Some links in this post are from our partners. If a purchase or signup is made through our partners, we receive compensation for the referral.

Many Canadian investors, especially beginners, wonder if we can invest in US stocks. And yes I say “we” because I am a Canadian investor, and I once wondered this exact question.

Because let’s face it – a lot of the exciting companies with attractive stocks are American based companies. While Canada has a few, Shopify likely being the most notable, American is the home of well known publicly traded companies like Tesla, Apple, Facebook, Google and Amazon, just to name a few!

But what about us Canadians? Can we invest in these US stocks?

Canadian’s can invest in US stocks. But before doing so, they first need to sign up for a Canadian based online brokerage account, deposit Canadian funds into their account and then convert these funds into American dollars.

So that’s the first thing, Canadian’s can definitely invest in American companies, but they need to do it with USD. Online brokerages today make it very easy for investors to convert currencies though, so don’t worry about that – I will show you how to do that later in the article.

Which brings me to my next point.

We now know that Canadian’s can invest in US stocks (I do it myself so I know!), but how exactly do you do it?

I’m glad you asked.

Here is How to Buy US Stocks in Canada

Step 1 – Sign Up for an Online Brokerage Account

Step 2 – Deposit Funds into Your Account

Step 3 – Convert CDN Funds to USD

Step 4 – Determine What US Stocks You’re Going to Buy

Step 5- Login to Your Online Brokerage Account

Step 6 – Purchase US Stocks

Below is a step-by-step walk through, with screenshots included, on how you can buy US stocks in Canada today. I use an online brokerage called Wealthsimple Trade and I’ve had an amazing experience with them so far.

If you wanted to give them a try, you can sign up here and you’ll get a $50 bonus with your sign up. Not bad hey – That’s almost 2 shares of AT&T!

How To Buy US Stocks in Canada -Step by Step

Step 1 – Sign Up for an Online Brokerage Account

The first step in buying US stocks in Canada is to sign-up for an online brokerage account.

Now you have a number of different options here. You can use one of the big 5 banks direct investment divisions like RBC direct investing or Scotia ITrade – each the big 5 Canadian banks have a direct investing division.

Or you could use an online brokerage like Questrade or Wealthsimple Trade which aren’t directly affiliated with any type of retail bank.

I personally use and recommend Wealthsimple Trade. I also use Questrade a little bit, but more so just to stay on top on the product updates and features so I can confidently speak on it.

I’ve even used Scotia ITrade when I started out back in 2017. And to be completely honest, they are all great online brokerages, and you’ll be able to buy US stocks with any of the ones I mentioned above, but like I said – I always recommend Wealthsimple Trade.

The sign-up process takes about 15-20 minutes, it’s completely free to get started, you can start with as little as $1, and unlike all the other platforms I mentioned, it has no commission fees. Not to mention, you’ll get a $25 cash bonus to start investing with when you sign up here.

Want to Start Trading Stocks? Try Wealthsimple Trade Today

Earn a $25 Bonus with Sign – Up

- No Commission Fees

- Investors Can Buy Fractional Shares

- No Minimum Balance Requirements

- Beginner Friendly App and Desktop Platform

- Access to the Crypto Markets

Step 2 – Deposit Funds into Your Account

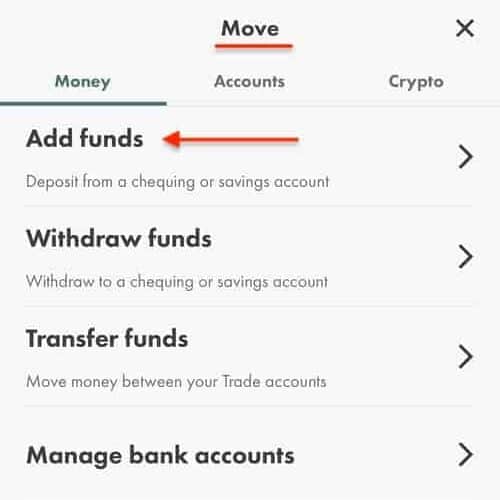

The next step in your journey to buying US stocks as a Canadian is depositing funds into your new online brokerage account.

So in order to do this, you’ll first need to connect your bank account to your brokerage account.

Both Wealthsimple Trade and Questrade support instant deposits, so once you connect your bank account to your online brokerage account, it won’t take long until you can actually purchase US stocks.

In my article, How to Open a Wealthsimple Trade Account I give a step-by-step guide (with screenshots) on how you can connect your bank account and add funds to your account. It’s a very straight forward process, but feel free to use this as a resource if you get stuck.

If you decided to go with Questrade instead, this article should help! This is straight from the Questrade help centre.

Quick Note: You need a minimum of $1,000 to start investing with Questrade whereas with Wealthsimple Trade you can start with as little as $1.

Okay so once you’ve created your account and deposited Canadian funds, it’s time to move onto step 3.

Step 3 – Convert CDN Funds to USD

Now that you have an Canadian online brokerage account, and you’ve deposited funds into your account, you are well on your way to buying some US stocks.

In order to do this however, you’ll need to use USD – so you’ll first need to exchange the Canadian dollars that you deposited for American – and as I mentioned earlier this is quite simple.

Most brokerages will have a section called “Exchange Funds” or something very close to that. This is where you’ll convert your cash from CDN to USD.

Quick Note: Questrade currently charges a small fee for converting CDN funds to USD. But so does every other online brokerage.

The image below is from my Questrade account, as you can see, this is a very straightforward process. And to be honest, it’s even (MUCH) easier with Wealthsimple Trade, which I’ll talk about next.

And now I’ll just touch on the Wealthsimple Trade process for converting your currency.

Well you actually do nothing. Yep, you just deposit your Canadian funds, find a US stock you want to buy and then confirm your order (will show you how to do that in the next steps).

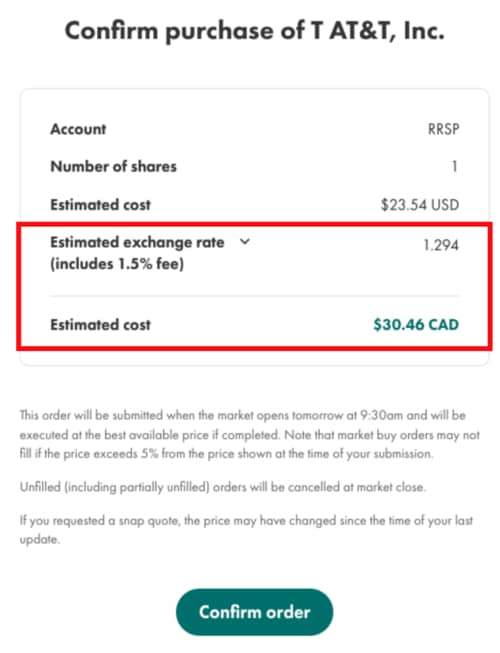

But yeah, Wealthsimple actually automatically does this for it’s investors when they buy US stocks. Wealthsimple currently charges a 1.5% conversion currency fee when you buy and sell American stocks.

To learn more about how exactly you can calculate what this fee would be, check out my article here as I break it down using an example.

Pretty sweet right? Not that it’s a huge task anyway, but with Wealthsimple trade, you don’t have to do any type of currency conversion. just pick the US stock you want to buy and let Wealthsimple take care of the rest.

Quick Note: Early in 2022, Wealthsimple launched its Wealthsimple Trade Plus subscription plan where investors can pay $10 a month to have a USD account where they can convert their CDN funds into USD (Similar to what I showed you with Questrade). If you are new to investing and don’t plan on trading that much volume, I’d stick to the basic, free plan for now.

And that’s it for step 3 – You are well on your way to buying some US stocks!

Step 4 – Determine What US Stocks You’re Going to Buy

Okay, so now we need to actually figure out what US stocks to buy.

If you already know what American stocks you want to buy, then that’s great! If not, allow me to give you my advice on how to go about choosing stocks to buy.

But before I do, just know that I never tell people to buy a specific stock, because well, know one knows for sure if a stock will go up or down. And if anyone tells you otherwise, run!

So when I look at what American stocks to buy, you might think I look at a ton of data, and charts, and numbers. And while I do sometimes do that, I never recommend that to beginners when starting out.

What I try to do is think, will this company be around in 40 years? And secondly, does this company have a good product or service?

For example, when I first started out buying US stocks, I just wanted to get my feet wet. So what I did was bought into some companies where I use their product or service.

I’ve always been a fan of Twitter, and the stock was around $30 at the time, so I bought a few shares of them. I also think Twitter will be around for the long haul (despite what some people think), so this was a perfect first stock for me to buy.

I actually still remember purchasing it.

Some other stocks I bought into, and continue to buy into, are companies like Shopify (Canadian company), Apple, Facebook, Microsoft, Amazon, just to name a few.

And why these stocks? Because for one – I think all of these stocks are going to be around for the long haul. Yes, they will have ups and downs when it comes to their share price, but in the long term I see the trajectory of all of these stocks being up and to the right.

Of course I could be wrong! But there is always a risk with investing.

And secondly, well I like investing in these companies because I use the products and services that they offer. I run an e-commerce website on Shopify, I have an Amazon Prime account, I have a ton of Apple products and I’m on Facebook almost everyday!

So that’s how my mind works when determining what stocks to invest in. Again, this is not financial advice, this is just to give you an insight on how I do it. If this process works for you too, then great!

If you have your own process, then that’s great too!

Regardless of how you decide on what US stocks to buy, once you’ve figured out what you’re going to invest in, it’s time to get to it!

Step 5 – Login to Your Online Brokerage Account

Okay, we are just about there!

At this point you should have your account created with your online brokerage of choice, you should have deposited funds into your account, then converted these funds to USD (not necessary if you are using Wealthsimple) and you should have at-least one stock in mind that you want to buy.

Now you need to login to your account. If you’ve made it this far, this part should be quick and simple.

Once you login, move onto the 6th and final step. This is where you’ll actually buy some US stocks.

Related Financial Geek Article: How to Buy Fractional Shares in Canada (6 Step Guide)

Step 6 – Purchase US Stocks

Last step! Wahoo.

In order to buy US stocks in Canada, we actually need to purchase the stocks – who would of thought that!

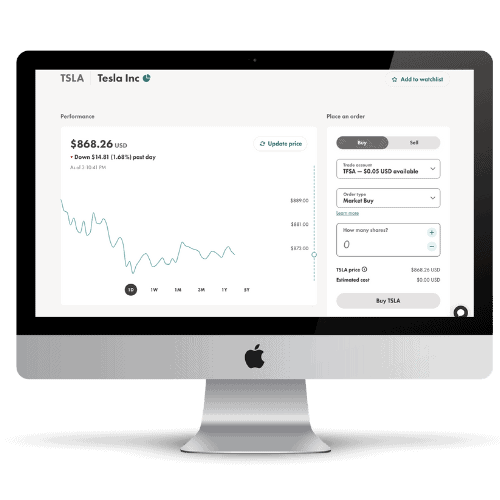

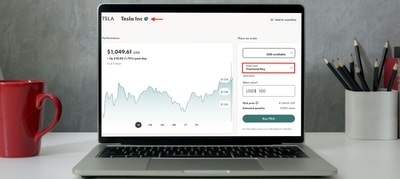

So if you are using Wealthsimple, this process is really straight forward. What you’ll first want to do is open your Wealthsimple Trade app (can also do this on a desktop) and then go to the “Discover” tab.

At this point, you’ll want to search for the name of the US company you want to purchase. For example, I’ll buy a stock of AT&T.

At this point you’ll be brought to this stock screen as shown below. So now all you do is click “Buy”. Don’t worry though, you won’t actually buy anything at this point.

Next you’ll be asked how many shares you’d like to buy. So enter that amount and then finally it’s time to confirm you order. As you can see from the image below, there is a small exchange rate fee included with your purchase.

To learn more about how exactly the fee is calculated, you can click on the down arrow on your screen or check out my article here.

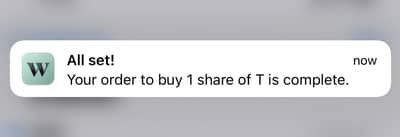

Once you click “Confirm Order”. you’ll see a confirmation screen like I have shown below. At this point your order is put through, but not yet confirmed.

A few seconds after you make your order, you’ll get a notification from Wealthsimple Trade telling you that your order is complete.

At that’s it!

If you followed along with me, congrats, you now own some US stocks.

Now I know I only went through how to purchase US stocks in Canada with Wealthsimple Trade, as I’m assuming that’s what most people reading this will decide to use.

But if you decide to use some other platform like Questrade or even one of the banking investment branches like Scotia iTrade, the process will be very similar.

Recap: How To Buy US Stocks in Canada

To recap, Canadians can most definitely buy US stocks in Canada.

The process a Canadian must go through to purchase US stocks is to first sign-up for an online brokerage, then they must deposit funds into their account and convert their Canadian dollars into USD. From there all that’s left is to find a stock (or stocks) to buy, login to their account and then purchase the shares.

As mentioned throughout this article, Canadians have many different options to choose from when it comes to signing up for an online brokerage.

I personally use and advocate for Wealthsimple Trade, but that’s not to say the other platforms aren’t good too.

If you had any another questions about anything to do with this entire process, please feel free to reach out to me here.

As always, thanks for reading, I really hope you found value in this article.

Geek, out.

![Can Shareholders of a Company Fire the CEO? [The Facts]](https://thefinancialgeek.com/wp-content/uploads/2023/04/Featured-Image-43.jpg)