If you are relatively new to the world of personal finance in Canada, you may have heard about the TFSA, but you may be skeptical on whether or not they are worth investing in.

The goal of this article is to clear that up for you, because in my opinion, it’s a no brainer.

TFSAs are definitely worth investing in. Not only do they allow your investments to grow and compound at a tax-free rate, but you can also make tax free withdrawals on your investments at any time. Additionally, the CRA allows you to re-contribute any TFSA withdrawals in the following year.

So if you’re someone who has debated the worthiness of a TFSA, I would say they are definitely worth investing in.

Now there are many advantages of the TFSA, but for the purpose of this article I am going to talk about the top three reasons why TFSAs are worth it.

Related Financial Geek Article: TFSA Advantages & Disadvantages (6 of Each)

For those of you who just want the jot note versions of the reasons why I think TFSAs are worth investing in, I will include a table here below.

| Top 3 Reasons Why TFSAs are Worth Investing In |

|---|

| 1. Tax-Free Investment Income |

| 2. Tax-Free Withdrawals |

| 3. You Can Recontribute TFSA Withdrawals in the Following Year |

For those of you who want to learn more about each of these reasons, keep reading as I go into each one in much more detail.

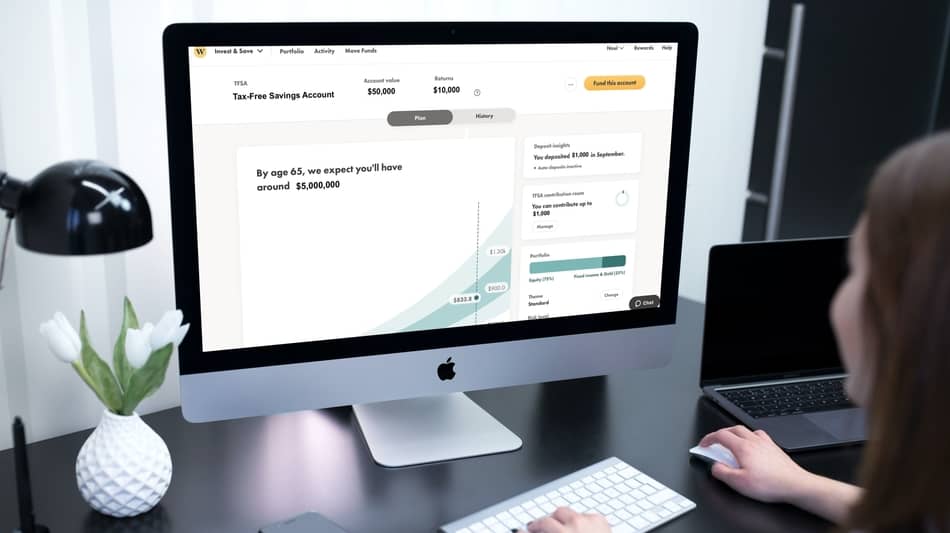

Open a TFSA with Wealthsimple Invest Today ($25)

Earn a $25 Bonus with Sign – Up

- Tax-Free investment income

- No account minimum

- 100% free to sign-up

- Wealthsimple is designed for beginner investors

- Wealthsimple invests your money for you

Top 3 Reasons Why TFSAs are Worth Investing In

Now I will go into each of these reasons in a little more detail. But before doing so, what does the word worth even mean?

Like what do I even mean when I say TFSAs are worth investing in?

Well the Oxford Dictionary defines worth as “the value equivalent to that of someone or something under consideration”.

So as it relates to this topic, the question really is – how much value do TFSAs offer Canadians?

Because let’s face it, if you go through the effort of opening up a TFSA account, you want to make sure it’s worth your while.

So let’s get into it.

1. Tax-Free Investment Income

So the first and most important thing you need to know about investing in a TFSA is that any investment income you earn is tax-free.

Not only that, but as your money grows and compounds within your TFSA, it continues to be tax-free. In other words, you will never be taxed.

For example, let’s say Paddy and Jack both invest $10,000 each. Paddy invests his money within a TFSA while Jack invests his money just in a normal investment account.

Assuming Paddy and Jack both earned a 10% return on their money, they would both make $1,000.

But here’s the difference, Paddy can keep all of his $1,000. It won’t be taxed at all. So he can reinvest it if he wants, he can withdraw it, he can do whatever he wants with it. The entirety of that $1,000 return on investment is his to keep.

Jack on the other hand will be taxed on his 10% return and therefore will only actually make a portion of his $1,000 investment income.

Why? Because remember, Jack didn’t invest in his TFSA like Paddy did which means his investment income will be taxed.

Anytime you can legally and ethically avoid taxes through registered investment accounts, like a TFSA, do it!

So if more money in your pocket is worth it to you, then this is one reason why you should open a TFSA.

Not only that, but setting up a TFSA takes hardly any time at all. If you don’t already have a TFSA open, I’d highly recommend opening one up with Wealthsimple for the reasons I outline in my article here.

2. Tax-Free Withdrawals

Another reason why TFSAs are totally worth investing in is because you’re able to withdraw money from your account whenever you want without being penalized.

Unlike an RRSP, the CRA allows Canadians to withdraw money from their TFSA completely tax-free whenever they wish.

I talk more about TFSA withdrawals in my article Do TFSA Withdrawals Count as Income, but basically, when you withdraw money from your RRSP, you get heavily, and I mean heavily hit in taxes.

Not only do RRSPs penalize you for withdrawing money from your account, but your withdrawal is then added onto your taxable income – so then you’re double taxed!

Not with the TFSA though, you can withdraw funds from your TFSA until the cows come home and you won’t be charged or taxed for this.

For example, let’s say Paddy invests $10,000 into his TFSA and Jack invests $10,000 into his RRSP. Both investors make a 10% return and each earn $1,000. Paddy decides to withdraw his $1,000 and go on a trip.

How much money gets transferred into Paddy’s bank account? $1,000.

Jack also decides to withdraw his $1,000 investment income.

Unfortunately though for Jack, he’s going to get hit with a 10% withholding tax right off the bat. So automatically he’s down $100. But it’s not done yet, that $900 is then added onto his taxable income and he’ll be forced to pay taxes on that as well (the amount depends on how much he makes on top of his investment income).

So Jack is just getting destroyed by taxes, not Paddy though – thanks to the TFSA.

I don’t mean to be bashing the RRSP here, there are many great benefits of investing in an RRSP as I outline here, but when it comes to shorter term investments that you’ll withdraw from before retirement, you’ll be much better off with a TFSA.

Open a TFSA with Wealthsimple Today ($25 Bonus)

3. You Can Recontribute TFSA Withdrawals in the Following Year

Another major reason why TFSAs are worth investing in is because you can recontribute any TFSA withdrawals you make in the following year.

In case you didn’t know, where the TFSA is a Canadian registered investment account with special tax benefits, you’re only allowed to contribute a specific amount to your account each year.

But here’s the great thing, every year the CRA gives us more contribution room and any contribution room we didn’t use in the previous years gets added on in the following year.

But not only that, any amount you withdraw from your TFSA in one year can then be recontributed in the following year. Not bad, hey?

So for example, let’s say my TFSA contribution room for 2021 is $5,000.

In January of 2021 I deposit $5,000 into my TFSA and completely max it out. Then in June of 2021 I decided I want to take a trip and withdraw $2,500 from my account.

While I can’t recontribute my $2,500 withdraw in the current year (2021), I can in fact recontribute it back in my TFSA in 2022 PLUS $6,000 which is the 2022 TFSA contribution limit that set my the CRA.

Now I know this is a lot of moving pieces, so if you want to learn more about this then I’m going to direct you to three of my other Financial Geek articles where I go more in depth and give more examples of how to calculate your contribution room and how it’s impacted by withdrawals.

Additionally if you want to check your TFSA limit as of today, check out my tutorial video here on how to do so.

But anyways, with all that said, the fact you can withdraw investment income from your TFSA as much as you want, and then recontribute your withdrawals in the following year makes the TFSA worthwhile.

While the first two reasons were enough for me to open a TFSA account, this is just an added bonus.

Conclusion

And that’s a wrap!

While I don’t usually include big, inspirational call to actions at the end of my articles, the one thing I would say here is that if you haven’t already, I’d highly recommend opening a TFSA.

I have my TFSA opened with Wealthsimple, and I have since 2016. In this article here I talk about the 9 reasons I recommend them and then it goes on to explain (with screenshots) step-by-step how to create an account.

If you’d rather just jump right into the sign-up process, you can go to the Wealthsimple sign-up page here ($50 bonus for doing so).

If you have no interest in opening a TFSA but were just curious on if they were worth it, then that’s great too! I hope this article helped you realize they are.

Remember, tax-free investment income, tax-free withdrawals, and they even allow you to recontribute your withdrawals in the following year! What other investment account in the world allows you to do that!

The CRA doesn’t give out gifts like this very often, so take advantage when they do.

Geek, out.