Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

If you’re like me, the thought of day-trading within your TFSA has crossed your mind at least once.

But have you ever heard of the saying, if it’s too good to be true then it’s too good to be true?

Well that phrase couldn’t be more applicable to this topic – the idea of day trading in your TFSA is in fact – too good to be true.

In other words, it’s not allowed.

The CRA doesn’t allow investors to frequently buy and sell securities within their TFSA. Any income generated from day-trading within your TFSA will be considered business income and will be taxed as such.

With that said, you might be wondering how the CRA determines whether or not the income you generate is business or investment income.

If it’s business income, then you’re going to get taxed on it.

If it’s deemed investment income and your investments are held within your TFSA, then you’re laughing – enjoy your tax free investment income.

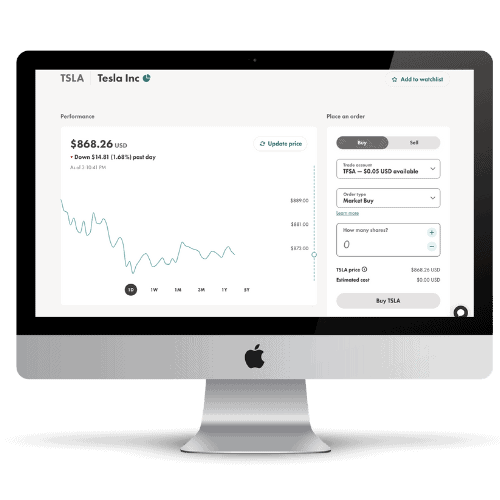

It’s also important to note that day-trading can be very difficult, I personally prefer to buy stocks that I plan to hold for a decent period of time. Not to mention, I buy and sell stocks and ETFs on Wealthsimple Trade, and while I love Wealthsimple Trade for the reasons I use it for, it’s not an ideal for day-traders. But I will say, if you are a Canadian Investor like me, and you want to get into buying stocks or ETFs, I always recommend Wealthsimple Trade.

Everything is all online, the sign-up process takes a matter of minutes, and it has no commission costs when you buy and sell stocks. (And you’ll get a $50 cash bonus with your sign up).

In the next section, we will talk about a few different factors that the CRA will look at when determining whether or not your TFSA investments reflect trading activities.

So why does all of this matter anyway? Because the Canadian government created the TFSA so Canadians could earn tax-free investment income, not business income.

If you want to day trade, that is perfectly okay, I’m not here to judge or persuade you not to, but the TFSA is not the account to do it in.

As you know, registered accounts such as the TFSA and the RRSP have rules that must be followed, this is simply another one of those rules.

Open a TFSA Today with Wealthsimple Trade ($25 Bonus)

Earn a $25 Bonus with Sign – Up

- No Commission Fees

- Investors Can Buy Fractional Shares

- No Minimum Balance Requirements

- Beginner Friendly App and Desktop Platform

- Tax-Free investment income

What Does the CRA Consider Business Income?

As stated above, if you as an investor are operating your TFSA like a business, your income won’t be tax-free as it will be subject to income taxes.

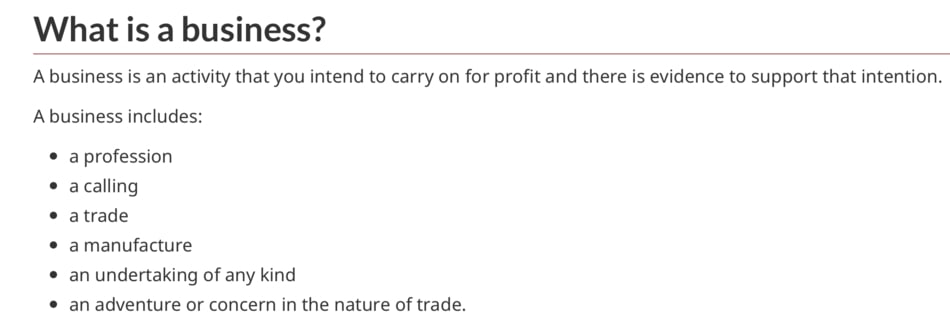

But what exactly does the CRA consider “a business”? Great question.

Below is a screenshot I took from the CRA website, this gives you the exact definition of what they define a business to be.

I will leave a link to this CRA article here.

The article states that business income is “income from any activity you do for profit.”

If you are day trading in your TFSA, you are doing so to make a profit, and therefore your income will be considered “business income”.

So clearly, trading securities within your TFSA as a means to a full-time income would be considered “a business”. Unless you are day-trading to….loss money and not make a profit? Which I highly doubt!

The CRA has no problem with hard-working Canadians earning tax free returns from their TFSA, but the returns have to be investment income, not business income.

All this to say, day trading is considered a business activity, so any returns you generate day-trading within your TFSA will be considered business income.

Now let’s talk about what the CRA will look at when determining the type of income that’s been generated within your TFSA.

Related Article: How to Invest in Stocks Within Your TFSA | Step by Step Guide

6 Signs of Day-Trading within a TFSA

Now we know that the CRA considers day-trading to be a business, so any profits made from day-trading will be taxed as business income and not investment income.

While the exact criteria of what constitutes day-trading within your TFSA is a little vague, here are some factors that we know the CRA looks at when trying to determine whether or not your TFSA income is considered business or investment income.

1. Duration of Holdings

How long are you holding your investments for?

If the CRA audits your TFSA activity and sees you holding securities for only a matter of weeks, you’re going to get dinged.

WIth that, don’t get too worried if you are legitimately not a day- trader but you decide to dump a few investments quicker than normal, you’ll probably be okay. As long as that was not your intention upon purchasing the stock, which we will talk more about shortly.

But again, consistently buying stocks and holding them for a short period of time is not a good look and it certainly something the CRA will look at when determining your trading motives.

2. Trading Volume

How often are you buying and selling securities?

If you’re trading stocks within your TFSA on a day to day basis, it shouldn’t come as a surprise that this activity will be considered day-trading.

But hold on, even those investors who trade multiple times a week or even month will potentially be flagged for CRA audit.

There isn’t an exact number that says you can make this many trades per month or per week, so you have to be careful as again it is fairly vague.

But don’t try to fool the CRA, the taxman will always get their money. If you are actively analyzing the stock market to buy and sell stocks in the short term, you’re going to get dinged.

Which brings me to my next point.

3. Time Spent Trading

Another key factor that the CRA will consider when evaluating your trading activity is the amount of time you’ve spent on making your investments.

Is this a full time job for you? Are you researching the markets for hours and hours each day?

If the CRA realizes you are spending a large part of your time analyzing market trends and trading securities, you’re going to get dinged.

4. Type of Investments

If your TFSA is getting audited by the CRA for trading activity, one of the things they will look at is the type of investments you are buying and selling.

Are you buying very high risk, speculative stocks that don’t pay dividends?

Related Article: Can You Buy Penny Stocks in a TFSA?

Or are you investing in safe blue chip stocks like AT&T?

Believe it or not, this is a very big indicator when it comes to determining what your intentions are.

Risky stocks fluctuate in price like crazy which creates opportunity for day-traders, which is great if you’re a day trader! But again, the TFSA isn’t meant for day-trading.

5. Experience in the Securities Market

Does the investor have their CFA or their trading equities certificate?

Or do they have other significant knowledge about financial markets?

If so, this could be a red flag that CRA auditors pick up on.

Similar to the previous factor – Type of Investments – an investor’s experience in the financial industry is not going to trigger an investigation, but it could be a factor that tips the scales for or against that investor.

6. Purchase Intent

If you get audited by the CRA for potential day-trading activity within your TFSA, one of the questions you might get asked is why you purchased a certain security.

Selling a security in the short term might not be a big deal if you had solid reasoning for both buying and selling that asset.

Things happen and investors often decide to quickly sell stocks that they planned on keeping for a long period of time, and that’s okay.

For example, if you bought shares from a company like Exxon Mobile in January of 2020 but then decided to sell them a month later in anticipation of the stock market crashing due to Covid-19, well that just makes good financial sense and you probably don’t have to worry about getting audited.

Conclusion

I never know how to write conclusions, they’re awkward – I can’t lie.

But allow me to briefly recap what’s been stated.

You are not allowed to day-trade in your TFSA.

So don’t do it. Do we have to complicate it more than that?

If you are doing either of these two things in your TFSA, the taxman (CRA) could be coming for you.

- Holding securities for a short period of time.

- Constantly buying and selling stocks.

While these are the main factors that might trigger a CRA audit, other factors that could impact your tax fate include your prior industry experience, the types of securities you bought, the reason for purchasing, and the amount of time you spent researching the stock market.

We’re all smart people here, we know if we are day trading or investing.

Here’s the bottom line, If you’re a day trader, or plan on dabbling in it, that’s fine, but don’t do it in your TFSA.

Geek, out.

One Comment

Comments are closed.