Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

If you are new to investing, but you want to get started, you’ve likely heard about Wealthsimple before.

Wealthsimple is an online investment management service founded in Canada in 2014.

This article will talk about nine reasons why Wealthsimple is a great platform for beginner investors.

So let’s just jump right into it.

Here are 9 Reasons Why Wealthsimple is Good for Beginners:

1. Easy Account Setup Process

First and foremost, Wealthsimple is great for beginners is because of how easy it is to set up your account.

All you do is go to their website, put in your email address, fill out some standard online paperwork – Name, Age, SIN, Address, Banking Information and so on.

From there, you’’ll indicate what type of account you want to open and what your investment risk level is on a scale of 1-10.

Sign-up for Wealthsimple Invest Today ($25)

Sign-up for Wealthsimple Invest Today

It pays extra to direct deposit

You could increase your Cash account interest by 0.5% with direct deposit.

There may be a few other questions on what your retirement goals are and what your savings rate is, but all I am trying to say is that it is pretty standard stuff.

The whole process takes roughly 30 minutes and anything you state in the sign-up process can easily be changed after. It’s not written in stone.

I said this in my recommendation article on Wealthsimple, but I’ll say it again here now, I actually find the setup process fun and exciting!

Creating a Wealthsimple account takes about 30 minutes and is all done online. It’s a very simple process

Related Financial Geek Article: How to Open a Wealthsimple Invest Account | Step by Step

2. Passive Investing

Wealthsimple is also a great investment platform for beginners because of its passive investment strategy.

What I mean by that is that you, the investor, can be very hands off.

You simply set your risk level at the start (1-10), which will talk about more shortly, and then let Wealthsimple do the rest.

Wealthsimple then invests your money within what’s called index funds. Index funds are popular investment vehicles used for passive investors who want to diversify their investments.

All this to say – you won’t be responsible for continually monitoring your investments and trying to decide what ‘s best, Wealthsimple does that for you.

You just set your investment risk level up front and then Wealthsimple will invest your money for you (with Index funds) based on your risk preferences.

Wealthsimple allows beginners to invest their money in a very hands off manner, while at the same time, giving them complete control over their investment risk levels.

3. No Account Minimum

One of the main reasons why Wealthsimple is great for beginners is because there is no account minimum.

If you only have $10 to invest, that’s quite alright, you can still open an account and invest with that $10.

Most beginners don’t have much money to invest when starting out, and if they do, they don’t want to jump in all at once.

Wealthsimple Invest allows you to do that. Other platforms for example, like Questrade’s portfolio plans require a $1,000 minimum deposit to get started.

But not everyone wants to commit that much when they are just getting started!

Wealthsimple is great for beginners because there are no minimum requirements for how much you need to deposit when starting out.

4. Setting Your Investment Risk Level is Simple

Now as I just mentioned, during the account creation process, you’ll be able to easily set your risk level, but even after your account is set up and your money is invested you can adjust your risk level just as easily.

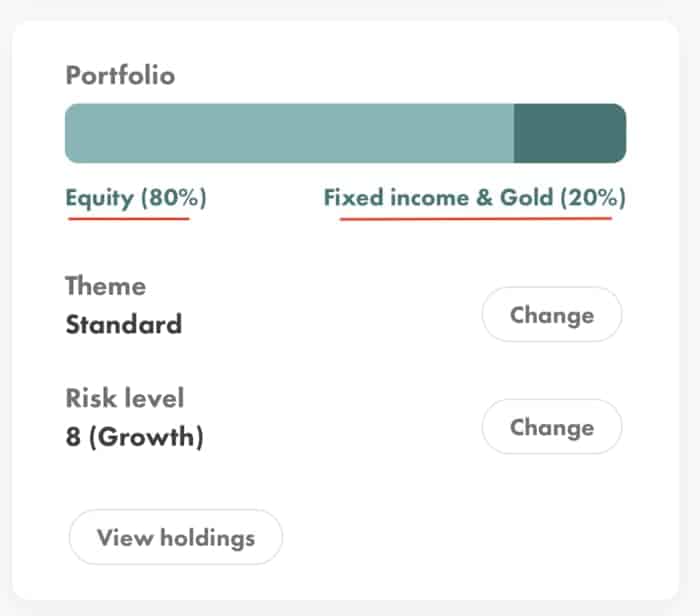

Wealthsimple allows you to drag a slider, as shown in the image below, on a scale of 1-10. 10 being the riskiest and 1 being the safest.

So the riskier you set your scale at, the more aggressively Wealthsimple will invest your money for you, which usually means more money invested into equities as opposed to fixed income or gold.

But the great thing is you don’t have to do anything except move that dial one way or the other. Wealthsimple takes care of the rest, they do all the investing for you based on your preferences.

Wealthsimple is great for beginners because setting your desired investment risk levels is done by sliding a dial between 1-10. That’s all you have to do.

5. Automatic Portfolio Rebalancing

Another reason why Wealthsimple is a great investment platform for beginners is because Wealthsimple automatically rebalances your portfolio for you on a consistent basis.

You may or may not know this, but Wealthsimple is what is referred to as a robo-advisor. So all their investments are done by following mathematical logic and advanced algorithms. In other words, there is minimal human intervention.

So, how does this help us? Well for one, it comes with lower fees, which will talk about shortly, but it also means our portfolios will continually be rebalanced based on the risk level we set.

For example, if you set a 6 risk tolerance on the 1-10 scale, then Wealthsimple will invest your money 60% in equities and the other 40% in fixed income and gold (and cash).

But what happens if (and likely when) your equites start to make money faster than your fixed income? Well your portfolio will start to skew away from that 60/40 split you initially requested.

Well, Wealthsimple’s algorithms will recognize this and then automatically rebalance your portfolio by selling off some of your equites and buying more fixed income/gold to rebalance your portfolio back to it’s preferred asset allocation mix (60/40).

As you can see below, my risk level is set at 8. Which means an asset allocation of roughly 80% equities and 20% fixed income and gold. This is my retirement fund (RRSP) and as I won’t be retiring anytime soon, I can afford to be a little more risky.

Pretty cool hey!

To learn more about the specifics of Wealthsimple’s rebalancing process, check out their Help Center article here.

Wealthsimple will automatically rebalance your portfolio’s asset allocation to continually match up with the risk level you set.

6. Depositing and Withdrawing Money is Easy

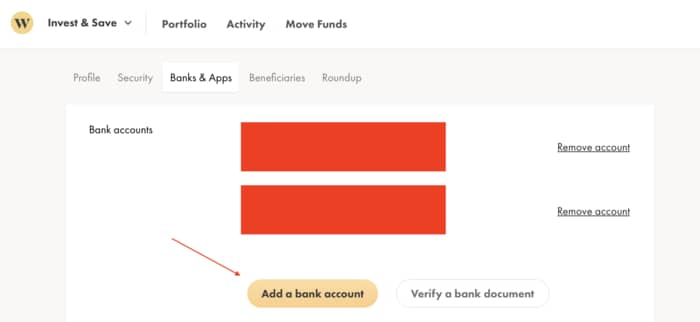

One more reason why Wealthsimple is a great investment platform for beginners is because of how easy it is to deposit and withdraw money from your account.

The first step of course is setting up your bank account to your new Wealthsimple account. This takes a few minutes, but not long. Don’t be intimidated by this process. Seriously, it’s very quick and easy.

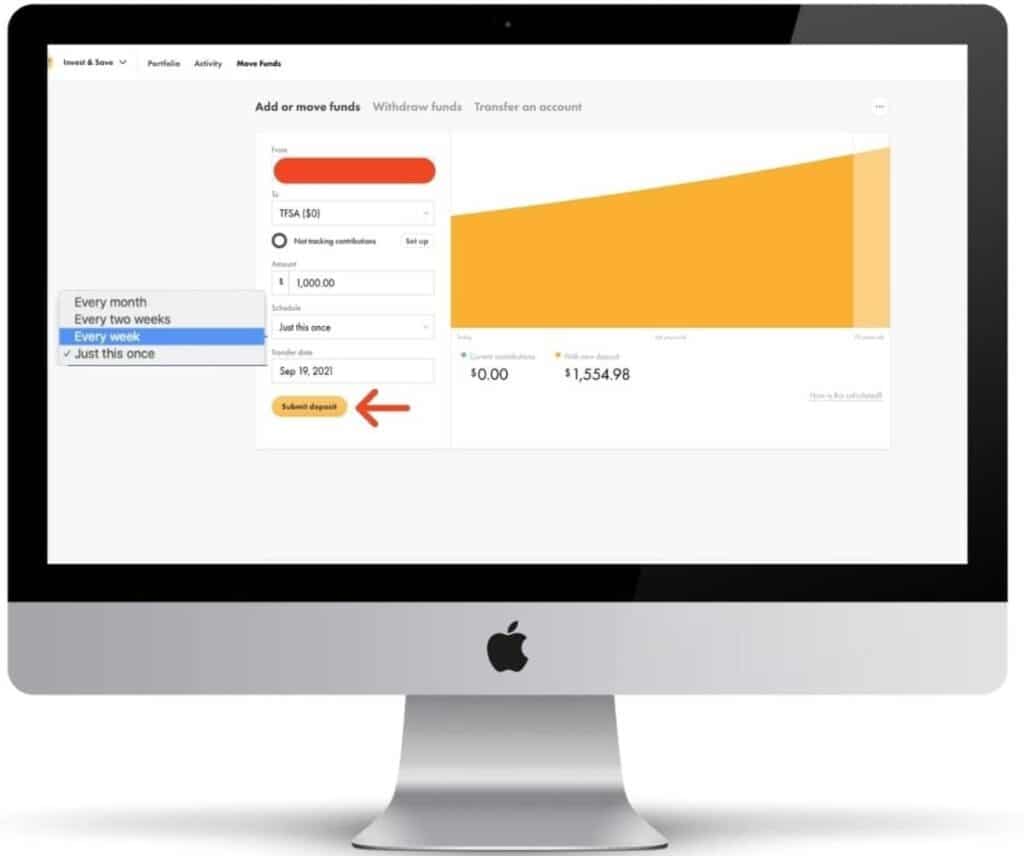

Once you’re connected, go to the “Move Funds” tab and then the “Add or Move Funds” sub tab.

As you can see from the image below, you can easily select what account you want money leaving from and what account you want the money to go to.

Additionally, you can set the frequency of your deposits or withdrawals, so if you want to make a monthly deposit, you don’t have to go in yourself and do it every month, you can automate this process.

This is one of my favourite features of Wealthsimple, I contribute 15% of my income to my RRSP every month, but I don’t ever think about it!

I should also mention that it’s completely free to withdraw and deposit money into your account, I don’t know why I’m only thinking about that now, but wow, yeah – all transactions in and out of your Wealthsimple account are completely free.

Withdrawing and Depositing Money to and from your Wealthsimple account is a simple and automated process.

7. Modern User Interface

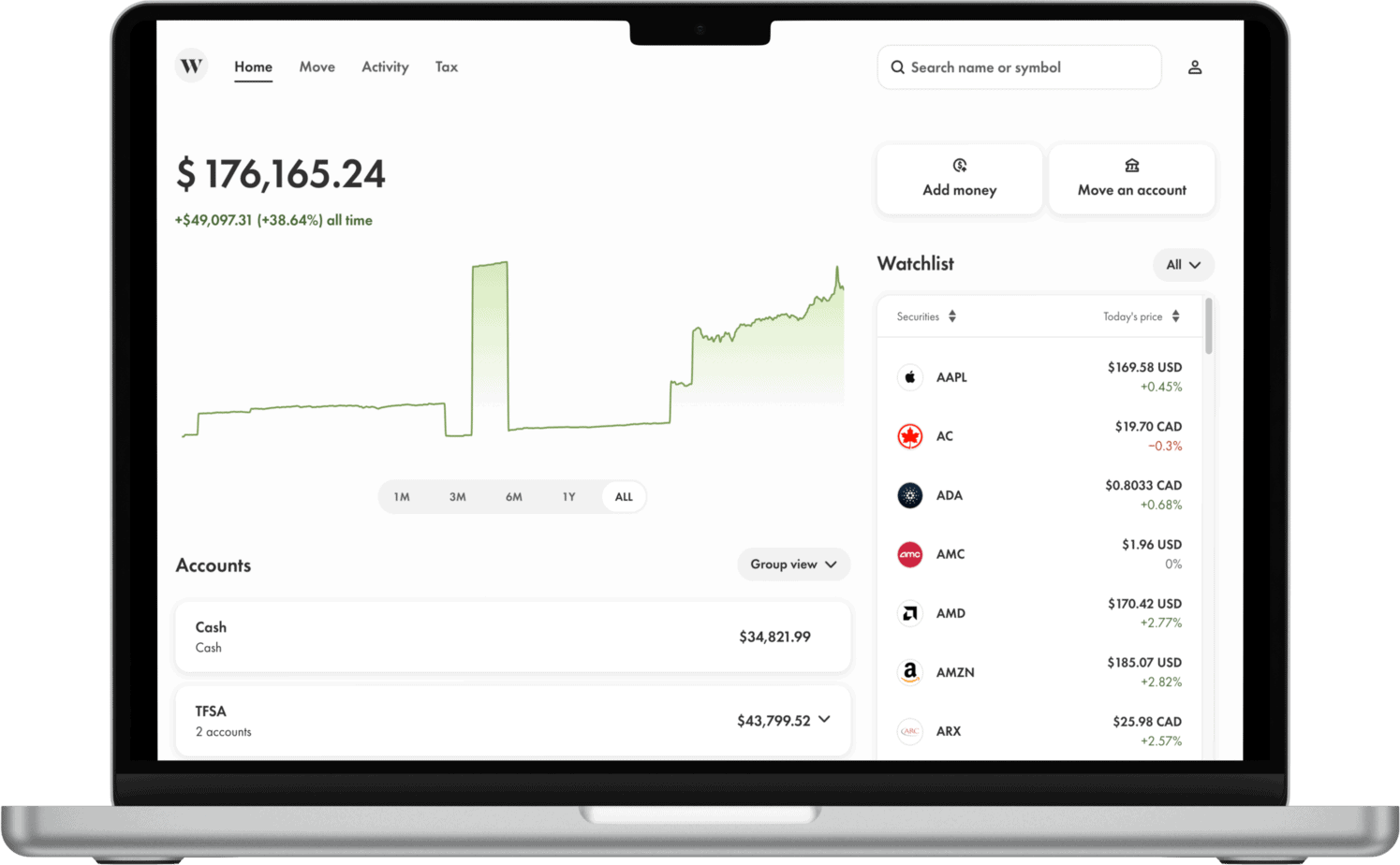

Wealthsimple’s modern looking user interface is another reason why it’s a great platform for beginners.

I talk about the user experience a bit in my Wealthsimple recommendation article as well, but unfortunately for privacy reasons I can’t share screenshots of my personal account, so you’ll just have to take my word for it! But come on, would I ever lie to you guys?

At the end of day, Wealthsimple’s target market is millennials, and they know that without a sleek, modern design, they will just go elsewhere. So I have to say, they do a great job at creating a very clean user experience both on desktop and mobile.

Wealthsimple has a very clean, easy to use interface on both desktop and mobile.

8. Low Management Fees

Another reason why Wealthsimple is a great platform for beginner investors is because of their low fees.

Now robo-advisors in general have low fees, and Wealthsimple is no different. From $0-$100k you’ll pay a .5% management fee per year and once you have over $100k in your account your management fee will drop to .4%.

A lot of financial advisors charge anywhere from 1.5% to even as high as 3%, which is really just ludacris – but we won’t get into that right now.

All you need to know is that a .5% management fee is very cheap, and as a beginner, do you really want to be paying high management fees? I doubt it. Heck, beginner or not, you never want to be paying high management fees.

For example, if you have $10,000 in your Wealthsimple account, your account will be charged $50 throughout the year.

Wealthsimple has low management fees. 0.5% when you have $0-$100k and only .4% when your balance is greater than $100k.

9. Great Customer Support

Last but not least, Wealthsimple has a great customer service department which is great for beginner investors. You can literally reach them in so many different ways. Phone, email, social media, automated chat, help centers – you name it. Wealthsimple is for the people!

As a beginner, you are likely to have questions about your account. Wealthsimple will be there to answer them for you. Trust me, when I was starting out with them I asked so many questions and they all got answered in a timely manner.

Unlike a lot of tech companies these days, Wealthsimple actually has a support line you can call! You don’t see that much anymore, and the reps I have personally dealt with so far have been very helpful.

So this is just reassuring, especially for someone new, you want to be able to talk to real people.

Rest assured, while your money may be managed by algorithms and computers, your concerns are managed by real life people.

Wealthsimple has a great customer support department

Conclusion

To conclude, if you are completely new to investing, I would highly recommend giving Wealthsimple Invest a try.

For the nine reasons discussed above, Wealthsimple is a great investment platform for beginners to get started with.

I’m also not speaking blindly here either, I’ve had my money invested with Wealthsimple since 2016 and have had nothing but a great experience so far.

If your not quite ready to sign up yet, but you’d like to learn more about Wealthsimple’s benefits and the sign up process, I’d recommend checking my article on the 10 benefits of opening an account with Wealthsimple along with a step-by-step guide (screenshots included) on how to setup an account.

Thanks for reading folks, As always, I hope this article provided you with some useful information that you can now take moving forward.

Geek, out.

![17 Tips for Moving Out With No Money [And Our Top 8]](https://thefinancialgeek.com/wp-content/uploads/2021/12/move-out-with-no-money.jpg)