Making smart money moves in your 20s is so important.

Forming good habits and learning the language of money at a young age will help form the foundation for your entire financial life.

While most people in their 20s are more worried about getting an education and finding a career they wish to pursue, there are so many things they can do along the way to ensure they make sound financial decisions.

With that said, this article talks about 18 ways individuals in their 20s can be smarter with their money.

1. Invest 10% of Your Income for Retirement

I know this is cliche, but start investing 10% of your income for retirement, even in your 20s.

In fact, the earlier you start the better.

You would be shocked at what a difference a few years can make in terms of how much money you have when you retire.

Look at this quick example,

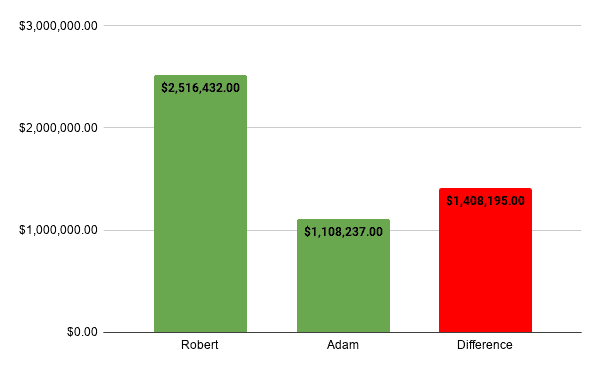

Robert and Adam both worked from age 25-65 and made $50,000 a year for their entire career.

Robert was smart and started investing 10% ($5,000) of his income for retirement at age 25 while Adam on the other hand “lived the dream” for 8 extra years and didn’t start investing for retirement until he was 33.

Let’s assume both Robert and Adam generated an average return on investment of 10% during their working years.

How much does each person have at retirement?

Robert: $2,516,432

Adam: $1,108,237

Difference: $1,408,195

Isn’t this crazy! Robert only invested $8,000 more than Adam, and they both generated a 10% ROI, but he ended up with over $1.4 million more than Adam!

Compound interest is a very powerful force. Starting to invest and save for retirement in your 20s can quite literally earn you millions of dollars more for retirement, as shown above.

2. Automate Your Saving and Investing Process

Another way to be really smart with your money in your 20s is to automate your saving and investing process.

Unfortunately, what a lot of people do is decide to save and invest “what’s left over” every month, but this approach never works.

You have to pay yourself first, also referred to as forced savings.

(I should mention this works best when you’re earning a predictable income.)

Okay, so here’s what you do.

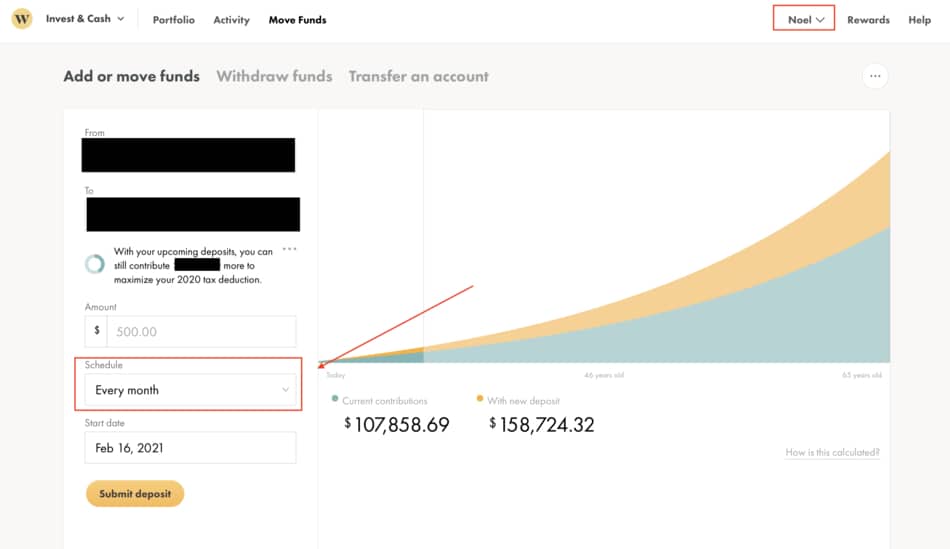

If you haven’t already done so, set up an investment account. I use and recommend Wealthsimple if you are a Canadian.

Once you get your account setup, connect your bank account to your brokerage account and then set up automatic deposits so that your funds are automatically withdrawn from your bank account every month and deposited into your investment account.

I’d recommend setting up your withdrawal dates to be the same day, or one day after, your paydays. That way, you won’t be tempted to spend money that’s been budgeted for retirement purposes.

It will be in and out of your account by the time you wake up in the morning.

3. Generate Multiple Streams of Income

You always want to diversify your income streams to reduce risk. No one thinks they’ll lose their job until they do. Take it from someone who has been fired before (me).

Your 20s is the best time to start generating these income streams for your future self.

Now the most common stream of income is your job, after that, most people look to investing outside a retirement account.

And while that’s a great start, why not try to diversify even more?

There are plenty of ways you can make money from home, online and in a passive manner.

I will leave a few of my related links here below for you to check out. These should hopefully spark your interest and get you thinking at least!

- Make Money Online as a Beginner | 17 Proven Ways

- 9 Easy Ways to Make Money Without Owning a Business

- 13 Proven Ways to Make Money When You Don’t Have Money

- Become Financially Independent Without a Job

So your options are plentiful. If I had to give you one piece of advice on this though, it’d be to do something you enjoy.

Don’t start something to make a quick buck. Plant your seed and water it everyday.

Over time, this seed will grow and hopefully provide you with a reliable source of income.

Play the long game, build something great and deliver real value to other people, the money will follow.

One great way to earn extra money is to do what I did and start a blog around something you are truly interested in.

Looking To Start Your Own Website or Blog?

Try Bluehost Today (Less than 5$/Month)

- 70% Off with Sign up Through the Financial Geek

- 1-Click WordPress Install

- Free Domain Name with Sign Up

- 300+ Design Templates

- 24/7 Expert Support

For a step by step guide on how to start a blog, check out my article Start a Blog in 3 Easy Steps | Step by Step Guide (2022) This article will give you a detailed, step by step guide on how to about getting a blog setup. It’s the exact same method I use for setting up the current blog you are reading, and again – it’s really inexpensive. The web-hosting platform I recommend is less than $5 per month.

4. Avoid High Investment Fees

Understanding how investment fees work in your 20s is a smart money move.

Most people never understand this, and it costs them big time.

What I mean by investment fees is the cost of doing business with financial institutions. When we give our money to institutions to invest, they charge us a percentage of our portfolio for their services.

These fees can range anywhere from .25% to 2.5% or even 3%. Here’s a hint, the lower the better!

I could go crazy talking about how important fees are and how much they matter, but allow me to just explain using an example.

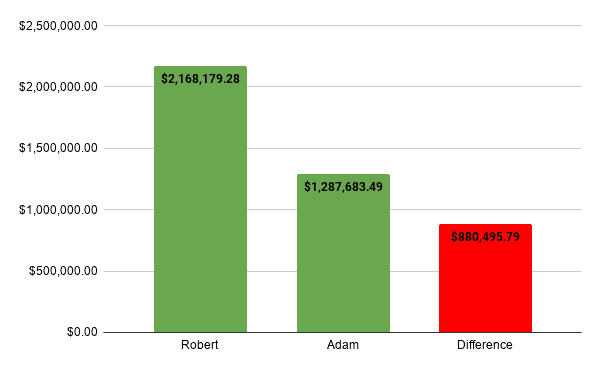

Robert and Adam, both start investing for retirement at age 25, they invest $5,000 a year for 40 years.

Before fees are calculated, Robert and Adam both generate an average return of 10% over the course of 40 years.

Robert does his investing with Wealthsimple and pays a .5% fee annually.

Adam invests his money with his parents buddy who’s a financial advisor and pays him a 2.3% fee annually.

Seems somewhat insignificant, right? Wrong!

At retirement, Robert has $2,168,179.28 while Adam only has $1,287,683.49.

So despite investing the exact same amount and generating the same return, Robert has over $880,000 more than Adam!

You see, fees are calculated as a percentage of your entire portfolio, not your returns. If you have a $1,000,000 portfolio and you generate a 10% return, you’ll have earned $100,000 before fees.

But your fee will be calculated based on your new portfolio value (which in this case would be $1,100,000) and not the $100,000.

So it’s not that surprising that Robert retired with so much more than Adam, he paid over four times as much in fees over his career.

Imagine being asked to pay four times more for a coffee than your friend, you’d never do it!

But because most people never understand how fees really work, they don’t know the difference!

Long story long, understand how fees work and avoid paying high ones!

5. Don’t Use Credit Cards

In your 20s, get in the habit of not using credit cards if possible.

While I’m not saying you shouldn’t have one, which I could argue too, I’m just saying don’t carry it around with you and avoid spending it unless completely necessary.

For example, I have a credit card but I keep it hidden away, out of sight out of mind. I spend it very occasionally and only do so to keep my credit score high.

I quite literally don’t even know what type of points I get with it, I think the movie passes?

Not only do credit cards come with massive interest fees, but stats show people spend more money on credit cards than they do with cash or their debit cards.

Think about how much harder it is to pay for something in cash than it is with your credit card.

It’s so easy and painless to use your credit card, people just tap it like it’s monopoly money. Unfortunately it’s not. Wouldn’t that be nice though.

So, if possible, avoid credit cards and any consumer debt during your 20s.

Not only will you spend less money on things you probably don’t need, but you also won’t be stressed out looking at your bank statements every month.

6. Buy Used Vehicles

Credit Karma states that the average car payment for Americans is $568 per month. I’m sorry, but that’s a ton of money that you don’t need to spend.

If you want to be really smart with your money in your 20s, buy used vehicles as opposed to new ones.

Now if you can truly afford to buy a brand new car with cash, then giver.

But if not, I highly recommend buying used cars and buying them with cash as opposed to financing.

Going into debt to buy a new car when you don’t have to just doesn’t make sense to me.

Instead of buying a new car every 5-10 years, imagine using that $568 monthly payment and investing it instead.

Do you know how much that would be after 30 years? Assuming a 10% return.

$1,283,957!

Is driving a new car really worth over a million dollars to you?

So instead of buying a new car from ages 25-55, invest in the stock market and retire early instead.

Not to mention, after a few drives in your new car, the novelty will wear off. You know what won’t wear off though, you’re monthly payments.

For more information on how to make a smart car purchase, check out Dave Rasmey’s video below.

7. Get a Visa Debit Card

Another smart money move for you to make in your 20s is to get yourself a Visa debit card.

Now piggy backing off the Don’t Use Credit Cards section, having a Visa debit card will help you do things you can’t do with a normal debit card while avoiding credit card debt.

That’s what I love about Visa debits, I have one with Scotiabank and it is great. I can buy things online and set up my monthly subscription accounts to the card.

But again, instead of paying for these things with credit, I purchase them with my Visa debit and the amount is automatically withdrawn from my checkings account.

Not only that, but it saves me the hassle of having to go in and pay off my credit card balance every few weeks!

8. Pay Off Debt

I think this one goes without saying, but I’ll say it anyways, paying off your debt in your 20s is a really smart thing to do.

Whether you have credit card debt, car debt, student loans, personal loans, whatever, pay them off as quickly as possible. (If you buy a house, this should be your only exception.)

I think the best way to do this is to start small. Pay off your small loans first, and then tackle the big one last.

Paying off the small ones first will get your juices flowing and will hopefully motivate you to really attack your debt head on and pay it off quicker than you ever imagined.

You might think you have the rest of your life to pay it off, but life happens quick so it’s better to start early.

One of my favorite quotes about money is from Mark Cuban, he said in an interview “you’ll never feel richer than the moment you get out of debt”.

9. Start an Emergency Fund

One of the smartest money things you can do in your 20s while you prepare for your adult life is to set up an emergency fund.

An emergency fund is 3-6 months worth of expenses set aside for unforeseen expenses.

These expenses could include things like your car breaking down, a family member dies or gets sick, job loss, hot water boiler breaks…you get the point.

For those of us who live on a budget, unexpected expenses like this are just not affordable. Unless of course, we have an emergency fund.

Tips for Starting an Emergency Fund

- Don’t invest these funds. You want these funds to be readily available and liquid in case of an emergency. I recommend a high-interest savings account.

- It’s okay to “lose money to inflation” in your emergency fund. An emergency fund is an insurance, and insurance costs money.

- Start your emergency fund with a bank separate from your day-to-day bank. This way you won’t be as tempted to dip into it. Out of sight out of mind.

- Just to be on the safe side, keep six months worth of expenses in your emergency fund.

Not only will an emergency fund help you avoid having to go into debt to solve an unforeseen issue, but it’ll give you peace of mind in knowing that you’re going to be just fine (financially) in the event something does happen.

Related Financial Geek Article: Emergency Fund Amount | How Much Should I Have Saved?

10. Negotiate Your Salary

In your 20s, it’s likely you’ll get your first “real job”.

For a lot of part-time jobs, hourly wages are really not negotiable, everyone gets paid the same amount, if you don’t like it, find another place to work.

But for a lot of career type jobs (engineer, lawyer), salaries can often be negotiated upon getting hired.

It seems like people always try to save a dollar here and a dollar there, but they often forget the other side of the coin, earn an extra dollar here and a extra dollar there.

Of course, you’ll need to wow your potential employer so they really want to hire you, but someone like you! That’ll be easy.

Jokes aside, The Harvard Business review has an amazing article here on how to negotiate a job offer.

You’d be surprised how one professional conversation with your employer can increase your earnings by $5,000, $10,000 maybe even $15,000 per annum.

But the key is to start this process in your 20s as this will set the pace for your future earnings as you progress throughout your career.

11. Focus More on Savings then Investment Returns

In your 20s, it is a smart idea to start investing for retirement, as mentioned at the beginning of the article.

And while you always want to monitor your investments to ensure they are on the right track, you shouldn’t obsess over them on a daily basis.

If you want to obsess about something, obsess over saying money as opposed to your return on investment.

Over time, this mindset should change, but until your nest egg is over $100,000, you should focus more on saving money.

Of course, once your portfolio value is into the hundred of thousands of dollars, then yes, your ROI is very important – but in your early years, it actually doesn’t make that much of a difference.

Think about it from a mathematical perspective, have a look at this example.

If Robert makes an 8% return on investment but only has $10,000 invested, he’lll have made $800.

If Adam generates a 4% return on investment with the same $10,000 investment, he’ll make $400.

So despite Adam having half as good a return as Robert, Robert only generates an extra $400.

Why? Because they both only have $10,000 invested. It’s not enough to make THAT big a difference.

Now, I want to reiterate, once your portfolio value is 6 and 7 figures large, your return on investment will matter much more, but while it’s under $100,000, focus all your time, energy and effort on saving more money as opposed to yielding an extra few percentage points.

12. Make an Uncomplicated Budget

Making a budget in your 20s is a very, vey wise move.

Budgets are one of the most talked about things in personal finance but yet, most people don’t have one.

Your budget should not be complicated, at all.

I’ll include a screenshot here below of what my budget looks like. It took me half an hour to make this on Google Sheets and I rarely have to touch it now.

As you can see, it is super straightforward, no fancy graphs, no crazy tables, just a few line items and then my free cash flow at the bottom.

The key is understanding where your money is going every month.

If you don’t give every dollar a job then things tend to get out of control. You end up spending way more than you should on things you don’t really need.

Budgets are great for helping you manage your money, but they’re also great for allowing you to spend money guilt free.

If at the end of the month I still have a few hundred dollars in free cash available, heck, you can bet I’m going to buy something online, go out for an extra dinner, play some online poker or whatever it is, and I don’t feel bad about it at all.

So create a budget and get in the habit of following it every month, it’ll be the most profitable 30 minutes of your life.

13. Use Tax Advantages Investment Accounts

When you start out investing for your future in your 20s, make sure to take full advantage of all tax beneficial investments accounts.

Whether this be an RRSP, TFSA, 401k, Roth IRA, or whatever, these are gifts from our governments that you need to take advantage of.

While I won’t get into the details of each account in this article, I would just urge you to first max out these accounts before opening up regular accounts.

Taxes will be the biggest expense of your life, reducing this expense by a few percentage points can quite literally save you hundreds of thousands of dollars.

14. Don’t Buy a Home Too Early

Just because you can afford the 5% down payment does not mean you can afford a home.

I always recommend doubling up on whatever the cost of the downpayment is. Whatever is left over after, top up your emergency fund – you’ll need it!

So if you need $15,000 for the down payment, save up $30,000.

This will put you in a comfortable position to pay for legal feels, closing costs, interest adjustments, inspection costs and of course, you’ll need to furnish the place.

While buying a home can be a great investment, I’ve watched too many people in their twenties buy homes prematurely.

They buy their house and then they’re essentially house broke. They’re in debt from all the unexpected costs (mentioned above) and this sets them back years financially.

What’s the point of this? Rent for an extra year or two, move home with your parents if you have too.

Don’t rush guys, wait until you are truly ready. The housing market isn’t going anywhere, you can bet on that.

The last thing you want is to be living in a house you resent for the financial crisis it has put you in.

Another piece of advice, have a fully funded emergency fund in place when you buy a house.

And lastly, if you really, really need to buy a home quickly, I give nine tips here on how you can speed up your down payment savings process.

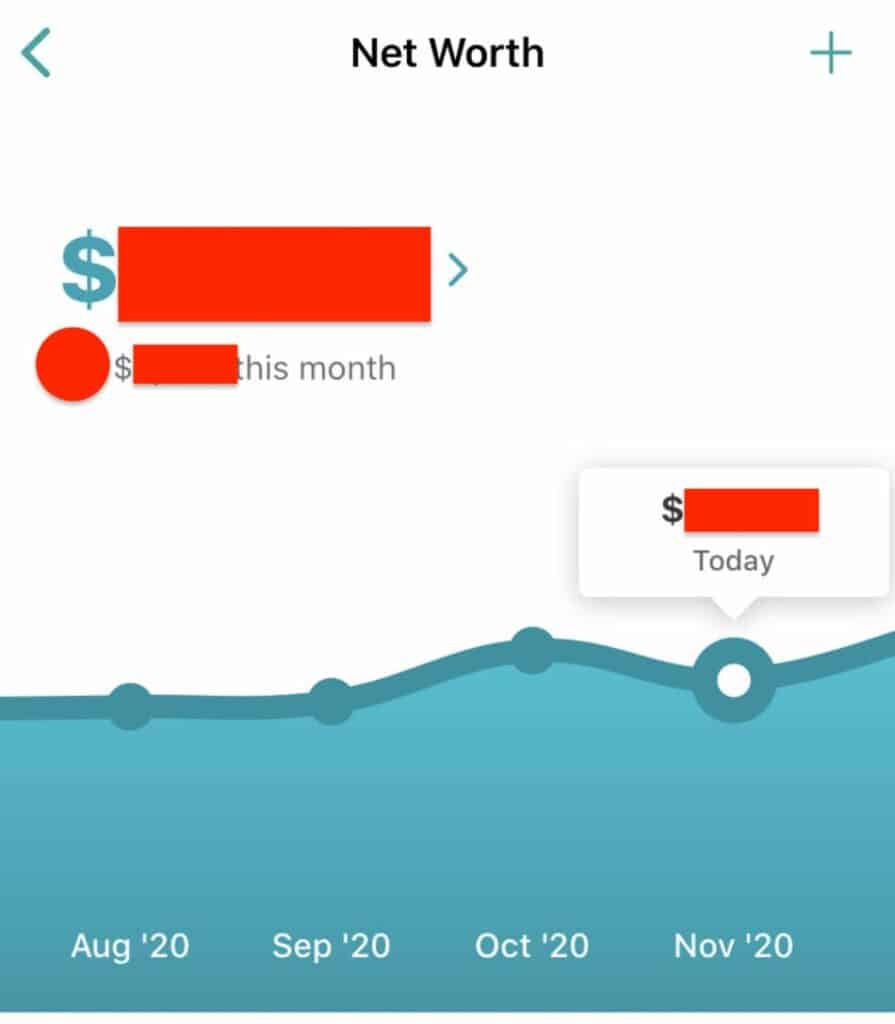

15. Track Your Net Worth

Another thing you should start doing in your 20s is tracking your net worth.

Net worth = Assets - Liabilities

Now this isn’t so you can tell people “my net worth is this amount”, because if you do that, you’ll have no friends.

The purpose of tracking your net worth is so you can measure your progress.

If you follow some of the tips outlined in this article, your net worth should be increasing month after month and year after year.

Now you don’t want to manually calculate this amount every month yourself, so I’d recommend using an app called Mint to help you with this.

This way, your net worth is being adjusted in real time so you can track it easily and efficiently.

If your net worth isn’t increasing every couple of months, something needs to change.

16. Live Below Your Means

Now this might seem obvious, but if you get in the habit of living below your means in your 20s, this will set the tone for the rest of your adult life.

But what does living below your means really mean? In my opinion, it’s pretty simple.

- Staying out of debt.

- Paying for these with cash and not credit.

- Never trying to keep up with the joneses

While I don’t have stats to back this up, I truly believe people that try to keep up with the joneses are less happy than those that don’t.

You’d be surprised at how much less stressful your life would be if you stopped trying to keep up to date with the latest and greatest consumer products.

I’ve had the same iPhone for 3 years, is it outdated? Yes, does it negatively affect my happiness? Not in the slightest.

Could I afford a new one? For sure, but why not spend money on things that will positively impact my happiness, which brings me to my next point.

17. Maximize Happiness Units When You Do Spend Money

Now I learned this from reading David Chilton’s book The Wealthy Barber, so I will give him credit for this but the earlier you can understand this concept the better.

I strongly recommend people in their 20s to get in the habit of maximizing their happiness with every dollar they spend.

In other words, think about what makes you truly happy and spend your money in those places.

In fact, it’s actually okay to overspend in places as long as those purchases positively impact your quality of life.

For example, I pay nearly $200 a month for a Crossfit membership, this may seem insane to some people, but it really contributes to my happiness from a mental and physical standpoint.

So I think this is a wise use of my money for me.

I mean think about cars for example, four months of car payments will likely cost you over $2,000 – think about the type of trip you could go on for that amount of money.

With that said, I’m not here to tell you what makes you happy. If the newest iPhone really brings you that much happiness, then heck, go get yourself that phone!

David Chilton also said in his book, (paraphrasing here) “experiences tend to get better over time while possessions usually get worse.” and I think that is so, so true. So keep that in when choosing what to spend your hard earned money on.

18. Don’t Be Cheap

Last but not least, in your 20s, but also during any time of your life, don’t be cheap.

Pay for cabs, pick up rounds of drinks, donate to local charities, pay for gas on road trips, bring extra beer to parties, offer to help friends in financial need, you get the point.

Being cheap is a terrible look, and once you get branded as being “cheap”, it’s hard to shake that perception people have of you. We all know someone like this.

So I know most of this article was about how to cut back on expenses, but if it’s ever a decision to spend money or look cheap, spend the money.

Being smart with money and being cheap are not the same thing. So be smart with your money, but don’t be cheap!

Conclusion

Being smart with your money in your 20s is not hard on paper, I think we can all agree there.

The concepts discussed in this article are fairly easy to understand, it’s the execution of these concepts that is the hard part.

But even so, with a little financial discipline, you should be able to implement most of these money tips during your 20s and continue on with them as you move into your adult life.

I hope this article provided you with a ton of value, as always, that is the main goal here.

Geek, out.