Each person, at some point in their life, must make the decision to become financially independent and live in a place that they pay for. For most, this means moving out of their parent’s house which presents a variety of challenges and at the very least, a daunting task.

Understanding when the time is right to move out and live on your own is difficult in its own right, but is largely predicated on your current financial situation. In order to take a leap into the real world and live on your own everyone knows they need money, but how much money is enough?

Related Financial Geek Article: 8 Tips for Moving Out (of Your Parents) with No Money

Can You Move Out with $20,000?

Understanding if it is the right time to move out relies on many different variables. Where you live or want to live, your employment status and any other subsequent income that you might have are all important factors that you must take into account.

Based on the $20,000 figure, living a lavish life is not yet in the cards, but living a healthy and sustaining life certainly can be. The common goal for understanding if you’re ready for a move is having at least 3 months of finances covered before you move.

This means that if you made no income for 3 months, you would still be able to live exactly how you want to. In order to calculate your 3-month expense outlook, you need to have an in-depth understanding of your expenses. The easiest way to do this is to track your spending and create a budget. If your rent costs $1,000 a month, and you have an additional $1,000 in other expenses such as food or bills, then your 3-month expense outlook should be roughly $6,000 plus an extra $1,000 dollars for any unexpected expenses that may arise.

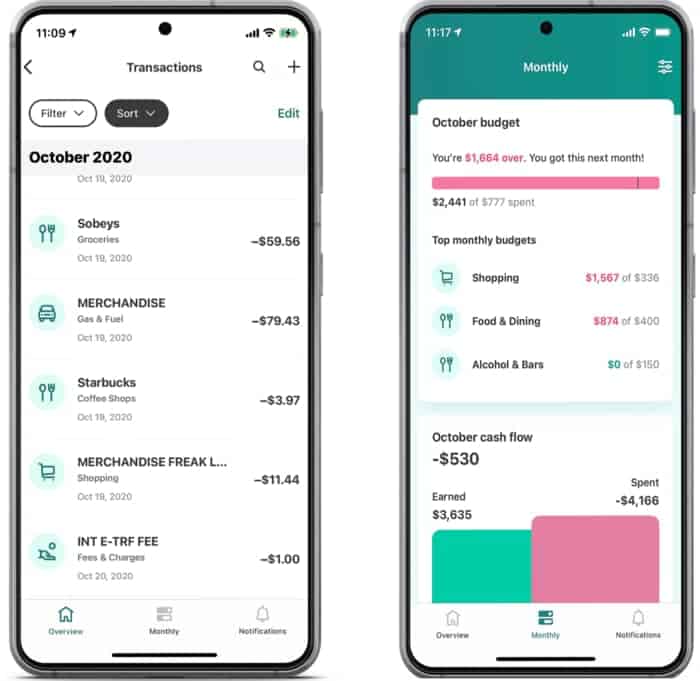

Financial Geek Tip: If you have a smart phone, download the Mint Budgeting app, it helps to track all your spending habits into categories. And it’s completely free!

Having a source of income is also very necessary if you plan to live independently. The general rule of thumb for your necessary income is you should never have to dip into your savings for common monthly expenses. Your monthly income should be enough to pay your bills and expenses while also being able to save a portion of it for the future.

If this is not the case with your current income you can either find a cheaper alternative living situation, search for a higher paying job, or create side hustles for yourself to make extra income. In the new age of interconnected commerce and technology, finding a side hustle can be simple and easy and be the difference between struggling financially through each month and saving for the future.

If you needed some side hustle ideas or inspiration, look no further than my article Make Money Online as a Beginner | 17 Proven Ways.

To recap, it is entirely possible to move our with $20,000. It all just really depends on the type of lifestyle you want to live.

You won’t be driving a BMW and living in a penthouse suite with just $20,000, but this amount along with some form of steady income is definitely enough to get you started. In fact, I actually think you could do it with much less, which is why I also wrote an article Can You Move out with $10,000 (which I also do think you can do!).

5 Tips for Moving Out with $20,000

1. Buy Second Hand

So the time has come, and you have finally signed your lease and are ready to move in. After paying the first and last months of rent, as well as moving fees, and other fees associated with moving to a new location you now are faced with furnishing your new home.

Not only will you need small appliances such as a microwave, but you’ll also need furniture such as a couch, tables, a bed, etc. These items can rack up huge payments and be extremely expensive to buy new.

Second hand furniture is an excellent method to lower the cost of moving out of your parent’s house. Find couches or tables through third party selling apps such as Facebook Marketplace or Craigslist, and who knows you may find some furniture you actually really like!

Related Financial Geek Article: 18 (Uncomplicated) Smart Money Moves For Your 20s

2. Live With Roommates

New renters quickly understand what their most daunting expense is: rent.

Rent for someone living alone can often be upwards of $1,000 and can be a huge payment (and stress) for someone earning a low income.

To alleviate the stress of rent payments, look for a roommate or two. A roommate not only will pay for a set amount of the rent, but can also help in paying expenses often not thought about. Small items such as toilet paper, soap, or something as simple as milk and butter will no longer be your sole responsibility and in the long run can help you save hundreds, if not thousands, of dollars.

Having a roommate, beyond the finances, will also help you navigate the world in which you have not yet walked in by, which is always a help and a comfort (especially when you have a beer in your hand!).

3. Understand Your Finances

Setting a monthly budget and comparing it to your income is the easiest way to identify if you can reasonably move out and live on your own. Understand the money you owe each month and the money you are bringing in. A lapse in understanding of your finances can lead to the inability to pay rent down the line, or the inability to pay a separate expense.

And trust me, no one wants that.

4. Do Your Research

Based on a variety of taxes, where you live can determine if you are ready to move out. In a state such as Texas, where property taxes are low and there is no state income tax, moving out with $20,000 is completely feasible. In a state such as New York, especially New York City, moving out with $20,000 is almost impossible based on the high cost of living.

Not only will different areas have different rental or tax costs, but products in the area such as food or gas will be different based on the cost of living in each state.

Each individual’s situation is different, so doing your research and understanding your specific situation is the only concrete way to identify if you are ready for a move.

5. Do Not Skip Insurance

Every registered vehicle must be insured to drive legally on the road, but not many people looking to make their first move understand insurance in other industries. Having rentor’s insurance when renting is a must to protect your finances in the long term.

The cost of renter’s insurance is usually not high monthly, but in the case of property damage having rentor’s insurance can be the difference between paying a deductible or having your landlord’s insurance company come after you for damages.

Which again, is something you absolutely do not want.

The Bottom Line

To recap, it is definitely possible to move out with $20,000. Be sure to live below your means, budget wisely and ensure you are generating some form of income to maintain financial stability.

Thanks for reading, folks! I wish you nothing but the best if you are about to move out of your parents place. Enjoy the next chapter of your life, it’s quite the ride.

Geek, out.

![How Much Money Should I Have Saved by 21? [Full Breakdown]](https://thefinancialgeek.com/wp-content/uploads/2022/03/Save-money-as-a-21-year-old-1.jpg)