Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

One of the most commonly asked questions about cryptocurrencies like Bitcoin is if they are a taxable investment asset.

In recent years, cryptocurrencies have become an increasingly popular investment asset amongst Canadians. But due to the industry still being mostly unregulated, there are a lot of questions regarding Bitcoin taxation.

Bitcoin gains are taxed in Canada. Capital gains made on an investment in Bitcoin are taxed in the same way that capital gains made on stocks are. If you sell your Bitcoin investment for a profit, then the Government of Canada will tax you on those profits.

As cryptocurrency investing increases among mainstream investors, they will likely have more questions about the impacts of their investments. The purpose of this article is talk about all things related to Bitcoin taxation in Canada.

Is Bitcoin Taxed in Canada?

As with most investment types in Canada, Bitcoin is subject to capital gains taxes.

Luckily for Canadians though, that’s actually the only tax associated with the digital currency as of now. So if you’re thinking about getting started with Bitcoin investing, you should first learn how it could have an effect on the way you report your annual income.

And in case you were wondering, there is no sales tax when you buy Bitcoin as an investment. There is also no tax on holding the token for as long as you want to, or for continuing to buy more. You can even mine Bitcoin without repercussion, but the second you sell your Bitcoin in Canada, you are subject to capital gains taxes, just like on any other investment.

How Much is Bitcoin Taxed in Canada?

As mentioned previously, Bitcoin gains in Canada are subject to the same capital gains tax rate as any other investment type. For Canadians, this means 50% of the capital gains made on the trade are taxable. And this is where a lot of confusion comes in for Canadian investors.

When Canadian investors hear that 50% of the capital gains made are taxable, everyone has the same reaction. You are not paying a tax in the value of 50% of your capital gains. It means that 50% of any of your capital gains are added to your annual income and are subject to the tax rate of your tax bracket.

Each Provincial jurisdiction also has its own tax rates on income. Please refer to your home provincial rates for the most accurate calculations. The federal tax rate for any investment capital gains is as follows:

| Tax Rate | Income Level |

|---|---|

| 15% | On the first $49,020 of your reported income that is taxable |

| 20.5% | $49,021 to $98,040 |

| 26% | $98,041 to $151,978 |

| 29% | $151,979 to $216,511 |

| 33% | $216,512 and over |

For more information on how taxes on cryptocurrency is treated in Canada, check out this article on the CRA website.

How to Avoid Tax on Bitcoin in Canada

While we will never condone any individual not reporting their income or capital gains for their taxes, there are some new ways to avoid paying tax on Bitcoin in Canada. The easiest way is to just hold your investment and not sell it.

Because remember, as of right now, you only pay capital gains tax on the profit made from a Bitcoin trade.

As I talk about in my article, Is Wealthsimple Crypto a TFSA? [Quick Explanation], you cannot directly buy or hold cryptocurrencies in your RRSP or TFSA, so unfortunately the normally utilized tax shelters for Canadians do not apply here. There are, however, some interesting new ways to get exposure to Bitcoin without actually buying the token.

There are several Bitcoin related ETFs that have popped up in Canada, and they are an excellent way to get exposure in your non-taxable investment accounts.

Some Bitcoin ETFs available to Canadians include the Purpose Bitcoin ETF, The Evolve Bitcoin ETF, CI Galaxy Bitcoin, 3iQ CoinShares Bitcoin ETF, and of course, the always popular Grayscale Bitcoin Trust.

These securities can be bought and sold within either your RRSP or TFSA like any other asset. Specifically for your TFSA, any gains on the Bitcoin ETFs will not be taxed. Of course, you don’t actually own or control your Bitcoin tokens and digital keys when you buy them through an ETF, but you do avoid paying taxes as well as some of the volatility that comes with trading Bitcoin directly.

Best Platforms for Buying Bitcoin in Canada

Canadian Bitcoin investors are lucky enough to have access to most of the major cryptocurrency exchanges and platforms. Some countries, like the US and China, do have restrictions on which exchanges can be used, and in the case of China, none can be used at all since Bitcoin has been completely banned.

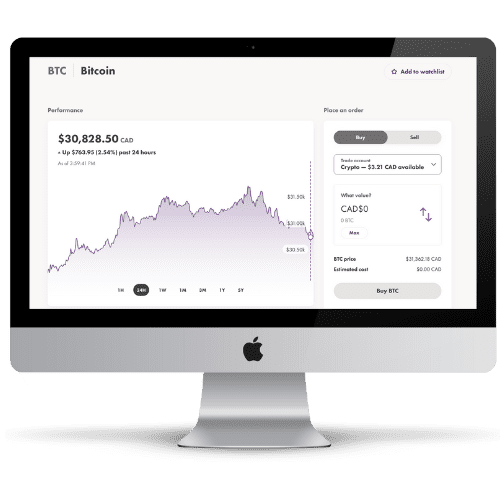

Wealthsimple Crypto is a very popular platform amongst Canadian crypto investors, especially among young investors. The platform has a wide range of crypto assets to invest in, as well as access to various Bitcoin ETFs that you can also hold directly in your Wealthsimple Trade account. Wealthsimple is also a Canadian platform and also has a highly rated mobile app.

I personally recommend Wealthsimple Crypto and have been a user since early 2021. If you did want to give them a try, you can get started here and you’ll earn $25 for doing so!

Fun Fact: Wealthsimple Crypto is Canada’s first ever regulated crypto platform. Try it Today for Free.

Want to Start Trading Crypto? Try Wealthsimple Crypto ($25)

Earn a $25 Bonus with Sign – Up

- Canada’s first regulated crypto trading platform.

- Trade Bitcoin, Ethereum, Dogecoin and 50+ coins

- Send and receive crypto to external wallets

- Get up to $5,000 instantly

- All-in-one pricing

Another popular exchange for Canadians is Newton. Newton offers a long list of diverse cryptocurrencies to invest in, and allows direct Interac bank transfers from all of the major Canadian banks. It also has a handy mobile app that you can use with both Android and iOS phones.

Finally, Toronto-based CoinSmart is gaining popularity amongst Canadian crypto investors. It has surprisingly low trading fees and is regulated by the Ontario Securities Commission (OSC). CoinSmart also has excellent 24/7 customer service for those who have any questions or concerns with their Bitcoin trades.

Related Financial Geek Article: Can You Buy Crypto on Questrade? Here Are The Facts

Conclusion: Is Bitcoin Taxed in Canada?

Absolutely, but only when you sell for a profit.

Try and think of Bitcoin more as an investment class then a currency. And when you sell an investment for a profit, you have to pay taxes on it – and that is no different for when you sell Bitcoin for a profit.

The exact amount you will have to pay will depend on where you live, what tax bracket you’re in, and how much profit you made.

The tax man always get’s their cut! Remember that.

That’s all folks! Thanks for reading, I hope you learned a thing or two from this article!

Geek, out.

![3 Reasons Why Coinbase Asks for Your SSN [Real Facts]](https://thefinancialgeek.com/wp-content/uploads/2022/05/Does-Coinbase-Ask-for-SSN-1.jpg)

![Will Shiba Inu (SHIB) Ever Reach $100? [THE TRUTH]](https://thefinancialgeek.com/wp-content/uploads/2022/03/Will-Shiba-Inu-Ever-Reach-100-2.jpg)