them when they do.

(Don’t be like Geoff!)

Geek, out.

![Do Index Funds Pay Dividends to Shareholders? [How it Works]](https://thefinancialgeek.com/wp-content/uploads/2022/05/Do-Index-Funds-Pay-Dividends-to-Shareholders-2.jpg)