Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

While most investors adhere to some form of buy and hold investing strategy, there are those who have a higher risk appetite that buy and sell the same stock during the same trading day. These are called day traders, and while there is nothing illegal about day trading, there are some serious red flags for those who are not sure what they’re doing.

Most Canadian stock brokerages allow day trading, although higher fees and added volatility make it a fairly risky endeavour.

Canadian investors can day-trade on the Wealthsimple Trading platform if they choose, but most people, including Wealthsimple, advises against in. Day trading is a risky endeavour regardless of which platform you use, but Wealthsimple’s platform in particular is not ideal for day-trading activites.

Day trading certainly became a more popular and mainstream “hobby” for some investors during the pandemic, as modern online brokerages like Wealthsimple saw an up tick in day-trading investment activity.

With that said, Wealthsimple’s platform is easy to use, intuitive, and has much lower fees than the other big banking brokerages in Canada. So if you did want to start “investing” with Wealthsimple Trade, now that’s an idea I would get behind.

But I said investing, not day-trading.

I use Wealthsimple Trade for all my stock investing and I love the platform. But I only buy and hold stocks that I like and that I think will appreciate over time, I don’t day trade. If you did want to try Wealthsimple Trade, the sign-up process only takes a few minutes. (And you’ll get a $50 cash bonus with your sign up).

Start Trading Stocks with Wealthsimple Trade Today ($25)

Earn a $25 Bonus with Sign – Up

- No Commission Fees

- Investors Can Buy Fractional Shares

- No Minimum Balance Requirements

- Beginner Friendly App and Desktop Platform

- Access to the Crypto Markets

But now, let’s take a look at some of the advantages and disadvantages of day trading on Wealthsimple.

| Pros | Cons |

|---|---|

| 1. Wealthsimple Trade has Lower Trading Fees | 1. Quotes Offered on Wealthsimple are 15 Minutes Behind |

| 2. Wealthsimple Trade has a Mobile Trading App | 2. There Can Still Be Fees for Day Trading on Wealthsimple Trade |

| 3. Wealthsimple Offers Fractional Share Trading | 3. Tax Implications for Day Trading |

Pros of Day Trading with Wealthsimple Trade

Pro #1 – Wealthsimple Trade has Lower Trading Fees

Unlike in the United States, Canadian traders are still bound by high transaction fees from most stock brokerages.

The reason? A majority of investors use the big Canadian banks as their brokerage, and these banks have a near monopoly over the market. Some bank brokerages will charge as much as $10 for each trade executed, plus foreign exchange fees for trading US-listed stocks.

Wealthsimple Trade gained a lot of popularity when it first launched because of the lower fees it offers to its traders. In fact, Wealthsimple charges nothing when you buy or sell a Canadian stock, and they charge a 1.5% conversion currency fee when buying US-listed stocks.

To understand exactly how these fees work, I give a complete breakdown of it in my article 4 Ways Wealthsimple Makes Money (From Each Product).

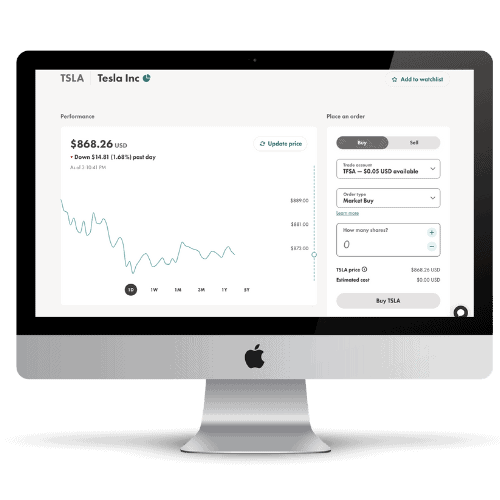

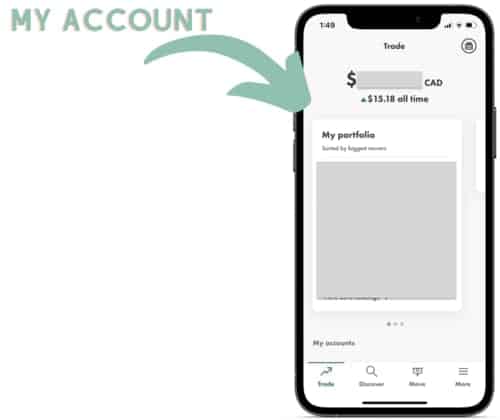

Pro #2 – Wealthsimple Trade has a Mobile App

Day trading on Wealthsimple just got easier as the company released a mobile app that is compatible with both Android and iOS operating systems. Similar to why platforms like Robinhood are popular in the US, Wealthsimple Trade allows full access to its trading platform no matter where you are!

The platform does have a desktop app as well for your computer or laptop, but these days, a mobile app is the best way to attract the younger generation of traders.

While again, I don’t day trade, but I do invest with Wealthsimple Trade and the mobile app is excellent.

Using the Wealthsimple app gives you access to everything that the brand offers on its site. Canadian investors can perform any kind of trade on the mobile app that can be executed on a desktop or laptop. Through the Wealthsimple Trade mobile app, traders can access assets like stocks or ETFs, as well as gain access to Wealthsimple’s cryptocurrency investments.

I must say, the Wealthsimple Trade mobile app is one of my favourite aspects of the product, it has a sleek design, it has a fast response time and it’s very easy to navigate.

Pro #3 – Wealthsimple Offers Fractional Share Trading

Believe it or not, this is a first in Canada as big bank brokerages just do not offer the ability to buy and sell fractional shares. Not even Questrade offers fractional shares yet, which I must say is somewhat surprising.

This practice of buying fractional shares has gained popularity in the US, but in Canada, things are still a bit outdated when it comes to buying fractional shares.

But for traders who do partake in day trading but don’t have a whole lot of capital to buy expensive stocks like Amazon or Alphabet, day trading in fractional shares could be a great solution for them as it would be a way to gain exposure to companies you otherwise wouldn’t of been able to afford.

Fractional shares operate similar to a stock split: the size of the pizza is the same but the number of pieces of that pizza becomes smaller. Still, it is a clear benefit for Canadian traders who are involved in the world of day trading.

Start Trading Stocks with Wealthsimple Trade Today ($25)

Earn a $25 Bonus with Sign – Up

- No Commission Fees

- Investors Can Buy Fractional Shares

- No Minimum Balance Requirements

- Beginner Friendly App and Desktop Platform

- Access to the Crypto Markets

Cons of Day Trading with Wealthsimple Trade

Con #1 – Quotes Offered on Wealthsimple are 15 Minutes Behind

While it isn’t the end all be all of day trading on Wealthsimple, it can be the difference between a good and bad trade entry. Wealthsimple openly states that its stock quotes are rolling on a fifteen minute delay. This really only matters for day traders as long-term investors do not need to concern themselves with a minute by minute performance of a stock.

Since day trading requires traders to time the market perfectly, having a delayed stock quote can be a game stopper. In fact, this delay would make day trading nearly impossible to execute, unless the trader uses a separate app for real time stock quotes and only uses Wealthsimple Trade to execute a trade.

I’ve actually tried this before, just to test it out. I used Yahoo Finance for real-time stock quotes, and then used Wealthsimple Trade to make purchases based on the Yahoo finance stock numbers. Let me just tell you, it was not fun.

So yeah, this should really be a show stopper when it comes to day-trading with Wealthsimple.

But wait! Theres more!

Con #2 – There Can Still be Fees When Day Trading on Wealthsimple Trade

Lower fees are a miracle for Canadian traders, but Wealthsimple charges fees for its trade, but just not in the form of commission fees. They are currency conversion fees. So when you buy a US stock, Wealthsimple takes a 1.5% fee on the conversion transaction, both when you buy and sell the stock.

These fees can really add up if you are trading with a decent amount of volume.

And let’s be honest here, the majority of the best investments when it comes to day-trading are based out of the US, so buying and selling non-Canadian stocks on the same day will really start to add up even on Wealthsimple Trade.

Con #3 – Tax Implications for Day Trading on Wealthsimple Trade

In Canada, day trading profits are treated as a business income and not capital gains. Why is this significant? Since they are taxed as business income and not capital gains, day trading profits see the 100% tax rate and not the 50% tax rate of the capital gains tax.

And if you were thinking about day trading in a TFSA, think again – my article 6 Things You Need to Know about Day Trading in a TFSA talks about what the CRA considers “day trading” when it comes to investors investing in their TFSAs.

So while this might not be a direct knock at the Wealthsimple Trade platform, and more so a jab at day-trading in general, it’s still worth making note of.

The Bottom Line

So here’s the bottom line. Don’t day-trade with Wealthsimple. In fact, I’d recommend not day-trading at all, but hey, who am I to tell you what to do.

I’m so against day-trading, I even wrote an article about it!

I will say though, if you are full steam ahead and plan to start day-trading, do it on another platform, not Wealthsimple. Questrade might be a better option for you.

And finally, while I don’t recommend Wealthsimple Trade for day-trading, I do recommend it for general investing. As mentioned earlier, I’ve used Wealthsimple Trade for a few years now and I love everything about it.

As always, thanks for reading!

Geek, out.